Self Employed W2 Mortgage, How To Get A Mortgage When You Re Self Employed Money

Self employed w2 mortgage Indeed recently has been sought by consumers around us, maybe one of you. Individuals now are accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the name of this article I will discuss about Self Employed W2 Mortgage.

- Https New Content Mortgageinsurance Genworth Com Documents Training Course Review 20s Corporation 20tax 20return 20form 201120s 20and 201040 20with 20w2 20and 20k1 Pdf

- Stated Income For Self Employed W2 Borrower

- Nestiny Funiversity Documents To Gather For Mortgage Loan Application

- How To Get A Mortgage When You Re Self Employed Money

- Need To Know Covid 19 Unemployment Benefits For The Self Employed News At Poole College

- 10 Down Georgia Self Employed Mortgage Lenders We Say Yes

Find, Read, And Discover Self Employed W2 Mortgage, Such Us:

- Self Employed Mortgage Guide And Faq The Lenders Network

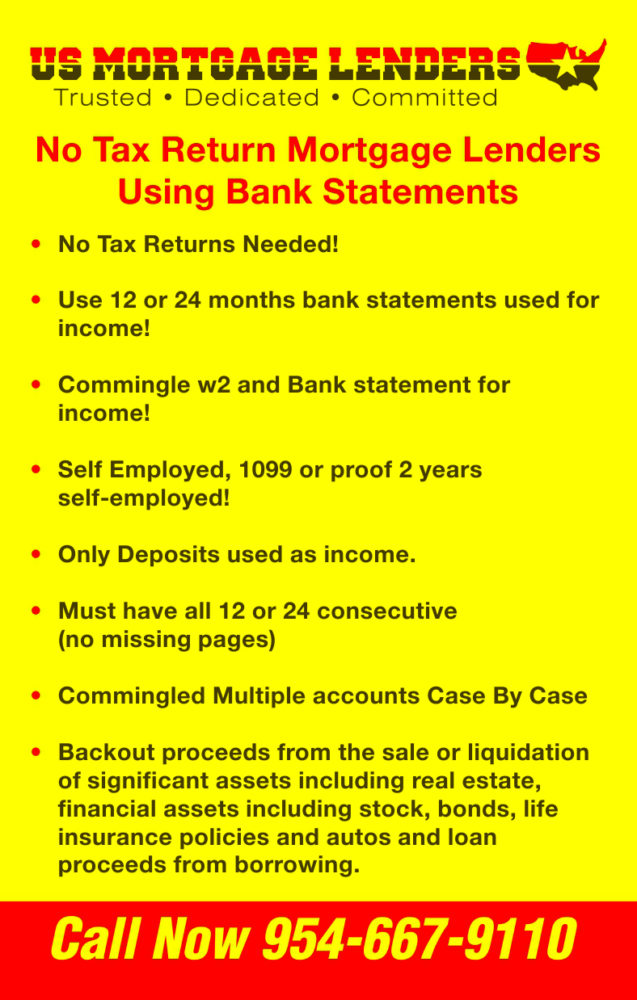

- No Tax Return Mortgage Lenders Use Bank Statements For Income

- Irs Form 4506 Sounds Harmless Enough 4506 T Mortgage Getloans Com

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqa19a 9ix8ojpihikyhjohkc5z0uincwgy724xnwghdw7rtlcg Usqp Cau

- Https Mortgagecurrentcy Com Wp Content Uploads 2019 12 Top 10 All Agencies 002 Pdf

If you re searching for Government Departments Clipart you've arrived at the right location. We have 104 graphics about government departments clipart including images, photos, photographs, backgrounds, and more. In such webpage, we additionally provide number of graphics available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

The challenge for self employed workers is that mortgage lenders will consider only their taxable income when assessing their dti ratio.

Government departments clipart. If youre self employed you probably already know that it may be a little harder for you to get a mortgage loan than for someone who works at a big company. In order for a self employed person to qualify for a fha loan they just meet the following requirements. Your credit score how much debt you have your assets and your income.

Many people assume that you must be a w 2 employee to be eligible for a fha loan. You must have been consistently self employed in the same line of work for at least the last 2 years. While getting a loan as a w 2 employee may be cheaper and easier than if youre self employed you dont have to go running back to your cubicle to qualify for a mortgagesome lenders may be.

If youre a self employed homeowner can you deduct your home mortgage interest from your taxes. However with mortgage for self employed versus w 2 borrowers self employed borrowers need to have two years of continuous employment unlike w 2 wage earners. The tax cuts and jobs act tcja imposed new limitations on the deduction that apply to all.

But the new tax law that went into effect in 2018 may do so. Self employed borrowers should be prepared to provide evidence of active income simply put the money you earn for your work. For example if a mortgage applicant has been laid off for two years and just started a new job on january 1 2017 they will be eligible for a mortgage loan on july 1 2017.

Mortgage lenders routinely require proof of income for mortgage approval which can be tricky when you dont have a w 2 or recent paycheck. When you work for someone else lenders go to your employer to verify the amount and history of that income and how likely it is youll keep earning it. For w 2 employees their pretax earnings are used.

The self employed borrower does endure more scrutiny that the standard paystubw2 employee. This is not the case. When youre self employed and you want to buy a home you fill out the same application as everyone elselenders also consider the same things.

If you go into your loan application with the proper expectations youll close your mortgage loan with very few surprises. Freedom mortgage doesnt reveal its credit requirements on its website but if youre applying for a conventional fixed rate loan or adjustable rate loan you should expect to need a minimum credit. Freedom mortgage is a direct lender that allows self employed borrowers to apply for a full range of mortgage loans through its online portal.

More From Government Departments Clipart

- Quickbooks Self Employed Invoice Logo Size

- How Many Government Jobs In India After 12th

- Government Tax Meme Template

- Uk Furlough Scheme 10th June

- Hp 246 Government Laptop Drivers For Win10 64bit

Incoming Search Terms:

- No Tax Return No W2 No Problem Hp 246 Government Laptop Drivers For Win10 64bit,

- Announcement 2020 009 2019 W 2 And Tax Return Transcripts Requirements Newrez Wholesale Hp 246 Government Laptop Drivers For Win10 64bit,

- Mortgages For Self Employed Chrisluis Com Hp 246 Government Laptop Drivers For Win10 64bit,

- No Income Check Mortgage Mortgagedepot Hp 246 Government Laptop Drivers For Win10 64bit,

- What Are The Best Mortgage Options For Self Employed Borrowers Hp 246 Government Laptop Drivers For Win10 64bit,

- How To Qualify For A Mortgage When You Re Self Employed Hp 246 Government Laptop Drivers For Win10 64bit,