Self Employed Disability Insurance Canada, Covid 19 What Happens If Your Employer Tells You To Stay Home During Virus Outbreak Ctv News

Self employed disability insurance canada Indeed lately is being sought by users around us, maybe one of you. People are now accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the name of this post I will talk about about Self Employed Disability Insurance Canada.

- Https Www Ilo Org Wcmsp5 Groups Public Dgreports Cabinet Documents Publication Wcms 629864 Pdf

- Understanding And Navigating The Long Term Disability Ltd Insurance Plan For Executives Apex

- Ultimate Guide To Short Term Disability Benefits Video Resolute Legal

- Https Www Oecd Ilibrary Org Mandatory Pension Contributions 5jfjdfvmc4r8 Pdf

- Covid 19 Employment Insurance And The Canada Emergency Response Benefit Badre Law Pc

- What You Need To Know About Disability Insurance Moneysense

Find, Read, And Discover Self Employed Disability Insurance Canada, Such Us:

- Tunji Singerr Financial Security Advisor Posts Facebook

- Great West G R O U P Short Term Disability Income Benefits Employee S Statement Pdf Free Download

- Feds Unveil 37b Cerb Transition Plan Setting Up New Sickness And Care Benefits Ctv News

- Coronavirus Covid 19 Canada Resources For Landlords And Tenants

- Company Structure

If you are looking for Government Website Hacked Philippines you've reached the right place. We have 101 images about government website hacked philippines including images, pictures, photos, wallpapers, and more. In such page, we also have variety of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

A Comparison Of Canada S Biggest Health Insurance Companies How To Save Money Government Website Hacked Philippines

Chapter 10 Key Terms Summary Fundamentals Of Human Resource Management Studocu Government Website Hacked Philippines

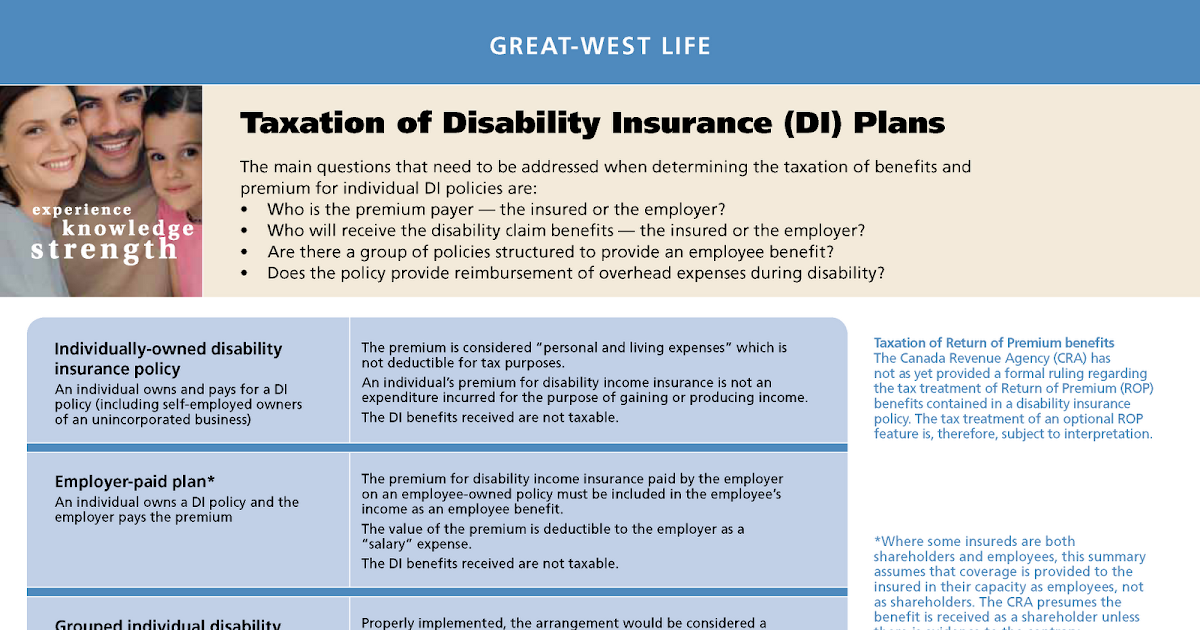

However you can get your own disability insurance plan through a life and health insurance agent.

