Government Spending And Tax Multiplier, Proportional Tax Function And The Balanced Budget Multiplier With Formula

Government spending and tax multiplier Indeed lately is being sought by consumers around us, maybe one of you. Individuals are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the name of the post I will discuss about Government Spending And Tax Multiplier.

- Tax Multiplier Formula Calculator Examples With Excel Template

- The Concept Of Balanced Budget Multiplier Bbm

- Introduction To Fiscal Policy Boundless Economics

- Tax Multiplier Formula Calculator Examples With Excel Template

- Tax Multiplier T Multiplier With Diagram

- Keynesian Cross And Balanced Budget Multiplier Economics Stack Exchange

Find, Read, And Discover Government Spending And Tax Multiplier, Such Us:

- Solved The Tax Multiplier Is Negative Because An Increase Chegg Com

- Tax Multiplier T Multiplier With Diagram

- Econowaugh Ap Spending Multiplier Vs Taxing Multiplier

- Spending And Tax Multiplier Practice Answer Key

- Tax Multiplier Formula Calculator Examples With Excel Template

If you re searching for Self Employed Van Driver Bristol you've reached the right place. We ve got 104 graphics about self employed van driver bristol adding images, photos, pictures, wallpapers, and more. In such webpage, we additionally have number of graphics available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

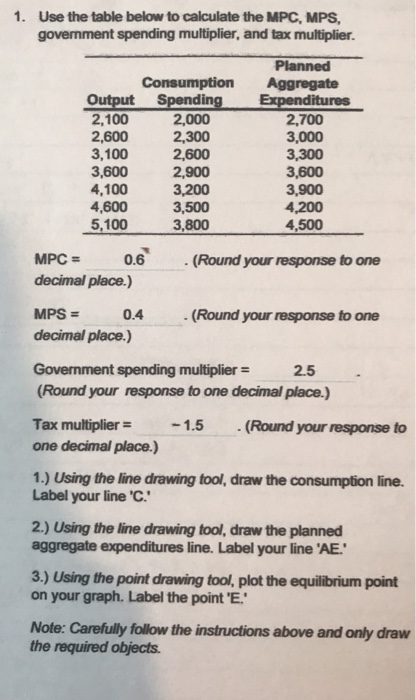

How much income would expand depends on the value of mpc or its.

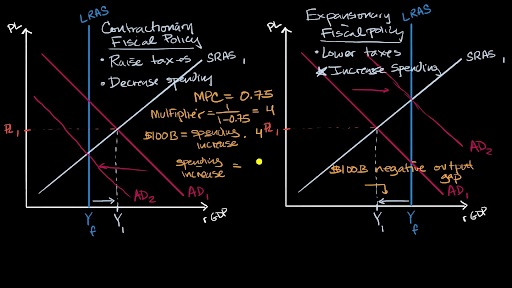

Self employed van driver bristol. A if the marginal propensity to consume is equal to 075 calculate the maximum. The government spending multiplier and the tax multiplier. The keynesian multiplier is an economic theory that asserts that an increase in private consumption expenditure investment expenditure or net government spending gross government spending government tax revenue raises the total gross domestic product gdp by more than the amount of the increase.

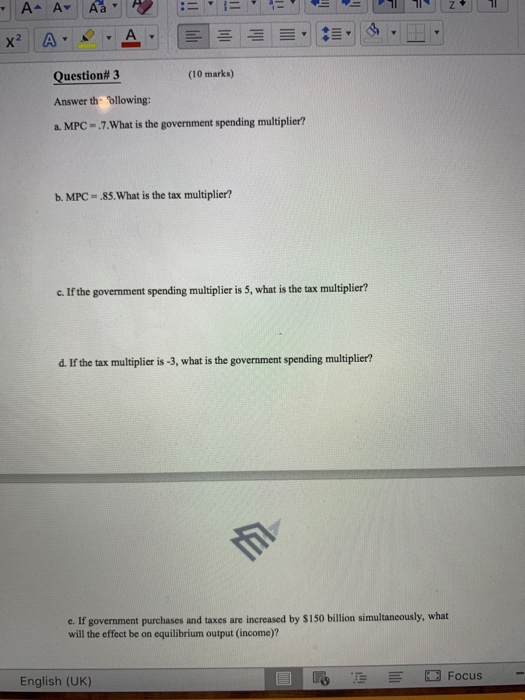

The term tax multiplier refers to the multiple which is the measure of the change witnessed in the gross domestic product gdp of an economy due to change in taxes introduced by its government. Mps stands for marginal propensity to save mps. The spending multiplier measures fiscal policy effects on the economy.

The government expenditure multiplier is thus the ratio of change in income y to a change in government spending g. To arrive at the increase in income as a result of the combined operation of the government expenditure multiplier and the tax multiplier we write the balanced budget multiplier equation as thus the increase in income y exactly equals the increase in government expenditure g and the lump sum tax t ie. The following formula gives the impact on rgdp of a change in g.

If there is an increase in government spending of 100 and an increase in taxes of 100 in econoland then the change in gdp will be. It shows how gdp increases or decreases in response to the changes in government spending. Tax multiplier formula table of contents formula.

Any change in the governments activities will have a significant impact on a countrys economy and consumer purchase power. Where tm s is the simple tax multiplier. Mps equals 1 mpc.

If there is an increase in taxes of 200 in econoland the decrease in gdp will be. Given the same value of marginal propensity to consume simple tax multiplier will be lower than the spending multiplierthis is because in the first round of increase in government expenditures consumption increases by 100 while in. In other words an autonomous increase in government spending generates a multiple expansion of income.

This number is related mainly to how much consumers save. 20 crore results in a decline of income of rs. If mpc 34 then the value of k t 341 34 3an increase in taxes of rs.

And mpc is marginal propensity to consume. Thus tax multiplier is negative and in absolute terms one less than government spending multiplier. If g is the component of a that changes then the government spending multiplier gm is given by the multiplier we derived above 20.

Https Apcentral Collegeboard Org Pdf Teaching Spending Multipliers Pdf Course Ap Macroeconomics Self Employed Van Driver Bristol

More From Self Employed Van Driver Bristol

- Government Consulting Firms Dc

- Self Employed Income Support Scheme Login

- Self Employed Retirement Plans Reddit

- Self Employed Mortgage Refinance

- Government Yojana 2020 Pdf

Incoming Search Terms:

- Proportional Tax Function And The Balanced Budget Multiplier With Formula Government Yojana 2020 Pdf,

- Https Yuiworld Files Wordpress Com 2011 05 Cfo Ch9problems Pdf Government Yojana 2020 Pdf,

- Ppt Chapter 13 Powerpoint Presentation Free Download Id 3028344 Government Yojana 2020 Pdf,

- Econowaugh Ap Spending Multiplier Vs Taxing Multiplier Government Yojana 2020 Pdf,

- Tax Multiplier Formula Calculator Examples With Excel Template Government Yojana 2020 Pdf,

- Fiscal Policy Government Yojana 2020 Pdf,