What Is The Furlough Payment Amount, Hmrc Publish Furlough And Training Guidance For Apprentices

What is the furlough payment amount Indeed lately is being sought by consumers around us, perhaps one of you. People are now accustomed to using the net in gadgets to view image and video information for inspiration, and according to the name of the post I will talk about about What Is The Furlough Payment Amount.

- Furloughed Vs Laid Off Advantages Disadvantages And Differences Workest

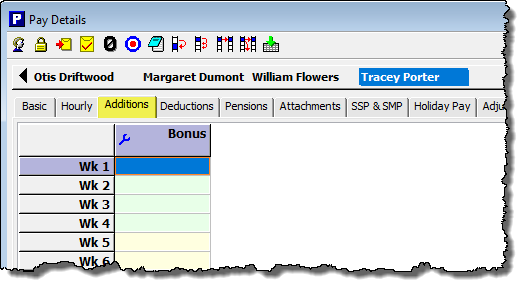

- Furloughed Workers Moneysoft

- Why Furlough Works Germany Spends Big To Save Jobs Europe The Economist

- The Effects Of The Coronavirus Crisis On Workers Resolution Foundation

- The Effects Of The Coronavirus Crisis On Workers Resolution Foundation

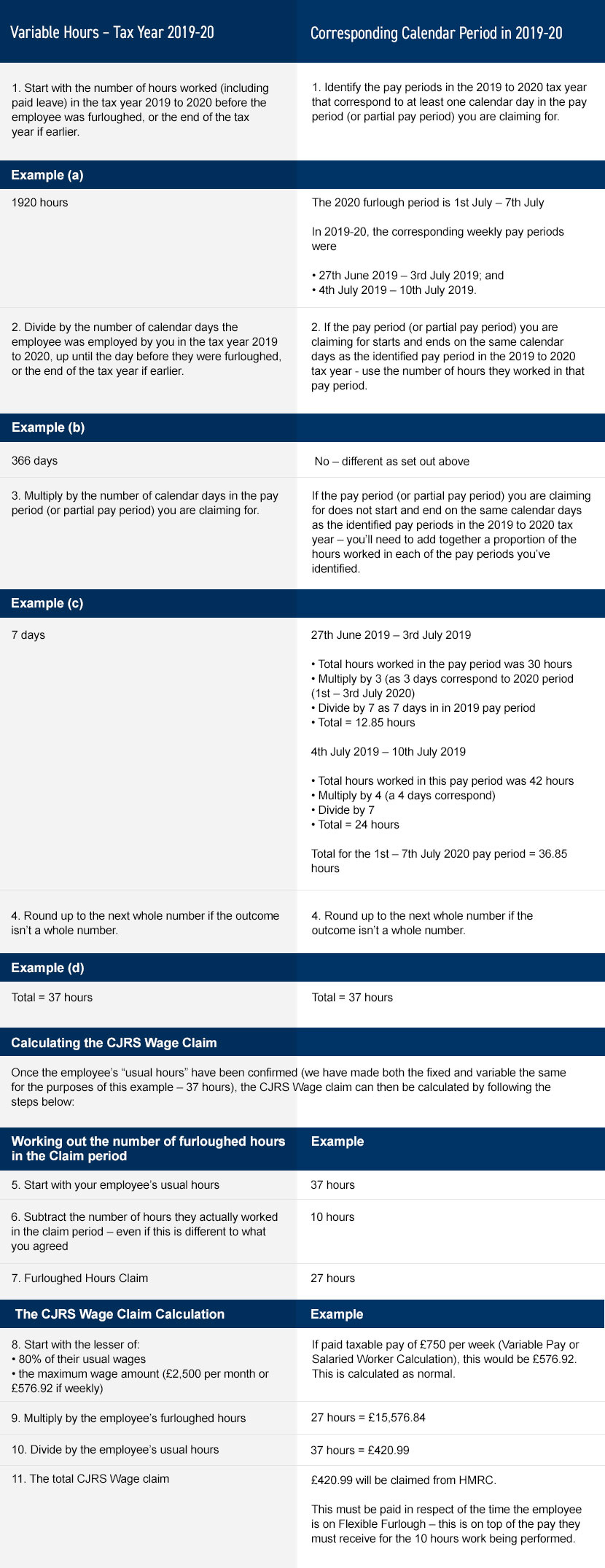

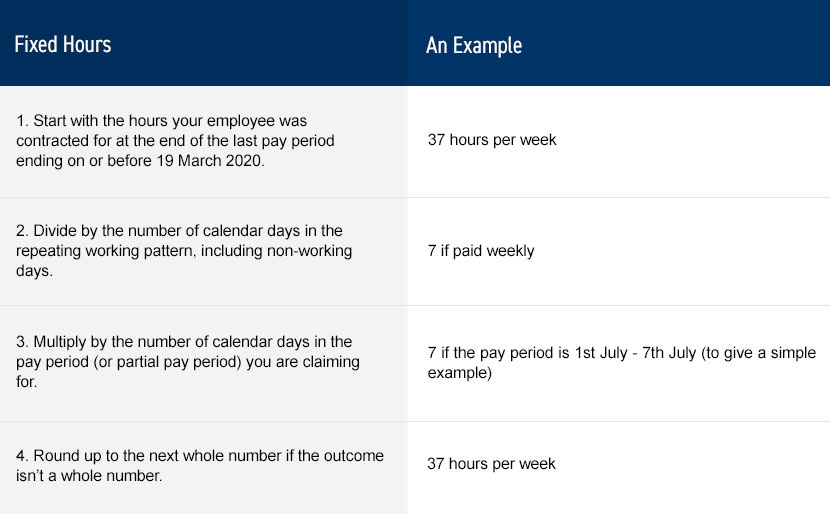

- Flexible Furlough Guidance And Examples Mazars United Kingdom

Find, Read, And Discover What Is The Furlough Payment Amount, Such Us:

