Self Employed Tax Rate California, California Self Employment Tax State Federal Compliance

Self employed tax rate california Indeed recently has been hunted by consumers around us, maybe one of you. People are now accustomed to using the net in gadgets to view image and video data for inspiration, and according to the name of the article I will discuss about Self Employed Tax Rate California.

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctiq D 6ex4ga2gzbusdq1vkj Ojahafxx7hxke1ffklhwm3ufl Usqp Cau

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcq0q2w N29adzqdentzncve3th56gyrhygkiwoa3au6mltjsbim Usqp Cau

- New York Taxes Layers Of Liability Cbcny

- New Tax Law Take Home Pay Calculator For 75 000 Salary Business Insider

- How Much Does A Small Business Pay In Taxes

- How To Report And Pay Taxes On 1099 Income

Find, Read, And Discover Self Employed Tax Rate California, Such Us:

- How To Calculate Payroll Tax

- California Self Employment Tax State Federal Compliance

- The Independent Contractor Tax Rate Breaking It Down Benzinga

- What Taxes Do I Pay As A Sole Proprietor Melissa Whaley

- Free Tax Estimate Excel Spreadsheet For 2019 2020 Download

If you re looking for Self Employed Disability Insurance Canada you've come to the right location. We ve got 104 graphics about self employed disability insurance canada including images, pictures, photos, wallpapers, and more. In such page, we additionally have variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Board of equalization franchise tax board.

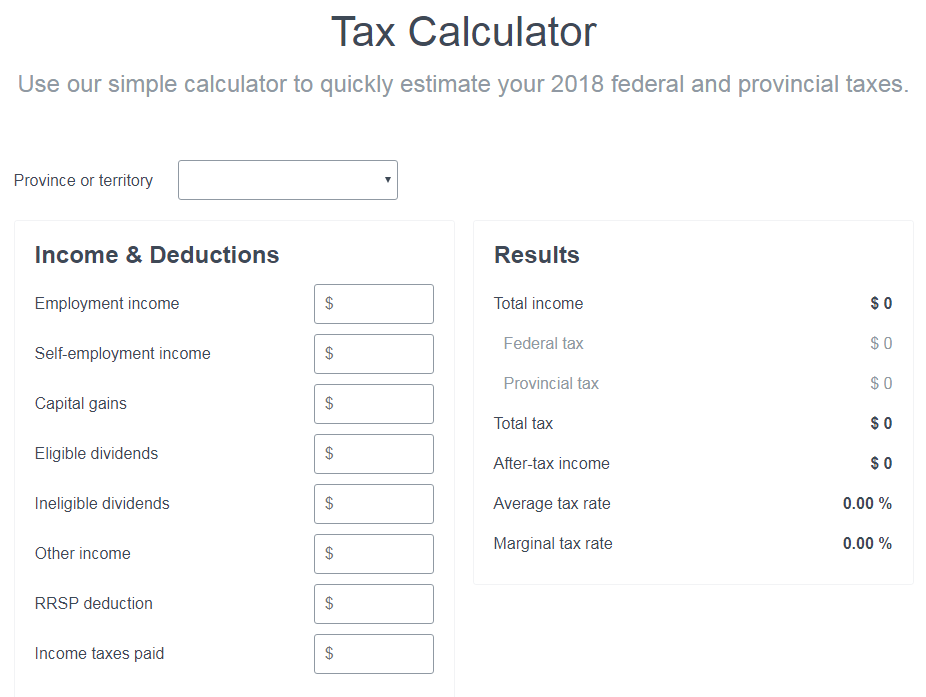

Self employed disability insurance canada. Use the link to the free calfile portal or print out the forms and mail them in. The biggest reason why filing a 1099 misc can catch people off guard is because of the 153 self employment tax. The self employment tax rate for 2019 and 2020 as noted the self employment tax rate is 153 of net earnings.

Department of industrial relations employment. Governors office of business and economic development permits and licenses secretary of state california department of business oversight. 124 for social security tax and 29 for medicare.

This tax applies to those who are sole proprietors with a net profit of 400 or more during the year. The 1099 tax rate consists of two parts. The self employment tax is calculated on 9235 of your total income.

Since you dont have an employer to withhold the tax and make payments for you its up to you as the business. Self employment tax is social security and medicare tax for people who are self employed. This rate is derived from the fact that self employed taxpayers can deduct the employers portion of the tax which is 765.

In case your self employment income equals more than the contribution and benefit base 132900 for the tax year 2019 multiply the result by 0029 and add 153 percent of the contribution and benefit base. Small business events in your area. The tax rate is currently 153 of your income with 124 going to social security and 29 going to medicare.

Current california self employment tax rates. Use forms 1040 es and 540 es schedule se to report self employment tax. The self employment tax applies evenly to everyone regardless of your income bracket.

View all methods on their payments page. 1 800 358 0305 email protected home. That rate is the sum of a 124 social security tax and a 29 medicare tax on net.

2016 tax rates for the self employed. Paying taxes on your self employment income. The irs offers several ways to pay your taxes.

Take advantage of these deductions. Doing business in the state. To pay your california self employment tax visit the ftb website.

In this case your self employment taxes paid would earn you a deduction of 353244 on your income taxes. This amount of 153 covers a social security payment of 124 and a medicare payment of 29. It also applies to individuals who have a net profit of 400 or more during the year from the partnership or limited liability company that is structured.

The current self employment tax rate is 153.

What Is Self Employment Tax And What Are The Rates For 2020 Workest Self Employed Disability Insurance Canada

More From Self Employed Disability Insurance Canada

- Philippine Government Procurement Process Flow Chart

- Government Law College Thrissur Thrissur Kerala

- Upcoming Government Exams 2020 Full List For Graduates

- Self Employed National Insurance Threshold 202021

- Government Of India Act 1919 Pdf In Hindi

Incoming Search Terms:

- Health Insurance Plans In California Individual Plans Quotes Government Of India Act 1919 Pdf In Hindi,

- How To Calculate Self Employment Tax In California Newpoint Law Group Government Of India Act 1919 Pdf In Hindi,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctungwvw6 R00h6x4zyttvcjixiq6b0asnvftxtqfftuqn0ot I Usqp Cau Government Of India Act 1919 Pdf In Hindi,

- Free California Payroll Calculator 2020 Ca Tax Rates Onpay Government Of India Act 1919 Pdf In Hindi,

- How To Calculate Your Effective Tax Rate My Money Us News Government Of India Act 1919 Pdf In Hindi,

- State Income Tax Wikipedia Government Of India Act 1919 Pdf In Hindi,

:strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

/ScreenShot2020-04-03at11.52.59AM-9d0f626d45704b75a451679182d740ef.png)