Self Employed And Employed Tax Calculator, Self Employment Guide Archives Triginta Self Employed Tax Calculator

Self employed and employed tax calculator Indeed recently is being hunted by users around us, perhaps one of you. Individuals now are accustomed to using the net in gadgets to see video and image data for inspiration, and according to the name of the post I will talk about about Self Employed And Employed Tax Calculator.

- How Much Does A Small Business Pay In Taxes

- Coronavirus Self Employed Small Limited Company Help

- Calculating Income Tax For The Self Employed Kontist

- Contractor And Freelancer Tax Calculator

- Income Tax Calculator Calculate Taxes Online Fy 2019 20

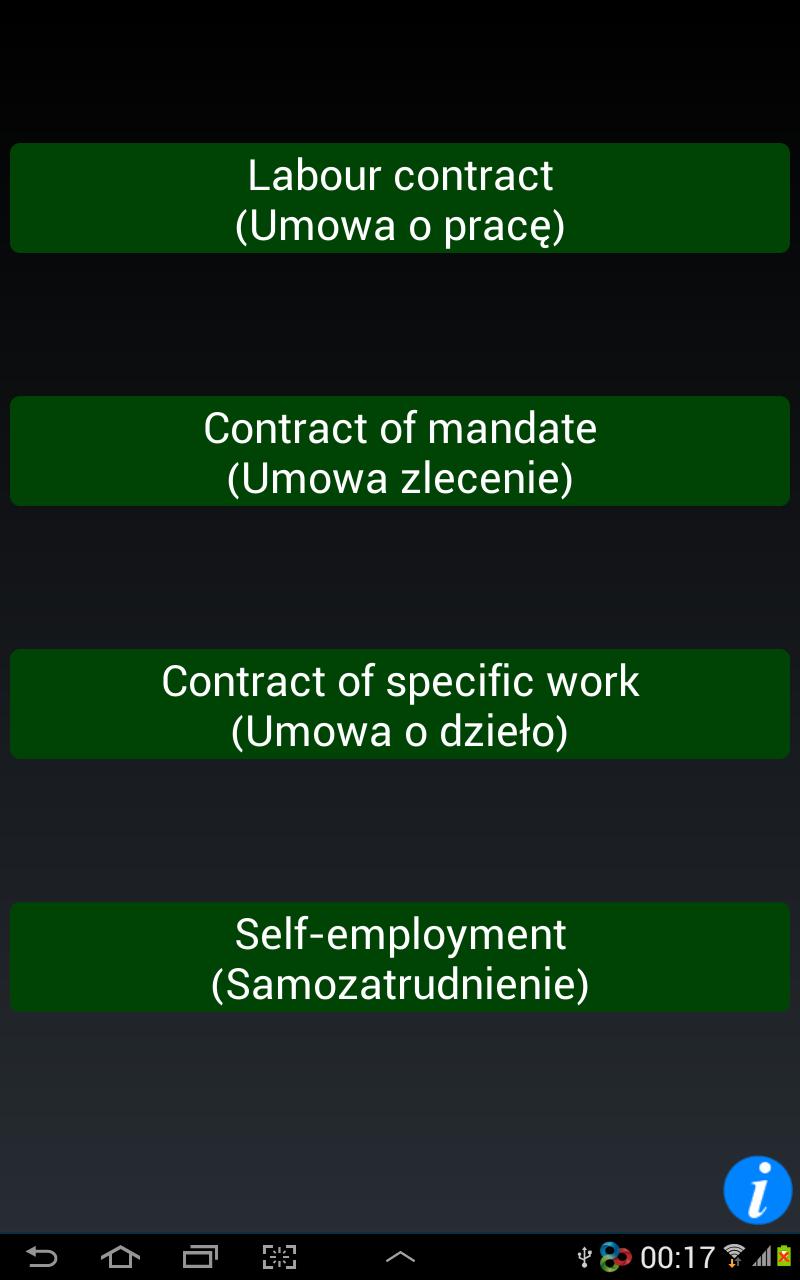

- Self Employment Tax Calculator For Romania 2020

Find, Read, And Discover Self Employed And Employed Tax Calculator, Such Us:

- Business Tax Calculator My Excel Templates

- Self Employed Tax Calculator

- Self Employment Tax Calculator To Help You Estimate What You Might Owe

- Calculating Your Tax With Self Employment Tax Calculator Is Safe Providing Details Is Just What People Need To Do Every Self Employment Employment Income Tax

- Contractor And Freelancer Tax Calculator

If you are searching for Government Watch List Notice you've arrived at the right place. We ve got 100 images about government watch list notice including pictures, pictures, photos, backgrounds, and more. In these page, we also have variety of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Contractor Tax Calculator Spreadsheet In 2020 Tax Deductions Business Tax Deductions Deduction Government Watch List Notice

If you are self employed your social security tax rate is 124 percent and your medicare tax is 29 percent on those same amounts of earnings but you are able to deduct the employer portion.

