Furlough Claim Rules September 2020, Flexible Furlough Guidance And Examples Mazars United Kingdom

Furlough claim rules september 2020 Indeed recently has been hunted by consumers around us, perhaps one of you personally. Individuals are now accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the title of this post I will talk about about Furlough Claim Rules September 2020.

- Coronavirus Job Retention Scheme Statistics September 2020 Gov Uk

- Job Retention Scheme New Flexible Furlough Rules Kpmg Ireland

- Furlough Scheme Extension Rules From July Through To October

- Coronavirus Furlough Scheme To Finish At End Of October Says Chancellor Bbc News

- Hmrc Probes 27 000 High Risk Furlough Claims In Hunt For Missing 3 5 Billion

- Tv1avwt6kqpsmm

Find, Read, And Discover Furlough Claim Rules September 2020, Such Us:

- Coronavirus Job Retention Scheme Statistics September 2020 Gov Uk

- Pandemic Related Furlough Frequently Asked Questions Wsdot

- Hmrc Getting Ready To Pursue Company Directors For Furlough Fraud Optimal Compliance

- Covid 19 Payroll

- Covid Redundancy Warning In Lockdown Appeal To Treasury Bbc News

If you re searching for Self Employed Invoice Template Uk Free you've reached the perfect place. We have 100 images about self employed invoice template uk free adding images, photos, pictures, backgrounds, and more. In these web page, we additionally provide variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

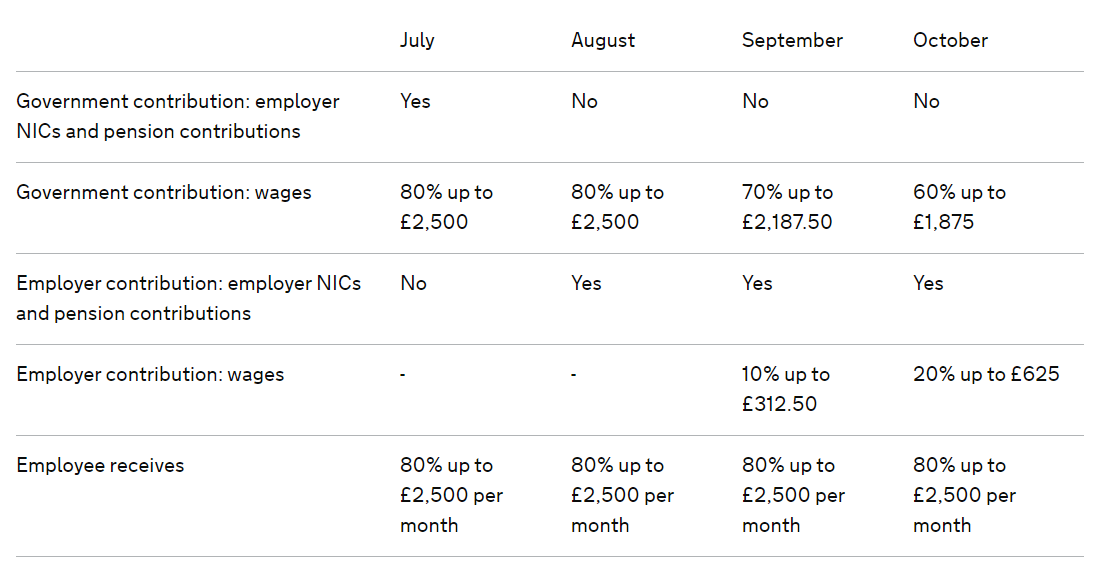

All the new furlough rules from september 1 including how your pay is changing from september 1 firms will have to start paying national insurance pension contributions and 10 of wages as the.

Self employed invoice template uk free. Only be able to claim for employees who have previously been furloughed for at least 3 consecutive weeks taking place any time between 1 march 2020 and 30 june be able to flexibly furlough. For september the government will pay 70 of wages up to a cap of 218750 for the hours the employee is on furlough. This month sees the next grant reduction to the payroll support offered by the government.

Thursday 17 th september 2020. As of september 1 the governments contribution towards furloughed workers wages has fallen from 80 to 70 up to a cap of 218750 a month. The first phase of contributions which began on 1 august 2020 has required employers to pay employers national insurance ni and pension contributions of furloughed workers wage costs concerning the hours that the worker does not work.

Employers should be aware that further contributions from employers will be needed from september. To be eligible to be furloughed you must have been on your employers paye payroll on or before 19 march 2020. The rules for an employment to qualify to be covered by the scheme are set out in guidance and two of the key rules are that the furloughed employee must have been employed on 19 march 2020 and.

All claims must be submitted no later than 30 november 2020 and you will not be able to add to that claim after 30 november. Employers must contribute to wage costs. Grant is capped at 218750.

You can only claim if you have previously furloughed your employee before 30 june 2020 and you submitted a claim for this by 31 july 2020. How is furlough changing from today. If you were hired after 19 march 2020 you cant be furloughed.

Eligible workers originally had to have been on their employers paye system on 28 february 2020 but this has since been extended. Its the penultimate month of the flexible furlough scheme and another change to the rules.

One In Five People Furloughed In Parts Of Uk Figures Show Express Star Self Employed Invoice Template Uk Free

More From Self Employed Invoice Template Uk Free

- When Does The New Furlough Scheme Start

- Government Worker Clipart

- Furlough Rules Employees

- Lenovo B490 Government Laptop Charger

- Government Quarters In Pune

Incoming Search Terms:

- Online Calculator Updated In Preparation For August 2020 Furlough Claims Payadvice Uk Government Quarters In Pune,

- Support Available From Uk Government Government Quarters In Pune,

- One In Five People Furloughed In Parts Of Uk Figures Show Express Star Government Quarters In Pune,

- Https Www Iris Co Uk Wp Content Uploads 2020 07 Earnie Covid 19 E2 80 93 Furlough Job Retention Scheme Changes And Important Dates Pdf Government Quarters In Pune,

- Employee Furlough Cjrs Guidance Information And Support Government Quarters In Pune,

- Furlough Timeline Explained What You Need To Know Gc Business Growth Hub Government Quarters In Pune,