Government website hacked philippines. If youre considering disability insurance make sure you. Idc insurance direct canada inc. What disability insurance for the self employed provides.

Get disability insurance if you are self employed. National service centre 4400 dominion st suite 260 burnaby bc v5g 4g3. You can and should get disability insurance if youre self employed.

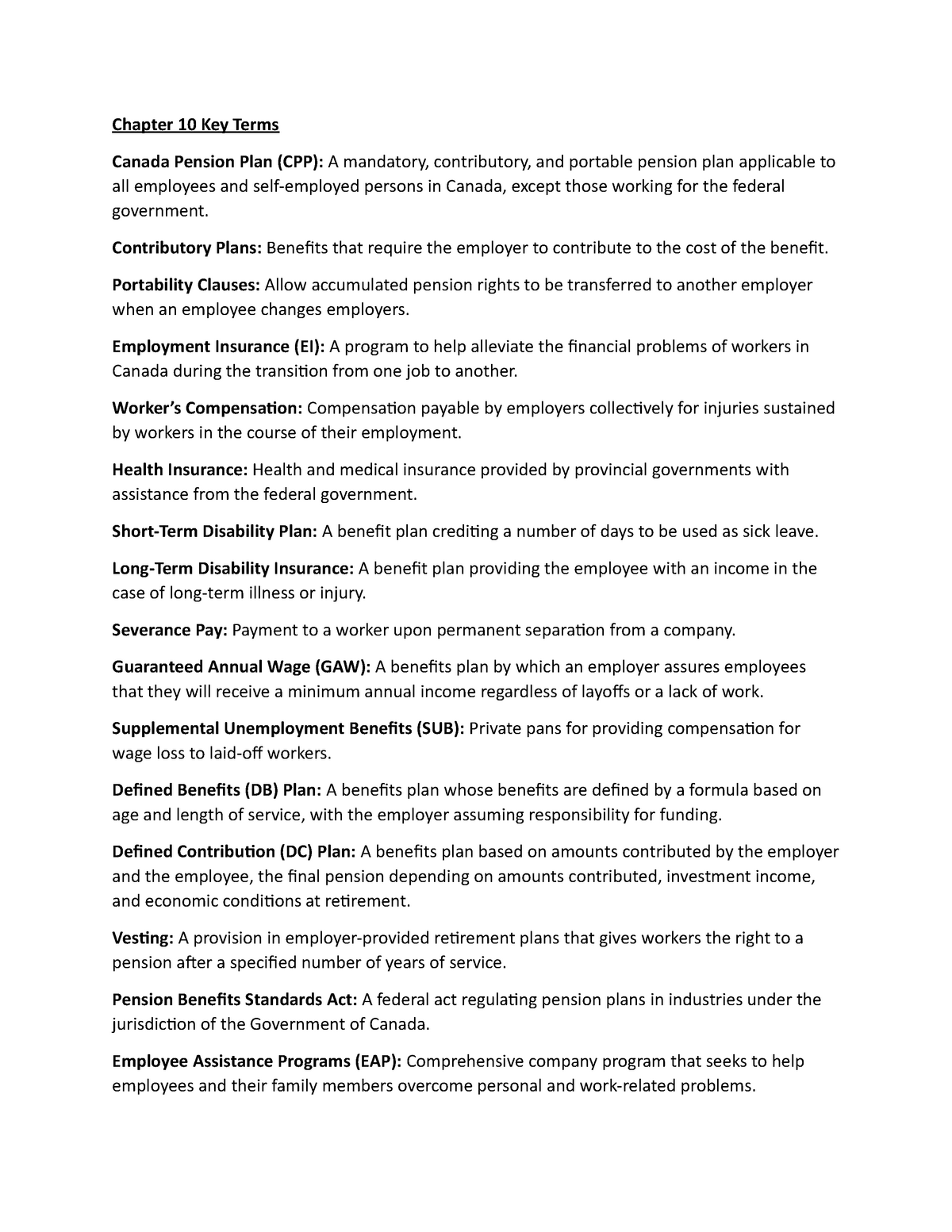

Social security disability insurance for self employed individuals social security disability insurance ssdi is a federal payroll tax funded program managed by the social security administration. Workers self employed or otherwise can only earn up to 4 credits each year regardless of their income. Depending on your age and your work history you may only require a few credits in order to receive disability benefits.

