Furlough Claim Rules, Furlough Scheme Extension Rules From July Through To October

Furlough claim rules Indeed recently has been sought by users around us, perhaps one of you. People are now accustomed to using the net in gadgets to view image and video data for inspiration, and according to the title of the article I will discuss about Furlough Claim Rules.

- Coronavirus Q A On Understanding Flexible Furlough And The Extended Furlough Scheme

- Coronavirus Covid 19 The Furlough Scheme In Scotland Spice Spotlight Solas Air Spice

- Coronavirus Job Retention Scheme Claims From July October 2020 Moneysoft

- Https Www Harpermacleod Co Uk Media 707529 Clubs Further Guidance Issued On Coronavirus Job Retention Scheme 140420 Pdf

- The Furlough Countdown Employment Law Blog Kingsley Napley

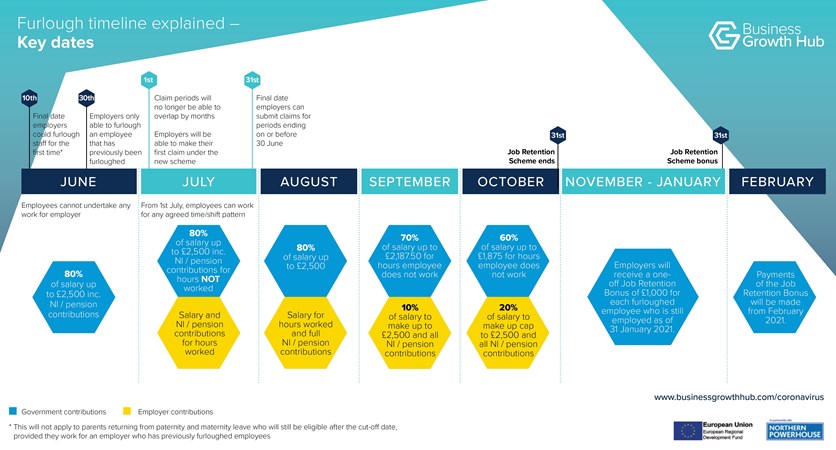

- Furlough Scheme Extension Rules From July Through To October

Find, Read, And Discover Furlough Claim Rules, Such Us:

- New Flexible Furlough Scheme An Overview Jfh Law

- Covid 19 Furlough Under Job Retention Scheme Faqs Make Uk

- Flexible Furlough Scheme Starts Today Gov Uk

- Furlough Scheme Still Shutting Out New Starters Not Paid Before 19 March Personnel Today

- How Will Hmrc Deal With Furlough Fraud Davis Grant

If you re searching for Self Employed Labourer Invoice you've come to the ideal location. We have 100 images about self employed labourer invoice including images, pictures, photos, wallpapers, and much more. In these webpage, we also provide number of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

Not Designated Furloughed By 10 June It May Not Be Too Late For Your Employer To Claim For You Under The Job Retention Scheme Low Incomes Tax Reform Group Self Employed Labourer Invoice

But businesses are allowed to offer part time arrangements so it is possible that your income could be a mix of.

Self employed labourer invoice. For workers paid a fixed full or part time salary furlough pay is based on what was earned during the last paid period before 19 march 2020. The furlough scheme protected over nine million jobs across the uk and self employed people have received over 13 billion in support. Furlough know new furlough rules.

Claim for some of your employees wages if you have put them on furlough or flexible furlough because of coronavirus covid 19. For furlough employers were able to claim back the portion of wages from the government through their hmrc portal. The rules say that employers must claim for a minimum for seven consecutive days.

To be eligible to be claimed for under this extension employees must be on an employers paye payroll by 2359 30th. The government sets out five scenarios and offers a calculator to help employers work out how much they need to claim. The maximum number of employees that this employer could furlough in any single claim starting on or after 1 july 2020 would be 50 although all 100 employees are eligible for furlough.

All the scheme changes explained. Business consumer who can claim for furlough when lockdown starts and rules for self employed workers the governments extension of much needed furlough payments in england should have. For an employee on a fixed term contract you would have been able to re employ them and put them on furlough as long as you previously submitted a claim for them in relation to a furlough period.

Published 20 april 2020 last updated 3 november 2020 see all. Here are the full furlough eligibility rules announced by the treasury. Your employer will have to choose the best calculation that fits you.

More From Self Employed Labourer Invoice

- Korean Government Scholarship Program Universities

- Self Employed Payment Slip Sss

- Self Employed Tax Brackets Ireland

- Government Consulting Jobs Near Me

- Self Employed Help After October 2020

Incoming Search Terms:

- The Coronavirus Job Retention Scheme Qandas For Employers Ashurst Self Employed Help After October 2020,

- Yya43siixwrf2m Self Employed Help After October 2020,

- What Is Furlough Leave Hill Dickinson Self Employed Help After October 2020,

- One In Three Furloughed Employees Asked To Break Rules And Keep Working Survey Itv News Self Employed Help After October 2020,

- Coronavirus Covid 19 The Furlough Scheme In Scotland Spice Spotlight Solas Air Spice Self Employed Help After October 2020,

- Furlough V Parental And Sick Leave Thorntons Solicitors Self Employed Help After October 2020,