Self Employed Register For Gst, Dealer Wise Process Of Gst Registrations Gst Return Forms Sag Infotech

Self employed register for gst Indeed recently is being hunted by consumers around us, maybe one of you personally. People now are accustomed to using the net in gadgets to view video and image data for inspiration, and according to the name of the post I will talk about about Self Employed Register For Gst.

- Uber Or Lyft Driver S Gst Hst Account Registration With Cra

- Sales Tax In Canada Hst Gst Pst When You Re Self Employed

- 골든트리컨설팅

- Excel Invoice Template Gst Coinsnow Co

- Gst Hst Information For Freight Carriers Pdf Free Download

- Gst How Self Employed Professionals Entrepreneurs Smes Can Get Ready For Gst The Economic Times

Find, Read, And Discover Self Employed Register For Gst, Such Us:

- Iras Responsibilities Of Gst Registered Businesses

- Gst Registration For Freelancers A Complete Guide Razorpay Freelancers

- Gst Pension Scheme

- Week 8 Tutorial Taxation Acct254 Ucnz Studocu

- 10 Things To Know About Freelance Taxes In Canada

If you re looking for Government To Citizen Services you've come to the perfect location. We ve got 100 graphics about government to citizen services adding pictures, photos, pictures, wallpapers, and more. In such web page, we also have variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

For gsthst purposes you may be able to claim an itc for the gsthst paid or payable on property such as capital property and inventory that you have on hand on the day you register.

Government to citizen services. Self employed consultants who get paid at a cycle of later than 50 days need a good plan. There is no other mechanism to avoid delay in compliances says aarti garg partner indirect tax anil k goyal and associates. They need to create a buffer of cash flow to rotate for payment of gst.

Self employment income is not automatically considered insurable under ei unless you have additionally entered into a special agreement with service canada to start paying premiums and filing schedule 13 with your income tax return. Register for a gsthst account. You can claim back expenses for business activity that you carry out.

Hi gst registration is mandatory in certain cases any business whose turnover in a financial year exceeds rs 20 lakhs rs 10 lakhs for north eastern and hill states. You need to register for gst if you earn over 60000 a year. You pay tax on net profit by filing an individual income return.

If you are a non resident and want to register for a gsthst account see guide rc4027 doing business in canada gsthst information for non residents. For more information go to input tax credits and guide rc4022 general information for gsthst registrants. However usually you register for gsthst because you are self employed at least partially.

If you are a recently self employed canadian or you are thinking about starting your own businessadding extra income with a side gig you may be curious about what the tax requirements and implications would be. Aside from the extra info youll include on your tax return you might also be required to register for a gsthst account and become a gsthst registrant. This is called standard gst registration.

Gst registered businesses must add on gst to all sales and then pass the collected gst to ird. You only need to register for gst once even if you operate more than one business. Thats why its important to charge this amount on your invoices something rounded can help you do automatically through its smart invoicing platform.

If your turnover is supply of only exempted goodsservices which are e. If you dont have a bn yet you will receive one when you register for your gsthst account. Not all sole traders need to register for and pay gst but in general if you earn over 75000 per financial year or drive taxis its mandatory.

If youre self employed you use your individual ird number to pay tax. You can register for goods and services tax gst online by phone or through your registered tax or bas agent when you first register your business or at any later time.

More From Government To Citizen Services

- Government Building Png

- Self Employed Cleaner Invoice Template Uk

- Furlough Scheme Extended In Europe

- Self Assessment Self Employed Form

- Furlough Scheme Uk Employer Contribution

Incoming Search Terms:

- Should You Register For Gst Rounded Furlough Scheme Uk Employer Contribution,

- A Creative Startup Tax Returns In Vijayawada Annual Return By Srikanth Issuu Furlough Scheme Uk Employer Contribution,

- 10 Tips To Get The Best Personal Loan Offer For Self Employed Persons Furlough Scheme Uk Employer Contribution,

- How To Register For The Gst Online Quora Furlough Scheme Uk Employer Contribution,

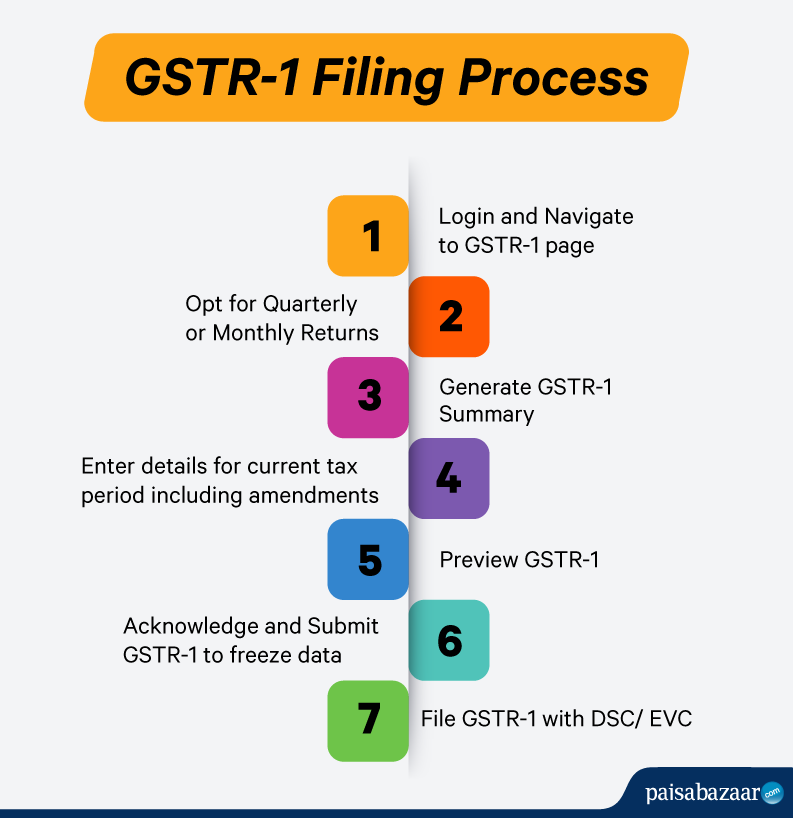

- How To Register For Gst Online Guide For Gst Registration Process Online Furlough Scheme Uk Employer Contribution,

- Gst Registration Online Gst Registration Process Requirements Guide Furlough Scheme Uk Employer Contribution,