- Uk Coronavirus Furlough Claim Calculator

- Flexible Furlough The Introduction Optimum

- Furlough Claim Report Now Available Cloud Payroll Blog Staffology Payroll

- Coronavirus Furloughing Employees

- Furlough Claim Calculator For Monthly Payroll Freeagent

If you re looking for Working Self Employed While Furloughed you've arrived at the perfect place. We have 100 images about working self employed while furloughed including pictures, pictures, photos, wallpapers, and much more. In such web page, we also provide number of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

Flexible Furlough Guidance And Examples Mazars United Kingdom Working Self Employed While Furloughed

The problem is that i dont think they have calculated my furlough pay correctly.

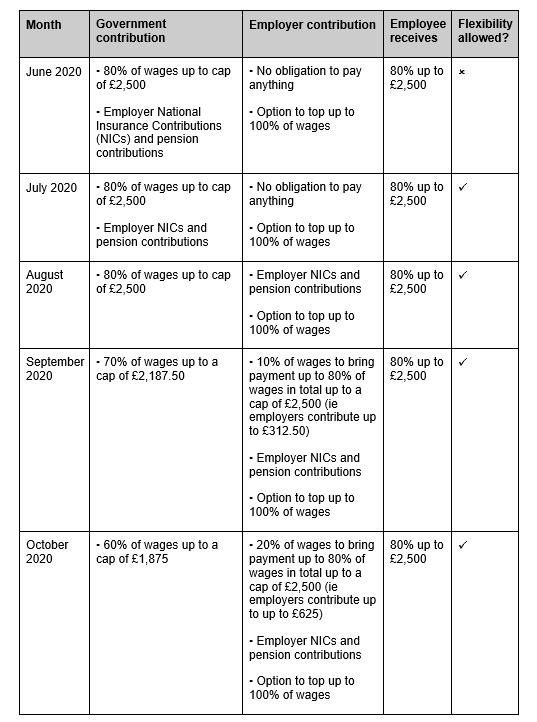

Working self employed while furloughed. This is the minimum amount you must pay your employee for the time they are recorded as being on furlough. The government has extended the furlough scheme meaning workers can get 80 of their salary paid through lockdown. As the employee is on fixed pay and the claim period is again the full pay period the maximum wage amount and 80 of usual wage will be the same amounts so the furlough pay is again based on.

My wage varies from month to month i get a basic amount and an extra amount for each day worked. My boss is only paying me and therefore i assume only claiming for 80 of the basic element but the guidance states that any regular payments can be included. The furlough scheme has been extended until december 2020.

You can choose to pay more than this but you do not have to. Flexible furlough must last for at least 7 days in a calendar month for an employer to make a claim. Under the coronavirus jobs retention scheme to give furlough its official title employees placed on leave receive 80 of their pay up to a maximum of 2500 a month.

The government is covering 80 per cent of the wages of furloughed staff up to 2500 but employees can. How much furlough pay you get will depend on the agreement youve made with your employer. Under the terms of the extension the government will pay 80 of a workers salary while the employer will have to meet the cost of national insurance payments and pension contributions.

Pay during furlough is taxable in the same way as someones usual pay would be. The scheme was due to end on october 31 but will now run throughout november as b. However hm treasury will now extend the furlough scheme until december when it will be replaced by the job support scheme.

More From Working Self Employed While Furloughed

- Self Employed Vs Entrepreneur

- Furlough Scheme Rules 3 Weeks

- Self Employed Taxes For Dummies

- Furlough Extension Germany

- Self Employed Health Insurance Deduction Basis Limitation

Incoming Search Terms:

- Furlough Faqs Self Employed Health Insurance Deduction Basis Limitation,

- More Than One In Four Uk Workers Now Furloughed Bbc News Self Employed Health Insurance Deduction Basis Limitation,

- Chancellor Extends Self Employment Support Scheme And Confirms Furlough Next Steps Gov Uk Self Employed Health Insurance Deduction Basis Limitation,

- Furlough Scheme Boris Johnson Extended Measures For Coronavirus Second Lockdown Personal Finance Finance Express Co Uk Self Employed Health Insurance Deduction Basis Limitation,

- Furloughed Workers Moneysoft Self Employed Health Insurance Deduction Basis Limitation,

- Https Www Gsa Gov Cdnstatic Furlough Guide To Reading My Earning 26 Leave Statement Pdf Self Employed Health Insurance Deduction Basis Limitation,