Self Employed W2, Insurance Premium On W2

Self employed w2 Indeed lately is being hunted by users around us, perhaps one of you personally. Individuals are now accustomed to using the net in gadgets to view image and video data for inspiration, and according to the title of this post I will talk about about Self Employed W2.

- Form W 2 Understanding Your W 2 Form

- What Is 1099 Vs W 2 Employee Napkin Finance Has Your Answer

- Freelance Taxes Made Easy 1099 Vs W2 Vs W 8ben

- Petition Ui Vs Pua For The Self Employed Change Org

- W2 To Self Employed Investor Investors Financial Freedom Freedom

- Self Employed Home Loans Home Facebook

Find, Read, And Discover Self Employed W2, Such Us:

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsgnio4y1qe2 C7fewqeptrhgspplu8ur805t2urujrbsffo9rw Usqp Cau

- You Self Employed We Got You On A Loan Nadjib Rusimbi Rusangwa Facebook

- Petition Ui Vs Pua For The Self Employed Change Org

- 1099 Vs W2 Be Better At Business Podcast Eagle Employer Services

- 1099 Self Employment Is Now A Better Tax Choice Than A W 2 Salary

If you are looking for Government Administration Jobs In Delhi you've reached the ideal place. We have 104 images about government administration jobs in delhi adding images, pictures, photos, wallpapers, and more. In these page, we additionally provide variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Understanding Form W 2 A Guide To The Wage Tax Statement Ageras Government Administration Jobs In Delhi

Self employment tax is also called seca tax from the self employed contributions act.

Government administration jobs in delhi. A w2 is a wage statement that your employer will give to you when you worked for them and they held out taxes for you. That rate is the sum. How do i get a w 2 if i am self employed.

The self employment tax rate for 2019 and 2020. As of 2014 the self employment tax rates were 124 percent for social security and 29 percent for medicare. July 17 2015 mst.

Self employed individuals generally must pay self employment tax se tax as well as income tax. There is no w 2 self employed specific form that you can create. Partnerships in a partnership each partner is only responsible for reporting their agreed upon percentage or amount.

In this case your taxable income is your self employment income so any income of the self employment business is considered your income. The short answer is it depends the best answer may be both. Se tax is a social security and medicare tax primarily for individuals who work for themselves.

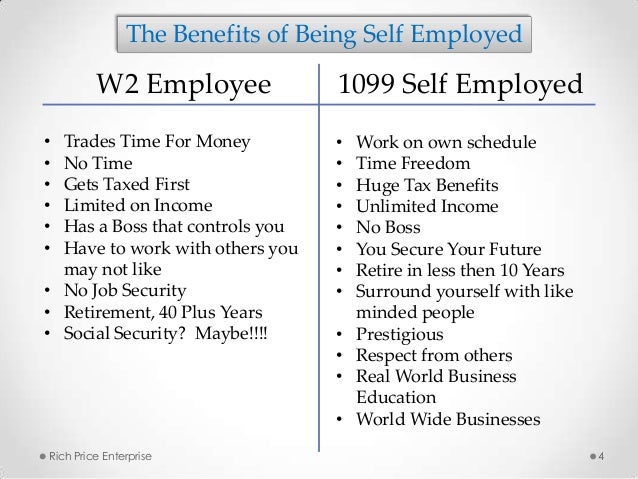

As noted the self employment tax rate is 153 of net earnings. As a self employed individual the onus of setting aside the money will fall on you. 94 comments i am often asked whether it is better to take a job as an employee or a job as an independent contractor or some other version of being self employed.

You are responsible for what you would pay as an employee as well as the employers share. The internal revenue service uses the self employment tax to account for social security and medicare taxes. A 1099 is a wage statement that your employer will give to you when you worked for them and they did not hold out taxes for you.

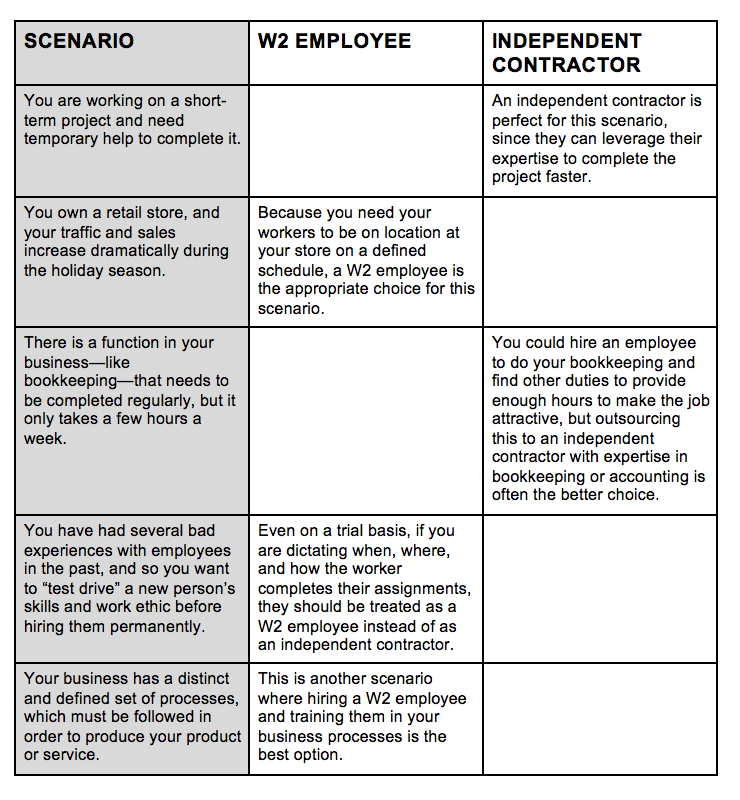

Self employment taxes are taxes paid by self employed business owners to the social security administration for social security and medicare based on earnings from a business you own not a corporation. Some of us have opportunities to work as either a w 2 employee or a 1099 contractor or even to be self employed as a small business owner. In the past it was usually a better tax choice to be a w 2 employee than to be self employed because employees paid slightly lower taxes on equivalent pay.

You may need to pay self employment taxes throughout the year. Neither if you are reporting your self employment income on schedule c as part of your personal form 1040 filing then you will not need to give yourself either a w 2 or a form 1099 misc.

More From Government Administration Jobs In Delhi

- Self Employed Furlough Scheme Hmrc August

- Government Gazette 2020 September 10

- Lenovo Government Laptop Charger Price

- Official Letter To Government Malaysia

- Government Gazette 2020 September 20

Incoming Search Terms:

- Yourtaxpro Instagram Posts Photos And Videos Picuki Com Government Gazette 2020 September 20,

- Freelance Taxes Made Easy 1099 Vs W2 Vs W 8ben Government Gazette 2020 September 20,

- Publication 531 2019 Reporting Tip Income Internal Revenue Service Government Gazette 2020 September 20,

- W2 Vs Self Employed White Coat Investor Government Gazette 2020 September 20,

- Saving For Taxes If You Re Non W2 Employed Saving Tax Employment Government Gazette 2020 September 20,

- I Swear By Quickbooks Self Employed For Taxes As A Freelancer Business Insider Government Gazette 2020 September 20,