Self Employed Home Loan Documents, Home Loan Application Form With Calculator And Pen Nearby Stock Photo Alamy

Self employed home loan documents Indeed recently has been sought by consumers around us, perhaps one of you personally. Individuals are now accustomed to using the net in gadgets to view video and image information for inspiration, and according to the title of this article I will discuss about Self Employed Home Loan Documents.

- Insiders Guide To Self Employed Income Proof For Home Loans

- How Can Self Employed Ensure Approval Of Home Loan Application

- Good Buy For Self Employed Home Loan Applications Documents Required Page 1 Created With Publitas Com

- Home Loans For Self Employed Applicants How To Calculate Turnover

- Calameo Securing Home Loans For The Self Employed

- Download Realcoordinator

Find, Read, And Discover Self Employed Home Loan Documents, Such Us:

- Finding A Home Loan When You Re Self Employed K2 Wealth

- Complete List Of Mortgage Application Documents Hsh Com Refinance Mortgage Refinance Loans Mortgage Loans

- Property Documents Required For Home Loan Property Walls

- How Can Self Employed Ensure Approval Of Home Loan Application

- Bank Salaried Self Employed Home Loan Income Documents Max 20cr Id 22409287948

If you are searching for Furlough Scheme Uk Employer Contribution you've arrived at the ideal place. We ve got 100 images about furlough scheme uk employer contribution adding images, pictures, photos, backgrounds, and more. In such webpage, we also provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

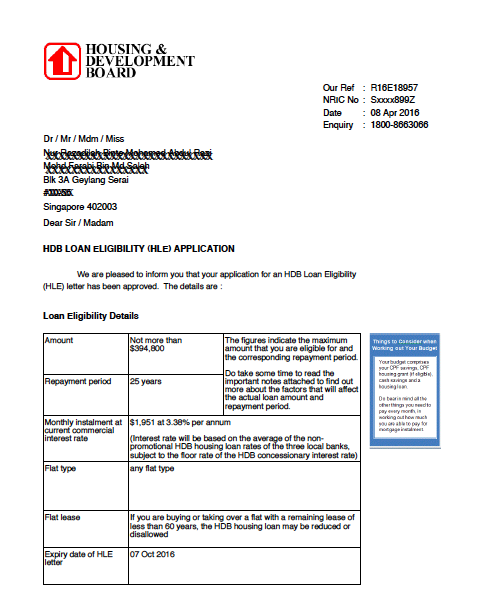

Loan against property can be availed by self employed salaried partnership firms private limited companies.

Furlough scheme uk employer contribution. Documents required for self employed. Irrespective of whether you are a salaried or self employed person you will need to furnish your identity proof with the bank. A self employed individual needs to have 3 4 years of business stability and an operational current account with hdfc to avail the loan without an income proof.

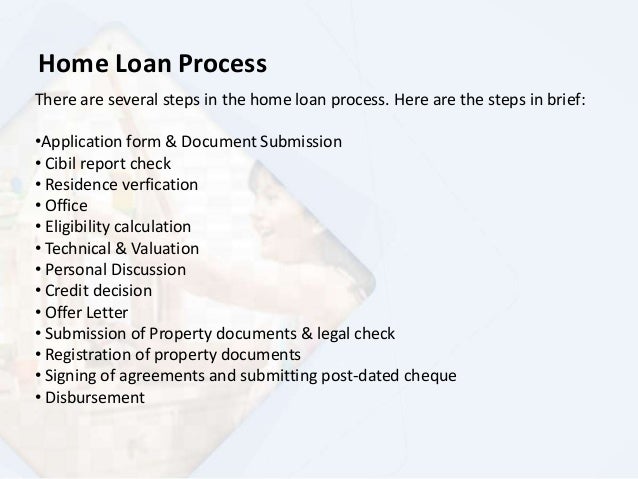

You can get your documents ready and avail the home loan against it. Self employed bond applicants face a trickier process when applying for a home loan. You can submit any of the.

