Voluntary Member Sss Payment Slip Form For Self Employed, Instruction For Sss Loan Online Payment

Voluntary member sss payment slip form for self employed Indeed lately is being sought by users around us, perhaps one of you. Individuals are now accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the title of the post I will discuss about Voluntary Member Sss Payment Slip Form For Self Employed.

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrbefp6j7sw7d7ta Mndn49fqpdhhyt Qb2lmdmlexfsofmwzpf Usqp Cau

- I M A Gorgeous Working Mom Where To Find Social Security System Sbr No For Self Employed And Voluntary Payment Individual

- Https Www Sss Gov Ph Sss Downloadcontent Filename My Sss Final Pdf

- Https Www Sss Gov Ph Sss Downloadcontent Filename Sss And You Booklet August2019 Pdf

- Https Law Upd Edu Ph Wp Content Uploads 2020 07 Sss Circular No 2020 004 B Pdf

- Sss Faq Pension Retirement

Find, Read, And Discover Voluntary Member Sss Payment Slip Form For Self Employed, Such Us:

- Sss Loan Payment Form Fill Online Printable Fillable Blank Pdffiller

- How To Apply Sss Sickness Benefit Or Social Security System You Should Knows

- Government Help Desk Sss Jobstreet Philippines

- How And Where To Pay Your Sss Contribution Youtube

- Sss Requirements For Self Employed Fill Online Printable Fillable Blank Pdffiller

If you are searching for Self Employed Business Loans Covid 19 you've come to the ideal place. We have 104 images about self employed business loans covid 19 including pictures, photos, pictures, backgrounds, and much more. In such webpage, we additionally provide variety of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Https Www Sss Gov Ph Sss Downloadcontent Filename My Sss Final Pdf Self Employed Business Loans Covid 19

How To Pay Sss Contributions As A Voluntary Member A Guide For Filipino Freelancers The Ultimate Virtual Assistant Resource Self Employed Business Loans Covid 19

Sickness benefit application form for self employedvoluntary member member separated from employment medical certificate.

Self employed business loans covid 19. Fund payment form. Responsibilities of self employed members. Register for an sss number via online right now.

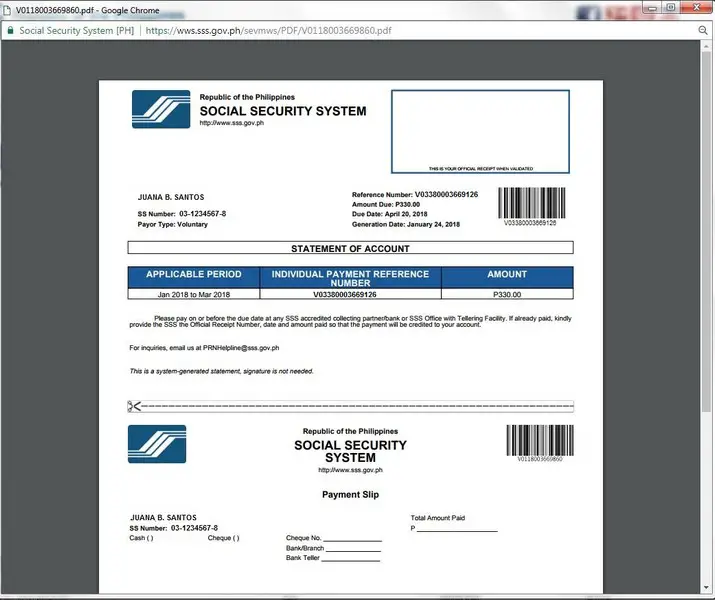

Go visit an sss branch and talk with one of their customer service representative. Employer transmittal list sickness benefit reimbursement application. Pay your sss contribution by filling out the ss form rs 5 or contributions payment return with the required information and put a check mark on the box for voluntary separated member.

Before paying register as self employed using sss rs1 form with proof of source of regular income ors sales ors sales commission receipts business permit. Not a member of sss. For voluntary and self employed.

