Self Employed Tax Rate 2019, 2019 Tax Rate Schedules Individuals Schedule X Single If Taxable Income Is Over But Not Over The Homeworklib

Self employed tax rate 2019 Indeed lately is being hunted by users around us, maybe one of you personally. Individuals are now accustomed to using the net in gadgets to view video and image information for inspiration, and according to the name of the article I will discuss about Self Employed Tax Rate 2019.

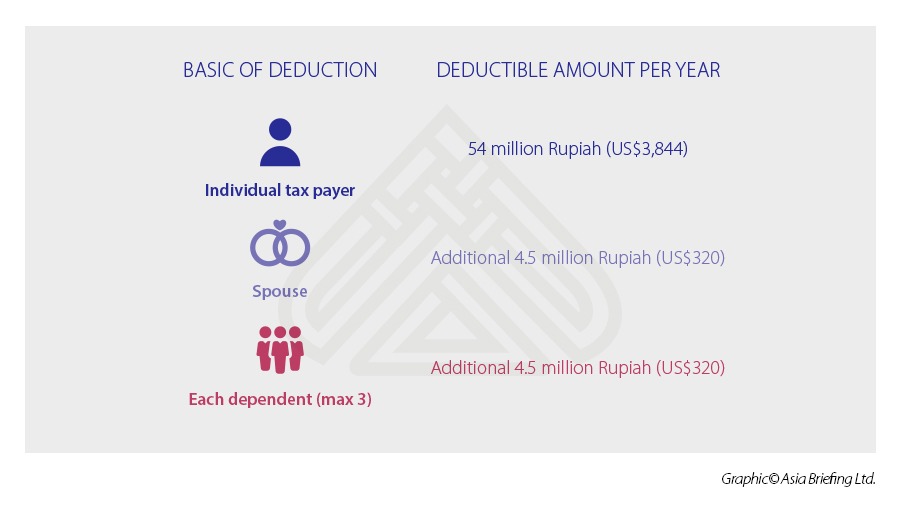

- Simple Tax Guide For Americans In Poland

- Filing 8 Income Tax T Ask Ation

- Estonian Taxes And Tax Structure As Of 1 July 2017

- Free Tax Estimate Excel Spreadsheet For 2019 2020 Download

- Income Tax For Self Employed Professionals Infographic Cloudcfo

- What Is The Self Employment Tax In 2020 Thestreet

Find, Read, And Discover Self Employed Tax Rate 2019, Such Us:

- 2

- Self Employed Pay Too Much Tax St Clair Financial

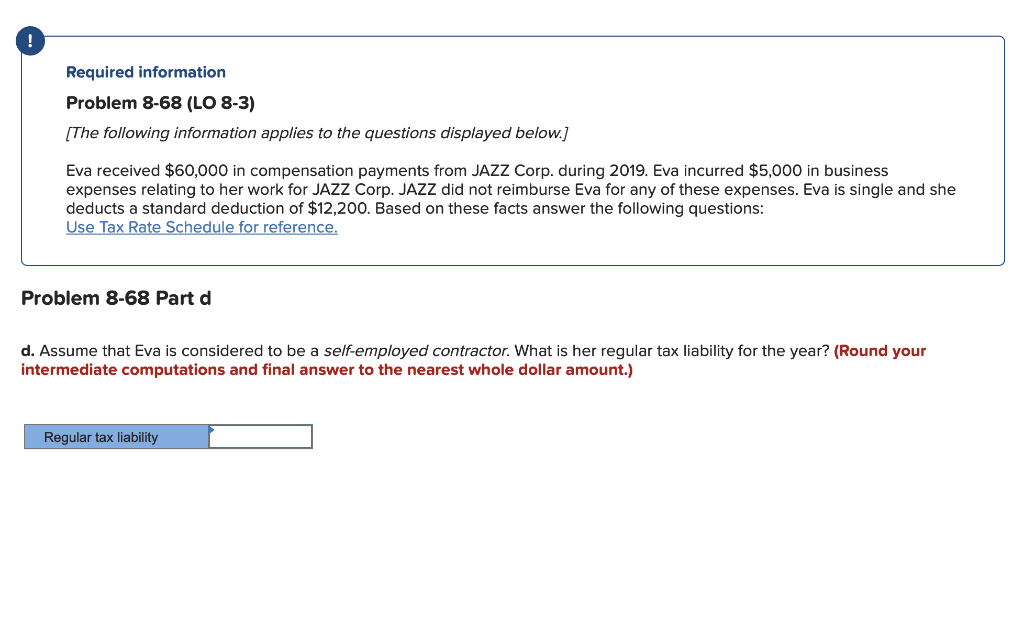

- Tax Guide For Independent Contractors

- Taxes For Self Employed Individuals In The Philippines

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

If you are looking for Government Laptop Scheme Ul you've reached the perfect location. We ve got 104 graphics about government laptop scheme ul including images, photos, pictures, wallpapers, and more. In these webpage, we additionally have number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

The rate consists of two parts.

Government laptop scheme ul. The current self employment tax rate is 153. Actual results will vary based on your tax situation. When to pay self employment tax.

These figures are mostly taken from the 2018 uk budget published 29 october 2018 and are subject to change. Self employment tax and the irs benefitting from acceptable deductions. 12500 visit this page basic tax rate.

The remaining 29 goes to medicare without any collectible earnings limit. 31st january 2021 personal allowance. Estimates based on deductible business expenses calculated at the self employment tax income rate 153 for tax year 2019.

That rate is the sum of a 124 social security tax and a 29 medicare tax on net. Income tax loss relief for self employed. For 2019 the first 132900 of your combined wages tips and net earnings is subject to any combination of the social security.

The self employed persons fica tax rate for 2019 january 1 through december 31 2019 is 153 on the first 132900 of net income plus 29 on the net income in excess of 132900. It is intended to benefit self employed people who were profitable in 2019 but as a result of the covid 19 pandemic will make a loss in 2020. The first 45282 of taxable income is taxed at 15 percent.

Canada has a progressive income tax and the federal tax rate on personal income for 2018 tax year is as follows. 6th april 2019 to 5th april 2020 tax return deadline. Pays for itself turbotax self employed.

Ultimately for the self employment tax 2019 youll have to pay both portions of employer and employee social security and medicare which breaks down as follows. 201920 tax rates for self employed in the uk. On 23 july 2020 the government announced the introduction of a new once off income tax relief measure.

If you had self employment income earnings of 400 or more during the year you are required to pay self employment taxes and file schedule se with your form 1040 which is generally due by april 15 now july 15 2020however if you expect to owe 1000 or more in combined income tax and self employment taxes youll need to make estimated quarterly tax. In other words the self employed persons fica tax rate for 2019 includes all of the following. 124 for social security old age survivors and disability insurance and 29 for medicare hospital insurance.

The self employment tax rate is 153. Of that percentage 124 goes to social security and is collectible up to 118500 of net earnings. The self employment tax rate for 2019 and 2020.

The next 45281 is taxed at 205 percent the portion of taxable income between 45282 and 90563. Current california self employment tax rates.

More From Government Laptop Scheme Ul

- Government Company Examples Class 11

- Self Employed Furlough Forum

- Uk Furlough Scheme Login

- Government Board Games

- Government Covid Relief For Businesses

Incoming Search Terms:

- How Much Does A Small Business Pay In Taxes Government Covid Relief For Businesses,

- Payroll Taxes What Are They And What Do They Fund Government Covid Relief For Businesses,

- What Is Self Employment Tax Rate Calculations More Government Covid Relief For Businesses,

- Understanding Self Employment Taxes As A Freelancer Tax Queen Self Employment Business Tax Money Frugal Government Covid Relief For Businesses,

- Do I Have To File Taxes Government Covid Relief For Businesses,

- 2 Government Covid Relief For Businesses,