Self Employed Retirement Plans Fidelity, Fidelity

Self employed retirement plans fidelity Indeed lately is being hunted by consumers around us, maybe one of you. People are now accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the name of the post I will talk about about Self Employed Retirement Plans Fidelity.

- The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year Myra Personal Finance For Immigrants

- Top 10 Small Business 401 K Plan Providers

- How To Set Up Your Starbucks 401k Starbucks Faster A Guide For Starbucks Partners Baristas

- Self Employed People Have A Lot Of Perks When It Comes To Saving For Retirement

- My Experience With Vanguard S Individual 401k

- Https Www Fidelity Com Bin Public 060 Www Fidelity Com Documents Retirement 401k Adoption Agreement Pdf

Find, Read, And Discover Self Employed Retirement Plans Fidelity, Such Us:

- Maximize Your Retirement Savings Fidelity Investments Fundamentals Explained Youtube

- 2

- Fidelity Solo 401k A Step By Step Guide To Setting Up Your Self Employed Retirement Plan Financial Panther

- Sep Ira Simplified Employee Pension Plan Fidelity

- Fidelity Investments Review 2020 Platform Fees And More

If you re searching for Government Korean Scholarship you've arrived at the perfect place. We ve got 104 graphics about government korean scholarship including pictures, photos, photographs, backgrounds, and more. In these web page, we additionally have number of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Why the self employed need a pension plan.

Government korean scholarship. Access a wide range of investments for your existing retirement plan through fidelitys brokerage account for plan sponsors. Contributions by phone or by mail. As with traditional 401 k plans the self employed 401 k is intended to help you save money for retirement and there are regulations in place to encourage you to do so.

Fidelity provides no plan documents tax reporting or administrative services. If youre self employed you might want to think about how youll fund your retirement. Call 800 544 5373 learn more.

The plan cannot provide for employee directed investments. According to a survey by the office for national statistics ons self employed workers aged 35 54 are more than twice as likely to have no pension wealth than those who have an employer. Find out how a self invested personal pension could help.