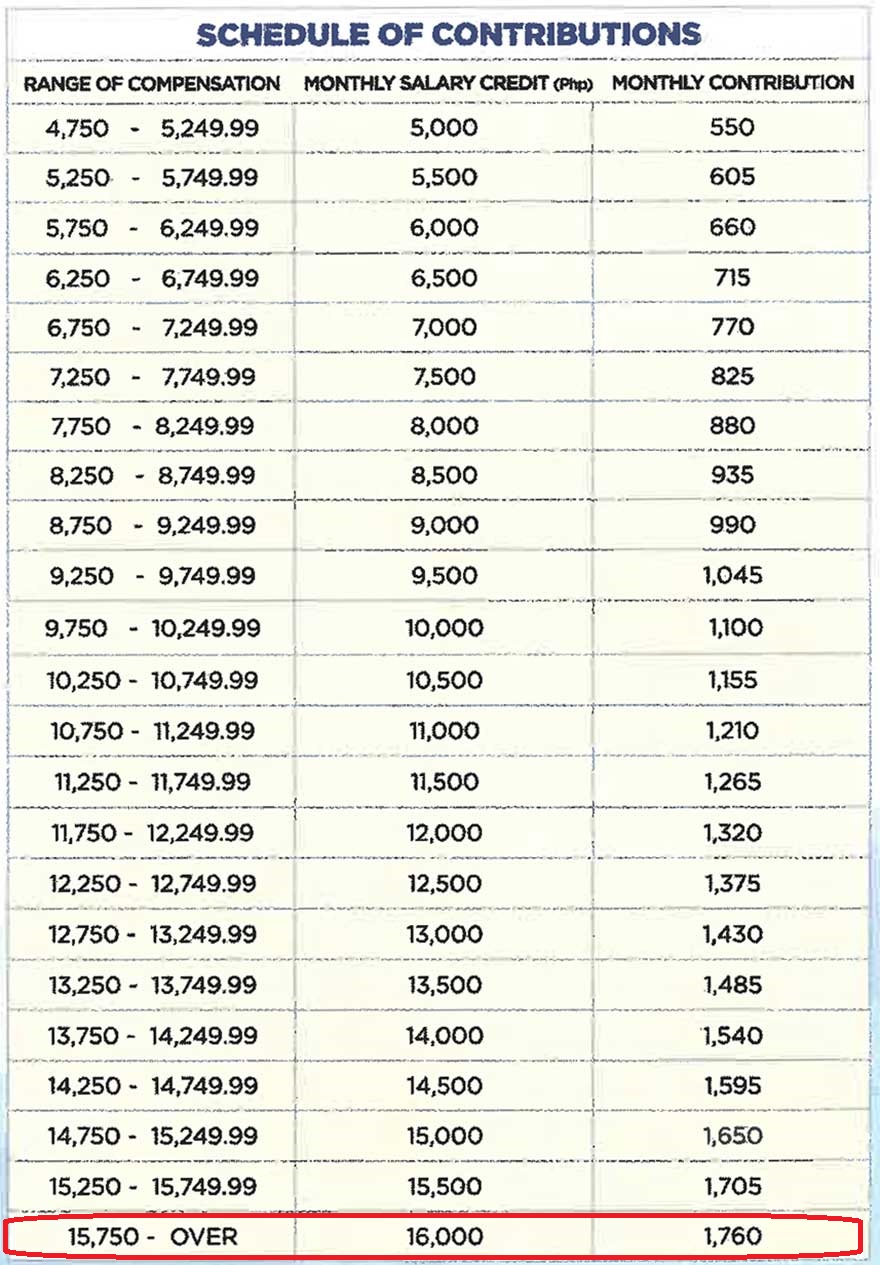

Second present your sss payment reference number then pay in the sss branch with teller facility or any sss accredited banks or payment partners. Social security system contributions. The total contributions paid by the employer in this payment form includes the social security contributions shared by both the.

As of august 24 2018 the following are the sss partner banks and non banks are only accredited to receive the sss payment reference number for employers and voluntary paying members. Just make your payment and check or write voluntary in your payment slip. Fund withdrawal form.

December 31 of the same year contributions for october to december. Register with the mysss portal. Apply for unified multi purpose id umid card.

Sss benefits for. Insurance agent real estate agent web designer. Where to pay your sss contribution.

Fund amendment form. The borrowers must be updated in the payment of other loans. January 31 of the succeeding year.

Just fill out the sss payment form with your correct information and wait for a few days for your payment to be posted to your sss. Self employed voluntary member non working spouse farmerfisherman and overseas filipino worker 1. There are 3 ways to convert sss coverage status from employed to voluntary or employed to ofw status.

For voluntary members or self employed members to qualify for a loan they must be currently paying contributions had paid six months worth of contribution for the last 12 months before applying for a loan. Keep himselfherself always informed of changes and enhancements in ec policies and benefit structure. You can pay at sss bayad center or sm business center.

You can pay your sss contribution at the sss office cashier or at any accredited sss payment center like sm business center or bayad center. Putting a check mark on the correct option or box will change the membership status from covered employee self employed ofw or non working spouse to a. Ofws monthlyquarterlyannual payment contributions for january to december.

Changing sss membership status.

Sss Online Application How To Get Your Sss Id Online 2019 Coins Ph Self Employed Business Loans Covid 19

More From Self Employed Business Loans Covid 19

- Furlough Claim Rules

- Federal Government Taxes Phone Number

- Government Home Loans First Time Buyer

- Government Shutdown 2019

- How Do I Apply For Self Employed Furlough Scheme

Incoming Search Terms:

- Sss Citizens Charter How Do I Apply For Self Employed Furlough Scheme,

- Https Www Sss Gov Ph Sss Downloadcontent Filename Sss And You Booklet August2019 Pdf How Do I Apply For Self Employed Furlough Scheme,

- How To Pay And Post Sss Employees Contributions Monthly And Quarterly How Do I Apply For Self Employed Furlough Scheme,

- Sss Payment Deadline For Voluntary Members Sss Inquiries How Do I Apply For Self Employed Furlough Scheme,

- Contributions Payment Form Sss Social Security United States Cheque How Do I Apply For Self Employed Furlough Scheme,

- Using Your Sss Contributions To Apply For A Salary Loan Blend Ph Online Peer To Peer Funding Platform In The Philippines How Do I Apply For Self Employed Furlough Scheme,