Self Employed Dental Insurance Deduction, Ohio Medical Expenses Worksheet

Self employed dental insurance deduction Indeed recently has been sought by consumers around us, perhaps one of you personally. Individuals are now accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the name of the article I will discuss about Self Employed Dental Insurance Deduction.

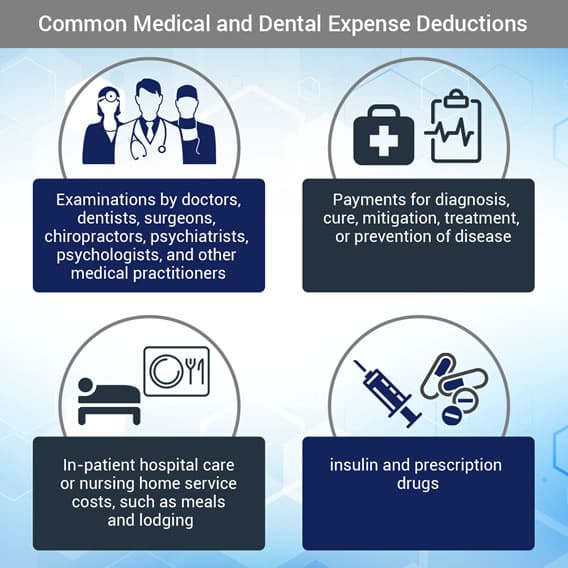

- What To Know About Deductible Medical Expenses E File Com

- Deducting Health Expenses Self Employed Health Insurance Deduction More Stride Blog

- Chapter 5 Itemized Deductions Other Incentives Ppt Download

- 4 Things To Know About Claiming The Self Employment Health Insurance Tax Deduction 1 800accountant

- Self Employed Health Insurance Deduction Healthinsurance Org

- 15 Big Self Employment Tax Deductions In 2020 Nerdwallet

Find, Read, And Discover Self Employed Dental Insurance Deduction, Such Us:

- Solved Self Employed Clergy Can Deduct Amounts Paid For M Chegg Com

- Ohio Medical Expenses Worksheet

- Self Employed Health Insurance Deductions 101 Decent

- What Is The Average Cost Of Small Business Health Insurance Ehealth

- What To Know About Deductible Medical Expenses E File Com

If you re looking for Self Employed Nanny you've reached the ideal location. We ve got 100 graphics about self employed nanny adding images, photos, pictures, backgrounds, and more. In such webpage, we additionally have number of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

