Self Employed W2 Income Fannie Mae, What If My Self Employed Borrower Changes Tax Filing Types Blueprint

Self employed w2 income fannie mae Indeed recently is being sought by users around us, maybe one of you personally. Individuals now are accustomed to using the net in gadgets to view video and image data for inspiration, and according to the title of the article I will discuss about Self Employed W2 Income Fannie Mae.

- Mountain Mortgage Guy Loan Approval Changes Could Help Many Self Employed Locals Column Vaildaily Com

- 2

- How To Calculate Self Employed Income For Mortgages Stated Income

- Https New Content Mortgageinsurance Genworth Com Documents Training Course Seb Form1084part1 Presentation 0520 Pdf

- Fannie Mae Rental Income Worksheet Fill Online Printable Fillable Blank Pdffiller

- Can I Get A Home Loan Or Refinance If I M Self Employed My Lender Jackie

Find, Read, And Discover Self Employed W2 Income Fannie Mae, Such Us:

- Https New Content Mortgageinsurance Genworth Com Documents Training Course Gnw Calculating 20income 20student 20may 202017 Pdf

- Fnma Form 1084 Fill Online Printable Fillable Blank Pdffiller

- Should I Use Fannie Mae Or Freddie Mac For Aus

- Https Www Merchantsbank Com Assets Files Z6d7dknp Stacking 20the 20odds 20in 20your 20favor Pdf

- Https Www Gopennymac Com Assets Documents Products Fannie Mae Homeready Product Profile Pdf

If you are looking for Government Company Features Merits And Demerits you've come to the perfect place. We ve got 100 graphics about government company features merits and demerits adding images, photos, photographs, backgrounds, and much more. In these web page, we also provide number of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Form 1084 Fill Online Printable Fillable Blank Pdffiller Government Company Features Merits And Demerits

Http Docs Cmgfi Com Wholesale External Training Pdf Seb Sam S Corps Cmg 4 2017 Pdf Government Company Features Merits And Demerits

The borrowers recent paystub and irs w 2 forms covering the most recent one year period.

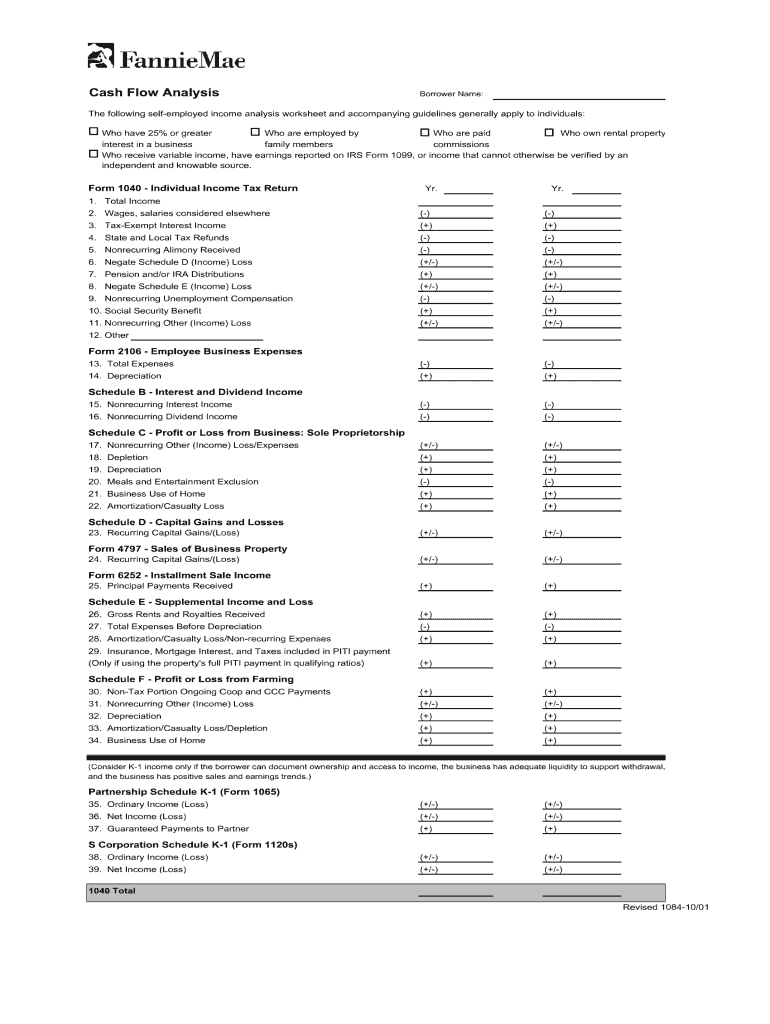

Government company features merits and demerits. Any individual who has a 25 or greater ownership interest in a business is considered to be self employed. Gives permission for a third party to retrieve the tax payers data. Fannie mae self employed borrowers whose business distributions are irregular or non existent will now have show access to their business income.

Its regarding the borrowers proportionate share of income or loss. Income from a business that has been negatively impacted by changing conditions. The following factors must be analyzed before approving a mortgage for a self employed borrower.

1120 or w 2 and 1099 transcripts that are on file with the irs. Virtually all lenders will soon follow. The hardest part of proving self employment income is the documentation requirements.

You do not need to include any income or loss from self employment if the borrower qualifies for the mortgage loan using only w 2 income. Both fannie mae and freddie mac have announced new standards for self employed borrowers. Luckily the guidelines have since relaxed and people with self employment income are better able to get a loan even with fannie mae.

Here is the actual guideline the borrowers proportionate share of. The stability of the borrowers income the location and nature of the borrowers business. Underwriting factors and documentation for a self employed borrower overview.

This can be shown easily by producing a letter of incorporation or the k 1 filing. Each applicant must sign a separate form regardless of the income source. Confirming the tax returns reflect at least 12 months of self employment income and completing fannie maes cash flow.

You do not need to include any income or loss from self employment if the borrower qualifies for the mortgage loan using only w2 income. Never self employed income for fannie mae or freddie mac. Look for a lender.

Fannie mae allows you to omit any income or loss from self employment in this situation. I see it being enforced more and more and if you are self employed you should be aware of it. Factors to consider for a self employed borrower.

New doc requirements for the self employed. Self employment documentation requirements for fannie mae loans. There is a little known rule fannie mae has regarding self employment income.

More From Government Company Features Merits And Demerits

- Government Organization During The Han Dynasty

- West Bengal Government Employee Identity Card

- Government Owned Companies In Sweden

- New Scheme To Replace Furlough Explained

- Drawing 3 Branches Of Us Government

Incoming Search Terms:

- Https Www Merchantsbank Com Assets Files Z6d7dknp Stacking 20the 20odds 20in 20your 20favor Pdf Drawing 3 Branches Of Us Government,

- Https New Content Mortgageinsurance Genworth Com Documents Training Course Seb 201084 202016 20case 20study 20pt 20i 20 April 202017 Pdf Drawing 3 Branches Of Us Government,

- Foreign Income What Why How To Qualify Blueprint Drawing 3 Branches Of Us Government,

- Fnma Self Employed Income Calculations Pdf Free Download Drawing 3 Branches Of Us Government,

- Can I Get A Home Loan Or Refinance If I M Self Employed My Lender Jackie Drawing 3 Branches Of Us Government,

- Fannie Mae Afrwholesale Com Drawing 3 Branches Of Us Government,