Self Employed Pension Plan Rules, Ppt What Is It Powerpoint Presentation Free Download Id 4391475

Self employed pension plan rules Indeed lately has been sought by consumers around us, maybe one of you. Individuals now are accustomed to using the net in gadgets to see video and image information for inspiration, and according to the title of the post I will discuss about Self Employed Pension Plan Rules.

- Details Of Sep Iras Vanguard

- Https Www Oecd Org Finance Private Pensions 42574955 Pdf

- Self Employed Retirement Plans Know Your Options Nerdwallet

- Https Www Qualifiedplans Metlife Com Qplans Pdf Prc20 L0209020164 Exp0510 Keogh Plans For Self Employed Individuals And Partnerships Final Pdf

- Ppt What Is It Powerpoint Presentation Free Download Id 4391475

- Pin On Best Of Cloud Friday Small Business Tips

Find, Read, And Discover Self Employed Pension Plan Rules, Such Us:

- Canada Pension Plan Explained Pwl Capital

- Pension Fund Overview Office Of The New York State Comptroller

- Sep Plans For The Self Employed

- Https Www Irs Gov Pub Irs Prior P560 2016 Pdf

- Https Www Leggmason Com Content Dam Legg Mason Documents En Insights And Education Brochure Advantages Sep Ira Pdf

If you re looking for All Government Jobs List After Graduation you've reached the perfect place. We ve got 104 images about all government jobs list after graduation including images, photos, pictures, wallpapers, and much more. In these web page, we additionally have variety of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

This means that many self employed people may struggle to make ends meet in later life as the maximum state pension is currently only 17520 a week 202021 and the state pension age is rising.

All government jobs list after graduation. Self employment external website is a great choice for many people but you need to take steps to plan and save for your later lifeyou dont get automatically enrolled into a workplace pension or have extra contributions paid in to your pension by an employer. Its down to each self employed individual to put some plans in place to secure financial stability in retirement years. A simplified employee pension sep plan provides business owners with a simplified method to contribute toward their employees retirement as well as their own retirement savings.

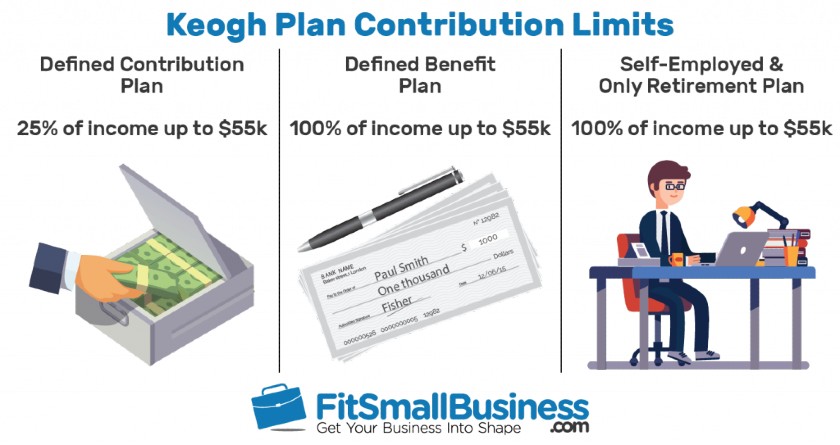

Self employed individuals who are high income earners 200000 to 1000000 or more should consider setting up a defined benefit pension plan if their goals are to reduce the taxes they pay each year and would like to make large annual contributions to fund their retirement. The new flat rate state pension is currently 16860 per week or 8767 a year and then only if you have made full national insurance contributions. The self employed arent required by law to enrol into a workplace pension and the workplace pension scheme doesnt apply to self employed.

If youre self employed youre entitled to the state pension in the same way as anyone else. It is strongly recommended for the self employed from the first day of starting your business you must ensure that your financial planning base is strong. Learn the basics of a sep plan.

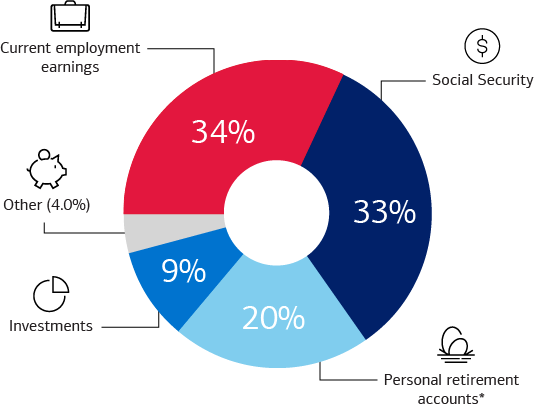

The below 10 golden rules have been critically examined which this author is of the opinion that the self employed must consider while actively engaged. For the current tax year 2019 20 the maximum value of the new state pension is 17520 per week. Simplified employee pension plan sep a sep plan allows employers to contribute to traditional iras sep iras set up for employees.

Contributions are made to an individual retirement account or annuity ira set up for each plan participant a sep ira. Simplified employee pension sep contribute as much as 25 of your net earnings from self employment not including contributions for yourself up to 57000 for 2020 and 56000 for 2019. Choose a sep plan.

Employers are obliged to automatically enrol their employees into a workplace pension scheme but if youre self employed then its up to you to start a pension. People who are self employed dont automatically get a workplace pension. Establish the plan with a simple one page form.

So unless people expect to work until they.

More From All Government Jobs List After Graduation

- Self Employed Nail Technician Resume

- Self Employed Accountant Salary

- Government Vacancy 2020

- Central Government Holidays 2021 Karnataka

- Furlough Extended To November

Incoming Search Terms:

- A Complete Guide To Self Employed Pensions Money To The Masses Furlough Extended To November,

- Taking Cash Out Retirement Plans Furlough Extended To November,

- 2 Furlough Extended To November,

- The Pension For The Self Employed Penfold Furlough Extended To November,

- What Pension Can I Get If I M Self Employed Pensionbee Furlough Extended To November,

- Self Employed Pension Tax Relief Simple Guide To Pensions Jf Financial Furlough Extended To November,