Either an audited pl statement or an unaudited pl statement along with 2 months. Heres how to successfully navigate the bond application process when self employed. Checklist for home loan applications.

The self employed individuals need to have a current account with the lender and also he needs to show 3. Last 12 months statement of bank account from which loan emi is paid. With iifl home loans not only are you assured of faster processing of your loan application but also enjoy a hassle free experience.

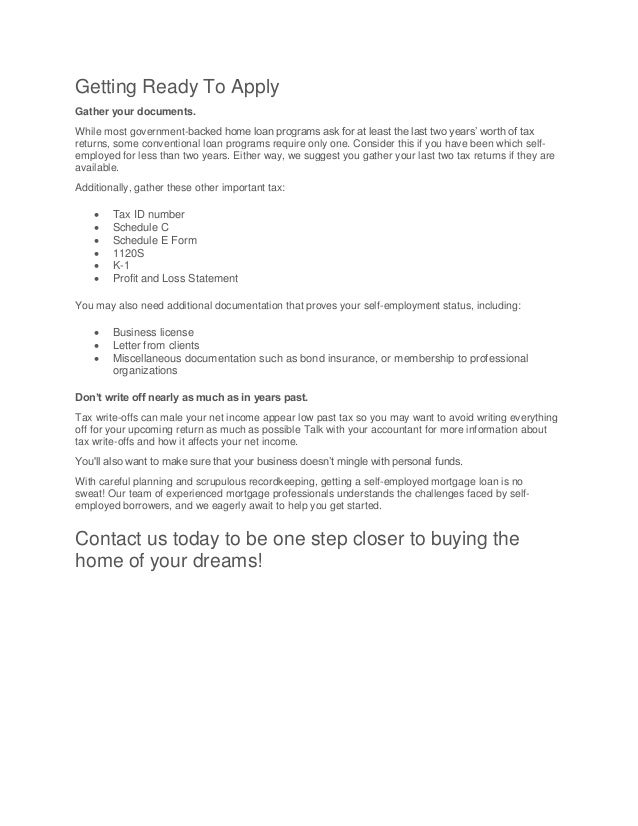

Application form with photo and signed by primary borrower and co borrowers yes. Application form and kyc. The new rules require self employed borrowers to provide one or two new documents when applying for a mortgage.

Loan statement loan track and list of property documents lod in possession of existing lender. Take a look below to know which banks offer a personal loan to self employed with no income proof. When you apply for the lap ensure to keep no objection certificate noc and property papers ready.

Recent changes make it easier. For all those salaried and self employed individuals out there heres a handy home loan document checklist which could help. Documents required for home loan.

Buying property is the single largest investment most people ever make and the majority will need finance in order to do so but the already laborious bond application process. To make your application process simpler here is a list of documents that you will need. For example you may only need one year of income tax documents to prove your.

Many people tend to harbour the notion that getting a home loan can be a long and tiresome process especially if you happen to be a self employed professional or business owner. One of the reasons why banks or financial institutions may be a bit apprehensive about sanctioning home loans to self employed individuals is due to the potential uncertainty surrounding their job continuity and income.

More From Furlough Scheme Uk Employer Contribution

- Will Furlough Scheme Be Extended Past October

- Self Employed Nail Technician Jobs

- Government Organization During The Han Dynasty And The Duties Of Each Division

- Furlough Scheme Extension Redundancy

- Government Majority Rule

Incoming Search Terms:

- Home Loan Documents List Salaried And Self Employed Floorrise In Government Majority Rule,

- Everything You Need For Your Home Mortgage Application Government Majority Rule,

- Essential Tips To Get Home Loans For Self Employed Inspire Buddy Government Majority Rule,

- Frequently Asked Questions About Home Loans Answered By Inrcredit Issuu Government Majority Rule,

- What Paperwork Is Needed For A Mortgage Loan Pre Approval In Kentucky Kentucky First Time Home Buyer Loan Programs For Fha Va Khc And Usda Mortgage Loans In Kentucky Government Majority Rule,

- Documents Required For Home Loan Self Employed Individuals Iifl Government Majority Rule,