Self Employed Retirement Plans Canada, Introduction To Pensions Ppt Video Online Download

Self employed retirement plans canada Indeed recently is being sought by users around us, maybe one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this post I will talk about about Self Employed Retirement Plans Canada.

- Rrsp Access Program Seaport Credit Vacation Financing

- Here S Everything You Need To Know About The Crb Including How It Will Affect Your Taxes Financial Post

- Retirement Game Plan For The Self Employed Money Coaches Canada

- Canada Pension Plan And Old Age Security A Cpp Overview

- Self Employed Here S How You Can Retire Comfortably Sun Life

- Retirement Income System Pdf Free Download

Find, Read, And Discover Self Employed Retirement Plans Canada, Such Us:

- Canadian Retirement Plans And Us Taxes All You Need To Know

- Https Cfmanitoba Ca Images Heartland Docs Entrepreneurs With Disabilities Pdf

- P E I Should Offer Pooled Pension Plans For Small Businesses Cfib Says Cbc News

- Canada Quebec Pension Plan Changes Are Coming

- Introduction To Pensions Ppt Video Online Download

If you are searching for Self Employed Furlough Can You Still Work you've arrived at the perfect location. We have 100 graphics about self employed furlough can you still work including pictures, photos, pictures, backgrounds, and more. In these web page, we additionally have variety of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Overview Of Government Benefits For Retired Seniors In Canada Self Employed Furlough Can You Still Work

Thats the bad news.

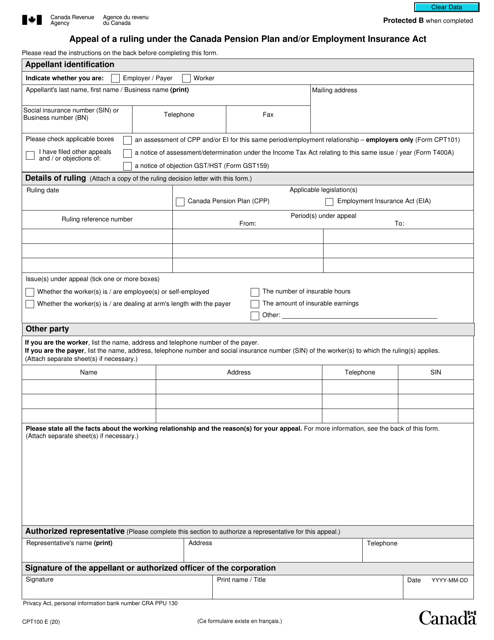

Self employed furlough can you still work. When you earn a wage or salary from an employer cpp contributions are taken straight from your pay cheque. There are many benefits to being self employed. Contribute to your canada pension plan cpp those who are self employed must pay 99 of their net income to cpp.

Unfortunately a done for you 401k plan where contributions are taken automatically from your paycheck and matched by an employer isnt one of them. People below 50 can make contributions of up to 18000 and those above the age of 50 can make additional 6000 contribution adding to a total of 24000. In this situation you can opt for the soloindividual 401k plan.

You need to carefully plan for changes that affect your budget. 4 low cost retirement plan options for self employed individuals. When youre self employed you still owe cpp payments and you need to set those side for tax time if your net income.

The canada pension plan cpp however does require contributions from self employed taxpayers with these contributions calculated when you complete your tax return. If youre one of the 28 million canadians who statistics canada says are currently self employed or run a small business you are likely well aware that along with freedom and independence comes unpredictable cash flowand that unpredictability can make building a solid retirement plan for your future a bit of a challenge. As a self employed person you are juggling the unique role of both employer and employee.

Per the cpp rules self employed individuals between ages 18 and 69 must contribute a portion of their net earnings over 3500 towards their retirement fund. For a self employed individual the following retirement plans could prove beneficial. In addition to the cpp self employed people are free to purchase and set up other retirement income investments.

Toronto jennifer yan loves being a circus coach and fitness instructor but the. Self employed individuals must contribute to the canada pension plan.

What Are The Best Retirement Plans In Canada 2019 2020 Guide Self Employed Furlough Can You Still Work

More From Self Employed Furlough Can You Still Work

- Government Furlough Scheme Timeline

- Does The Furlough Scheme Pay Redundancy

- Comparing Systems Of Government Worksheet Answers

- Cartoon Tree Cartoon 3 Branches Of Government

- Self Employed Expenses Template Uk

Incoming Search Terms:

- Retirement Game Plan For The Self Employed Money Coaches Canada Self Employed Expenses Template Uk,

- I M Self Employed Where Do I Enter My Income And Expenses H R Block Canada Self Employed Expenses Template Uk,

- Rrsp Access Program Seaport Credit Vacation Financing Self Employed Expenses Template Uk,

- Is Retirement A Good Deal In Canada Easy Jobs Retirement Planning Rental Income Self Employed Expenses Template Uk,

- Canada Pension Plan And Old Age Security Overview Self Employed Expenses Template Uk,

- Civilization Ca The History Of Canada S Public Pensions Self Employed Expenses Template Uk,