Self Employed What Can I Claim For Working From Home, What Self Employed Expenses Can You Claim If You Work From Home

Self employed what can i claim for working from home Indeed lately is being sought by users around us, perhaps one of you personally. Individuals now are accustomed to using the net in gadgets to view image and video information for inspiration, and according to the title of the article I will discuss about Self Employed What Can I Claim For Working From Home.

- Third Self Employed Grant To Rise To 7 500 Which News

- I M Self Employed How Do I Claim Help From The Coronavirus Job Retention Scheme Internewscast

- Coronavirus Self Employed Small Limited Company Help

- The Self Employed Guide To Justifying Ridiculous Expenses On Your Tax Return

- How To Claim Universal Credit If You Re Self Employed Or Have Lost Your Job

- Working From Home Tax Allowance Yorkshire Accountancy

Find, Read, And Discover Self Employed What Can I Claim For Working From Home, Such Us:

- Self Employed Toolkit Everything You Need To Know About Being Self Employed In The Uk

- Supporting People And Companies To Deal With The Covid 19 Virus Options For An Immediate Employment And Social Policy Response

- Home Expenses To Claim When You Re Self Employed Faqs Money Donut

- Self Employed How To Claim Tax Deductions For Your Apartment Home Office Radpad Blog

- Self Employed Working From Home Jf Financial

If you are looking for Self Employed Opportunities you've reached the perfect location. We ve got 100 images about self employed opportunities adding pictures, photos, photographs, backgrounds, and much more. In such page, we also have variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

Self Employed Toolkit Everything You Need To Know About Being Self Employed In The Uk Self Employed Opportunities

You can either claim tax relief on.

Self employed opportunities. You can only use simplified expenses if you work for 25 hours or more a month from home. 6 a week from 6 april 2020 for previous tax years the rate is 4 a week you will not need to keep evidence of your extra costs. The simplified expenses flat rate method or.

Based on business hours or 25 to 50 hours per week self employed workers are eligible to claim simplified expenses of 26 a month 312 a year. With simply business you can build a single self employed insurance policy combining the covers that are relevant to you. You can claim either using.

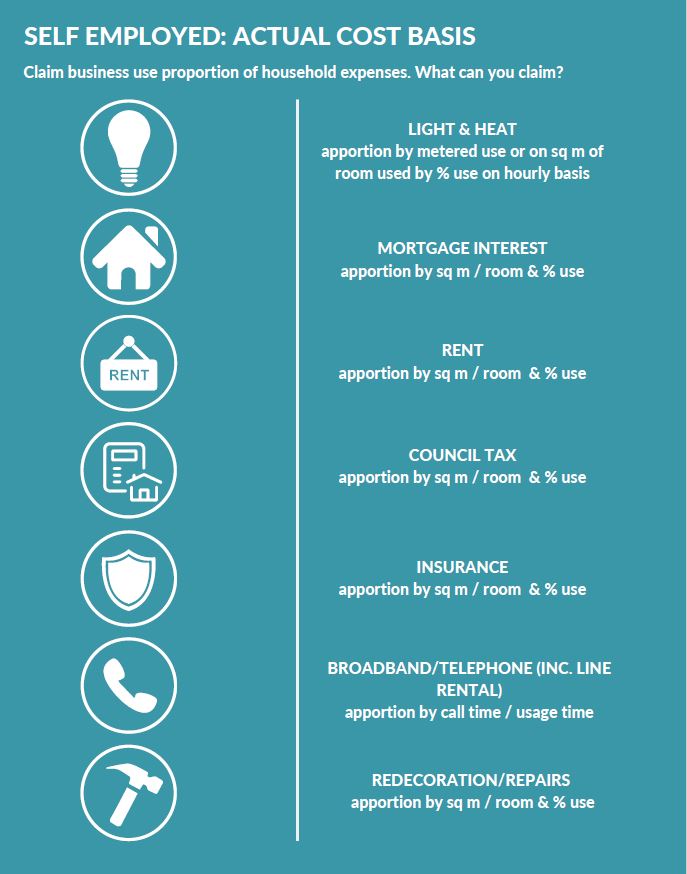

Claiming expenses if you are self employed. How much you can claim. You can claim expenses for rent maintenance and repair utility bills property insurance and security.

If you are self employed and working from home for at least 25 hours per month then you can claim a flat rate allowance on your taxes. Here you can claim tax relief on the up to 6 a week cost. Whether you are keeping costs down just starting out or simply like the thought of a commute that involves strolling downstairs many self employed workers choose to work from home.

Hours of business use. Martin lewis founder of moneysavingexpert this week confirmed with hmrc that it will consider claims from employees working at home due to coronavirus measures if their usual workplace is closed. The actual costs of your household bills.

The amount you can claim is based on whether you are self employed or an employee working from home. Working from home allowances for the self employed updated for 2021 this article was published on 03082020 self employed guide to claiming allowances for working at home. If you are self employed or a sole trader you will have expenses you can claim here is how you can calculate your home working expenses when you are running a business.

If you work from home at least 25 hours a month. The article highlights how to work out the rent mortgage council tax phone and broadband and the internet expenses. Simplified expenses method for claiming use of home.

You can claim the business proportion of these bills by working out the actual costs. What you can and cannot claim.

More From Self Employed Opportunities

- Self Employed Driving Jobs

- Massachusetts State Government Organizational Chart

- Government Institutions Logo

- Furlough Scheme Extended Bbc News

- Government Watchlist Search Covid

Incoming Search Terms:

- Hunter Gee Holroyd Home Sweet Home Tax Relief And Home Working Hunter Gee Holroyd Government Watchlist Search Covid,

- How To Claim Expenses When You Re Self Employed Courier Government Watchlist Search Covid,

- Self Employed Expenses Archives Finmo Government Watchlist Search Covid,

- Third Self Employed Grant To Rise To 7 500 Which News Government Watchlist Search Covid,

- Self Employed Working From Home Jf Financial Government Watchlist Search Covid,

- Hunter Gee Holroyd Home Sweet Home Tax Relief And Home Working Hunter Gee Holroyd Government Watchlist Search Covid,