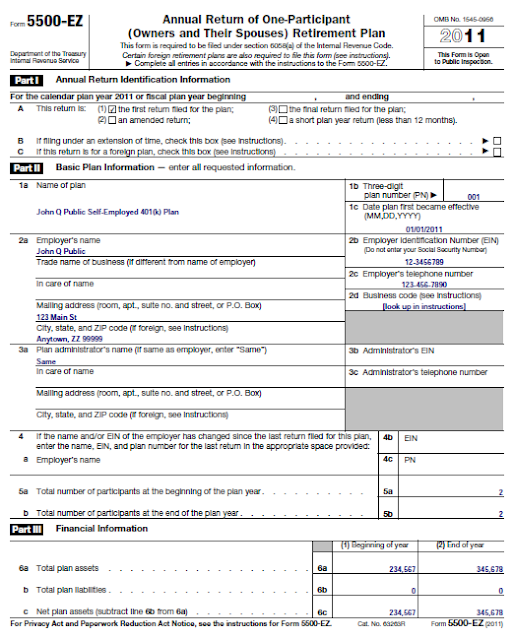

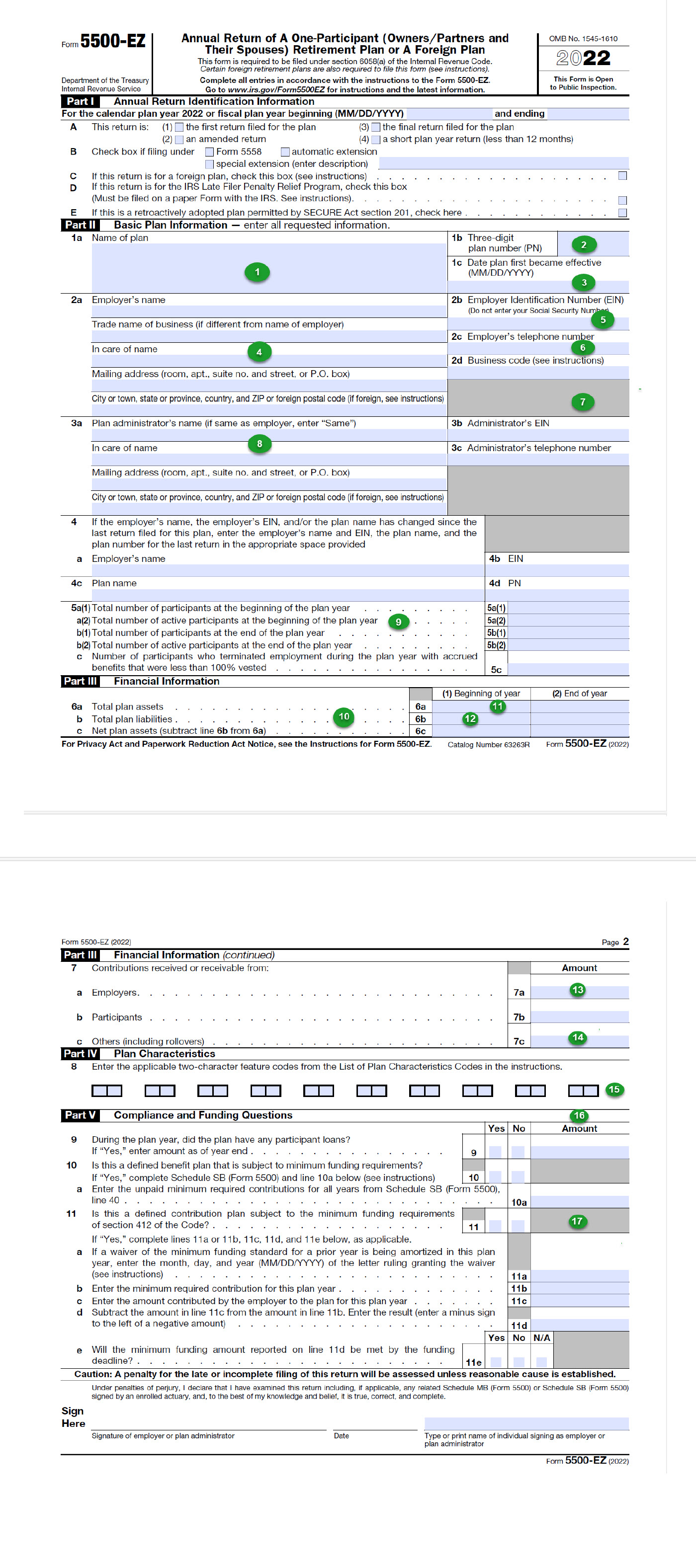

Fidelity retirement plan self employed 401k adoption agreement instructions. Fidelitys retirement service retirement planning calculators. Estimate the maximum contribution amount for a self employed 401k simple ira or sep.

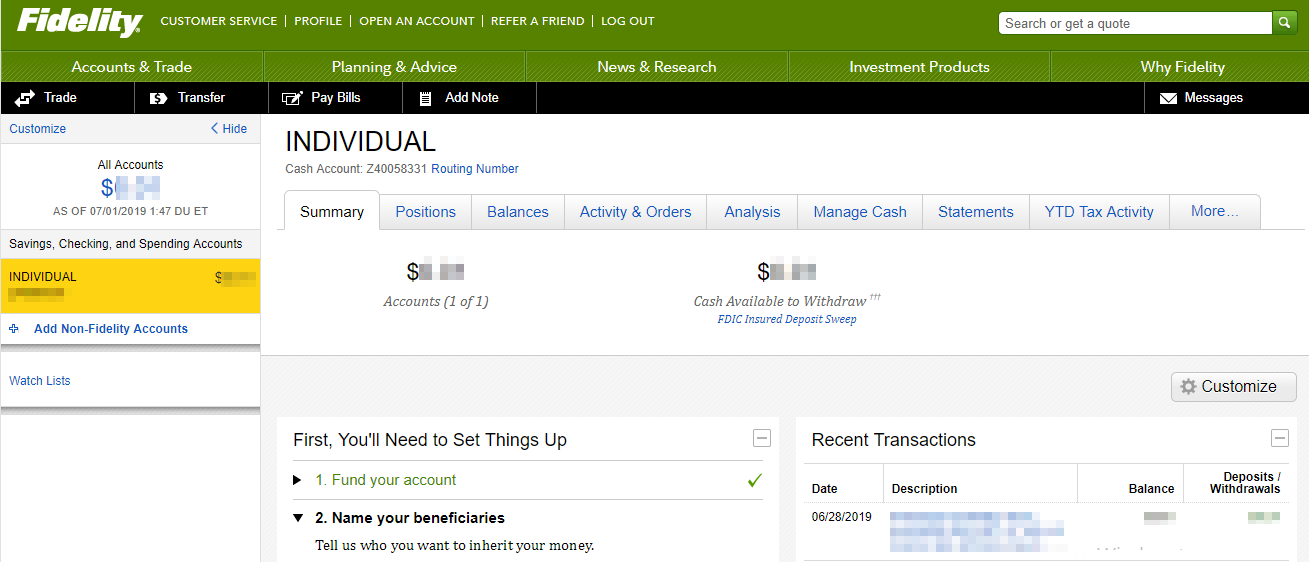

Withdrawals prior to age 59 may be subject to a 10 early withdrawal penalty along with any applicable income taxes 1. No account fee or minimum to open an account 1. Fidelity does not provide a template retirement plan document.

Access to fidelity retirement professionals to help with your plan. This page looks at the different pension options open to you and compares them to. Dont get caught out when you retire.

This is a prototype plan for use with the fidelity retirement plan basic plan. Reasons to consider self employed 401k plans. Estimate the maximum contribution amount for a self employed 401k simple ira or sep.

The fidelity self employed 401k plan can help sole proprietors maximize their retirement savings contributions. This account can only be used as an investment account for the plan. 003 to adopt or amend the fidelity self employed 401k plan.

Complete the profit sharingstandardized 401k plan adoption agreement no. Wide range of investments.

More From Government Korean Scholarship

- Local Government Vacancies 2019

- Was Furlough Extended

- Central Government Functions

- Furlough Scheme Rules March 2020

- Will Furlough Scheme Be Extended Past June

Incoming Search Terms:

- Self Employed Retirement Plans Know Your Options Nerdwallet Will Furlough Scheme Be Extended Past June,

- Https Www Fidelity Com Bin Public 060 Www Fidelity Com Documents Customer Service Self Employeed 401k Acct App Pdf Will Furlough Scheme Be Extended Past June,

- The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year Myra Personal Finance For Immigrants Will Furlough Scheme Be Extended Past June,

- Can You Have Multiple 401 K Accounts Will Furlough Scheme Be Extended Past June,

- Fidelity Solo 401k A Step By Step Guide To Setting Up Your Self Employed Retirement Plan Financial Panther Will Furlough Scheme Be Extended Past June,

- Fidelity Solo 401k A Step By Step Guide To Setting Up Your Self Employed Retirement Plan Financial Panther Will Furlough Scheme Be Extended Past June,

/betterment-vs-fidelity-go-3fea7f0f82c948ec863d1f114832ce95.png)

:max_bytes(150000):strip_icc()/fidelity_go_productcard-65e3ebd9071045d0bfaa6eee82b220a1.png)