Self Employed Labourer Tax, 5 Things You Must Do When You Go Self Employed Bytestart

Self employed labourer tax Indeed lately has been hunted by users around us, maybe one of you personally. Individuals are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the name of the post I will discuss about Self Employed Labourer Tax.

- Self Employed Or Freelancer Singapore Managing Cpf Income Tax Etc

- Specialising In Contracting Services For Cis Operatives Tax Legal Compliance Pdf Free Download

- Your Bullsh T Free Guide To Income Tax In The Uk

- Unemployment Wikipedia

- Https Nanopdf Com Download Average Monthly Earnings Compensation Of Employees And Unit Pdf

- Http Researchbriefings Files Parliament Uk Documents Sn00196 Sn00196 Pdf

Find, Read, And Discover Self Employed Labourer Tax, Such Us:

- Self Employment Freelance Work Flat 3d Web Isometric Concept Stock Illustration Illustration Of Self Unrecognizable 49096440

- Https Nanopdf Com Download Average Monthly Earnings Compensation Of Employees And Unit Pdf

- More Women Are Self Employed In India Fewer Hold Salaried Jobs Business Standard News

- What Types Of Insurance Do You Need If You Re Self Employed Daveramsey Com

- Http Researchbriefings Files Parliament Uk Documents Sn00196 Sn00196 Pdf

If you are looking for Furlough Scheme Extended France you've come to the perfect place. We have 104 images about furlough scheme extended france adding images, photos, photographs, backgrounds, and more. In such webpage, we additionally provide number of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

It is important that you are aware of what allowable expenses you can claim against your income.

Furlough scheme extended france. The report has called for significant reforms to the way that the self employed are taxed and how it is governed and overseen. This will impact the five million self employed people in the uk as rates shoot up from 19. However say you earned 40000 in your full time job an additional casual income of 2000 would be taxed at 40 800.

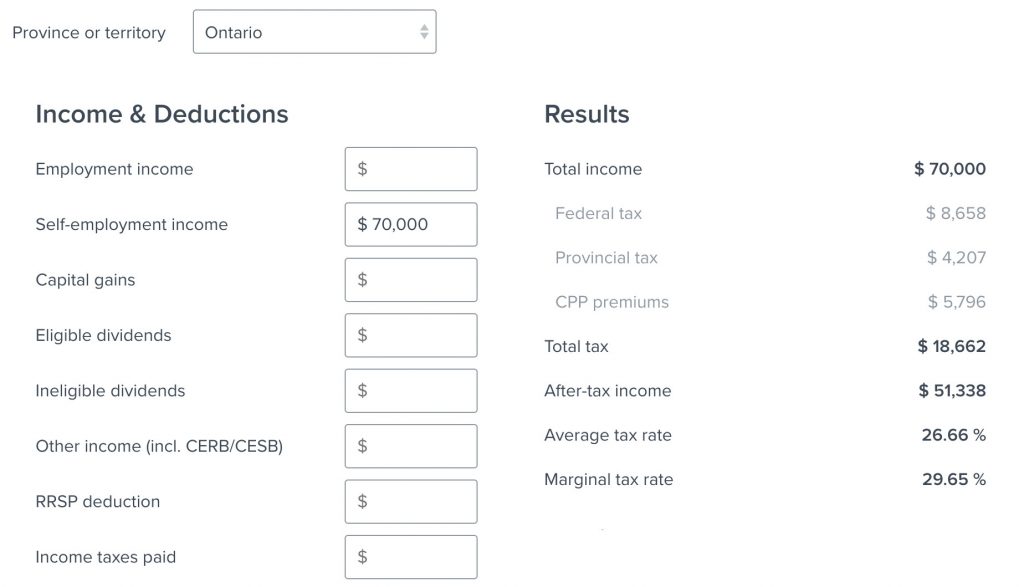

Hm revenue and customs hmrc may regard someone as self employed for tax purposes even if they have a different status in employment law. You pay 2000 20 on your self employment income between 0 and 10000. The deadline is january 31st of the following year.

From our experience there are a number of people that end up paying more tax than necessary either because they havent recorded evidence of their costs or they dont realise what expenses and allowances they can claim. Payment after deduction of tax at 20 most labour only subcontractors will have tax deducted at a flat rate of 20. So for example if you earn 20000 in your full time job and earn 2000 casual income then you will pay tax at 20 on your additional earnings 400.

Employers should check if a worker is self employed in. Someone whose business has a gross profit of 30000 would pay an extra 2172 in tax while someone with a gross profit of 50000 would be down 4517. The voluntary classification settlement program vcsp is an optional program that provides taxpayers with an opportunity to reclassify their workers as employees for future tax periods for employment tax purposes with partial relief from federal employment taxes for eligible taxpayers that agree to prospectively treat their workers or a class or group of workers as employees.

You will need to submit a self assessment tax return and pay these taxes and contributions yourself. As well as changing the ways that dividends are paid corbyn plans to hike corporation tax in the uk. All self employed building labourers have to complete a tax return.

You pay 7200 40 on your self employment income between 10000 and 28000. Usually labourers are employed rather than self employed or under the cis system where as skilled labourerstradespersons would fall under cis. Taxation of the self employed a new report from labour business is highly critical of the governments taxing of freelancers through the off payroll regulations.

More From Furlough Scheme Extended France

- Government Official Ancient Egypt

- Self Employed Deductions

- Self Employed Hmrc Login

- Government Procurement Card Policy

- Furlough Extension Latest News

Incoming Search Terms:

- Free Invoice Templates Online Invoices Furlough Extension Latest News,

- Am I Employed Self Employed Both Or Neither Low Incomes Tax Reform Group Furlough Extension Latest News,

- Https Nanopdf Com Download Average Monthly Earnings Compensation Of Employees And Unit Pdf Furlough Extension Latest News,

- Your Bullsh T Free Guide To Income Tax In The Uk Furlough Extension Latest News,

- The Hidden Cost Of Self Employment The Independent The Independent Furlough Extension Latest News,

- Self Employed Invoice Template Free Download Send In Minutes Furlough Extension Latest News,