Short term disability insurance is meant to provide a buffer for a short period of time so you can avoid a run on your rainy day fund invading your savings or using credit cards to get by. Close to eight million canadians own disability insurance as part of their workplace benefits but business owners also need to recognize that disability insurance is among the most effective ways to ensure that self employed entrepeneurs can continue to control and manage their businesses. Ideally you would want to also have long term disability insurance if you are self employed in case you disability lasts more than 90 days.

As an entrepreneur you have a few options. Many employers offer disability insurance. The typical benefit period youre allowed to collect money for is between two to 10 years and some companies offer a plan that can pay until you reach retirement age.

If a self employed individual has to work because of injury or sickness disability insurance helps to provide some income and security for the business owner. People who are self employed often benefit the most from having insurance policies. Self employed disability insurance rate factors.

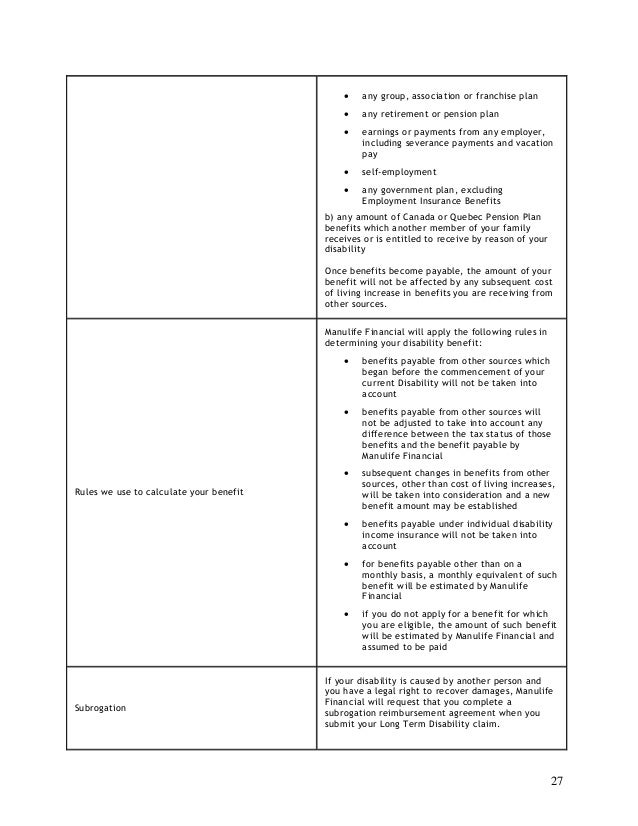

Disability insurance policies differ significantly in what is covered how long they will pay and how they define your income on which they do pay. Long term disability insurance for the self employed long term disability is designed to cover injuries or illnesses that result in being unable to work for over 180 days. What to consider when buying disability insurance.

The taxes you pay into the social security system make you eligible to receive benefits if you become disabled. If youre self employed you can also get disability insurance that will cover many of your business expenses if youre unable to work. Should you need to file a claim youll be able to provide the documentation your short term disability.

If you are self employed especially as a sole proprietor with no employees you may not issue yourself a pay check so its vitally important that you keep detailed records of your income. One type of insurance that is available and should be considered is disability insurance.

More From Government Website Hacked Philippines

- Japan Government Debt To Gdp 2020

- Government Nursing Jobs In Arkansas

- Furlough Scheme Will Be Extended

- Hm Government Logo Transparent White

- What Is Furlough Money

Incoming Search Terms:

- Company Structure What Is Furlough Money,

- Home Landmark Canada What Is Furlough Money,

- Https 2ndchance Ca Wp Content Uploads 2020 04 Applying For Ei And Cerb Benefits Pdf What Is Furlough Money,

- Canadian Life And Health Insurance Taxation Of Critical Illness And Disability Insurance Cheat Sheet What Is Furlough Money,

- 2 What Is Furlough Money,

- What You Need To Know About Disability Insurance Moneysense What Is Furlough Money,