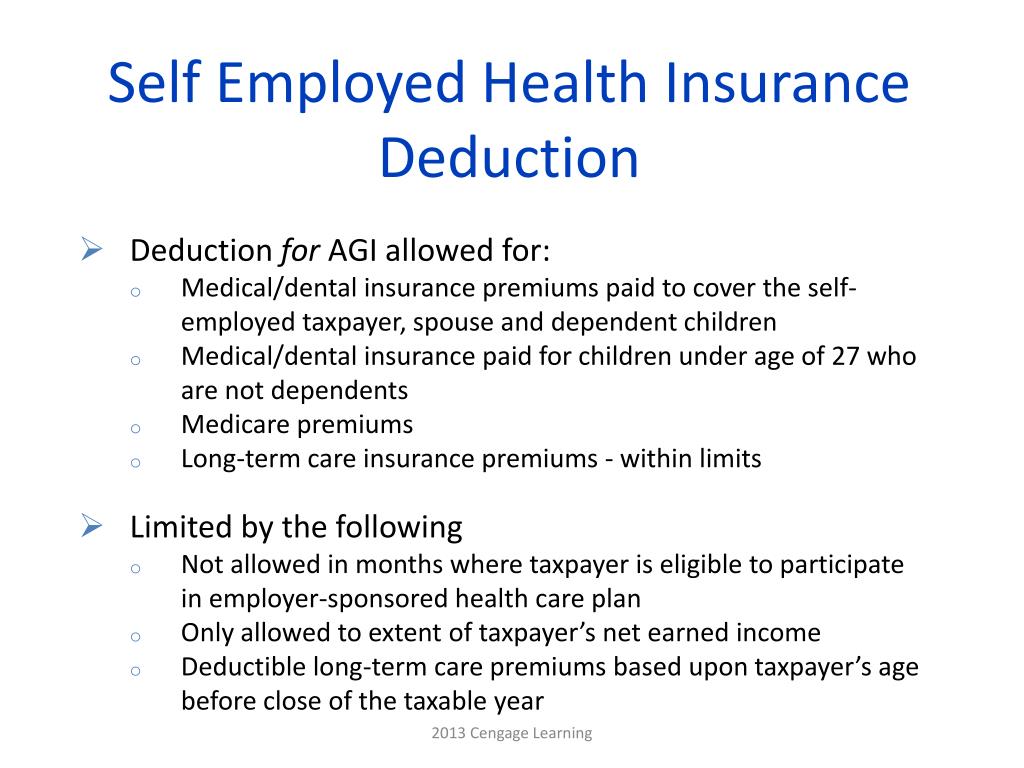

An s corporation cannot deduct health dental and other medical premiums for a shareholder who owns more than 2 percent.

Self employed nanny. If you are self employed you may be eligible to deduct premiums that you pay for medical dental and qualifying long term care insurance coverage for yourself your spouse and your dependents. Self employed individuals may deduct dental insurance premiums under certain conditions in the form of an adjustment to income on schedule 1 rather than as an itemized deduction on schedule a. A reduction in asset value by the amount of an expense.

Self employed insurance tax deductions are applicable to insurance premiums for medical dental or long term care. If you are reporting a net loss on schedule c you cannot deduct any part of the health insurance premiums you paid. No deduction can be taken at all without reporting profits.

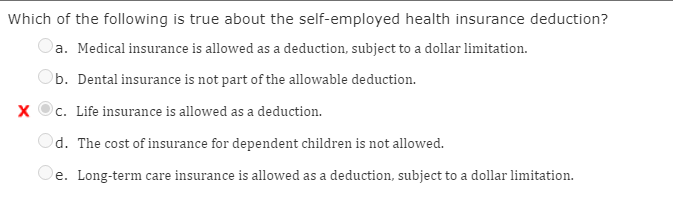

The self employed health insurance deduction applies to health insurance premiums for yourself your spouse and your dependents. This includes dental and long term care coverage. Below are the necessary steps to ensure the self employed health insurance deduction can be taken.

One of those times is to qualify to take the self employed health insurance deduction. The self employed health insurance deduction is a tax deduction that covers medical dental and long term care insurance premiums for those who are self employed. Self employed people are allowed to deduct health insurance premiums including dental and long term care coverage for themselves their spouses and their dependents.

An error can result in the loss of substantial tax savings. When youre an s corporation owner with more than 2 of the company stock youre treated the same as a self employed person when it comes to deducting health insurance premiums. This health insurance write off is entered on page 1 of form 1040 which means you benefit whether or not you itemize your deductions.

How to claim the deduction if youre self employed. Yes as stated by the irs for the self employed health insurance deduction the deduction is for medical dental or long term care insurance premiums that self employed people often pay for themselves their spouse and their dependents. Self employment income is reported on schedule f if youre a farmer or schedule c for other sole proprietors.

Make sure you follow these steps closely. In this case its a medical expense. If im self employed can i deduct my dental insurance premiums as well as my health insurance premiums.

The same types of premiums for their spouses dependents and any non dependent children under the age of 27 can also be deducted.

More From Self Employed Nanny

- Furlough And Unemployment Benefits

- Top Government Jobs In India Quora

- Government Employee Government Resume Sample

- Furlough Scheme Uk Definition

- Government Intervention Graph

Incoming Search Terms:

- Tips Of Self Employment Tax Deductions Government Intervention Graph,

- Can I Write My Health Insurance Off As A Business Expense Finance Zacks Government Intervention Graph,

- Did You Know Personal Health Insurance Premiums Are An Eligible Tax Deductible Expense In Ontario Ontario Blue Cross Government Intervention Graph,

- 7 Easy Ways To Reduce Self Employment Taxes In 2020 Self Employment Tax Deductions List Tax Deductions Government Intervention Graph,

- Self Employed Health Insurance Deduction Government Intervention Graph,

- Can Cobra Qualify For The Self Employed Health Insurance Deduction Finance Zacks Government Intervention Graph,