Government watch list notice. 2018 self employed tax calculator. You pay 7200 40 on your self employment income between 10000 and 28000. Normally these taxes are withheld by your employer.

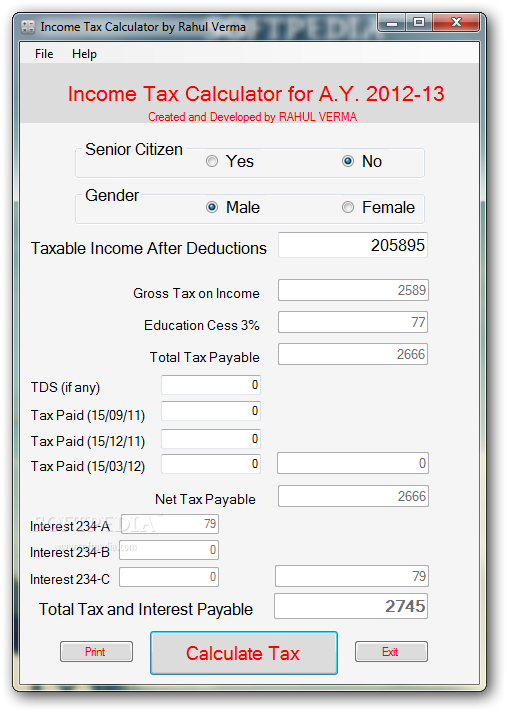

Please note that the self employment tax is 124 for the federal insurance contributions. Select your filing status. The results also include the calculations from the form 1040 es estimated tax for individuals worksheet for the 2020 tax year for your reference.

You will need to submit a self assessment tax return and pay these taxes and contributions yourself. If you are self employed use this simplified self employed tax calculator to work out your tax and national insurance liability. This calculator provides an estimate of the self employment tax social security and medicare and does not include income tax on the profits that your business made and any other income.

Please note that the self employment tax is 124 for the fica portion and 29 for medicare. 2020 self employed tax calculator. However if you are self employed operate a farm or are a church employee you may owe self employment taxes.

Employed and self employed uses tax information from the tax year 2020 2021 to show you take home pay. If you 1 are self employed as a sole proprietorship an independent contractor or freelancer and 2 earn 400 or more you may need to pay se tax. To pay self employed taxes you are required to have a social security number and an individual taxpayer identification number.

This will be used to determine if you owe the additional. Do i have to pay self employment tax. Self employed individuals are responsible for paying both portions of the social security 124 and medicare 29 taxes.

More information about the calculations performed is available on the details page. The deadline is january 31st of the following year. The calculator uses tax information from the tax year 2020 2021 to show you take home pay.

If youre a church worker your church employee income should be at least 10828 before you are required to file self employed tax. However if you are self employed operate a farm or are a church employee you may owe self employment taxes. Use the below calculator to get an estimate of your se taxes.

More information about the calculations performed is available on the details page. You will pay an additional 09 medicare tax on the amount that your annual income exceeds 200000 for single filers 250000 for married filing jointly. If you receive a form 1099 you may owe self.

See what happens when you are both employed and self employed at the same time with uk income tax national insurance student loan and pension deductions. For a more robust calculation please use quickbooks self employed. Normally these taxes are withheld by your employer.

Use this calculator to estimate your self employment taxes.

More From Government Watch List Notice

- Government Consulting Internships

- Types Of Government Quiz Answers

- Government Budget Deficit Definition Economics

- New Furlough Scheme Eligibility

- Furlough Scheme Extended July

Incoming Search Terms:

- How Much Should You Budget For Taxes As A Freelancer Furlough Scheme Extended July,

- Saunders Web Solutions Self Employed Earnings And Tax Calculator July 2000 Furlough Scheme Extended July,

- Income Tax Calculator Apk 1 5 5 Download Free Apk From Apksum Furlough Scheme Extended July,

- Self Employment Tax Calculator App Design Brittany Muir Furlough Scheme Extended July,

- Tax Calculator Uk Tax Calculators Furlough Scheme Extended July,

- Allowable Expenses That Self Employed Individuals Can Claim Asktaxman Over Blog Com Furlough Scheme Extended July,