Self Employed And Employed Tax Uk, Understand Personal Tax And Ni For Self Employed Starting A Business

Self employed and employed tax uk Indeed lately is being sought by consumers around us, perhaps one of you personally. People are now accustomed to using the net in gadgets to view image and video data for inspiration, and according to the title of this article I will discuss about Self Employed And Employed Tax Uk.

- Self Employed National Insurance Class 2 And Class 4 Rates

- Uk Tax System Too Difficult For Landlords And Self Employed Financial Times

- Millions Of Self Employed To Benefit From Second Stage Of Support Scheme Gov Uk

- Sole Trader Tax A Guide For Start Ups The Newly Self Employed Bytestart

- Listentotaxman Mobile Uk Salary Tax Calculator 2020 2021 Hmrc

- Am I Employed Self Employed Both Or Neither Low Incomes Tax Reform Group

Find, Read, And Discover Self Employed And Employed Tax Uk, Such Us:

- Sole Trader And Self Employed Tax What Tax Do Businesses Pay

- Tax What You Need To Know As A Working Self Employed Actor

- Sole Trader Tax A Guide For Start Ups The Newly Self Employed Bytestart

- A Guide To Claiming Self Employed Expenses Goselfemployed Co Small Business Tax Business Tax Deductions Small Business Tax Deductions

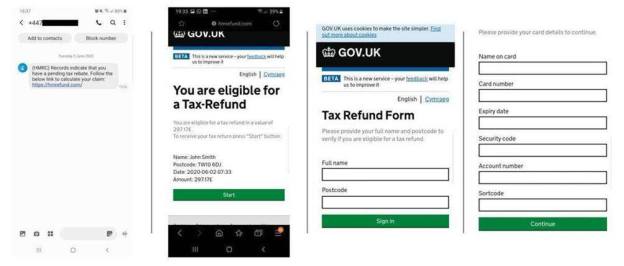

- Hmrc Fake Grant Scam Tax Mail Claims Self Employment Grant Has Been Approved

If you re searching for Government Intervention Economics Help you've reached the right place. We have 104 graphics about government intervention economics help including images, photos, pictures, backgrounds, and more. In these webpage, we also have variety of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

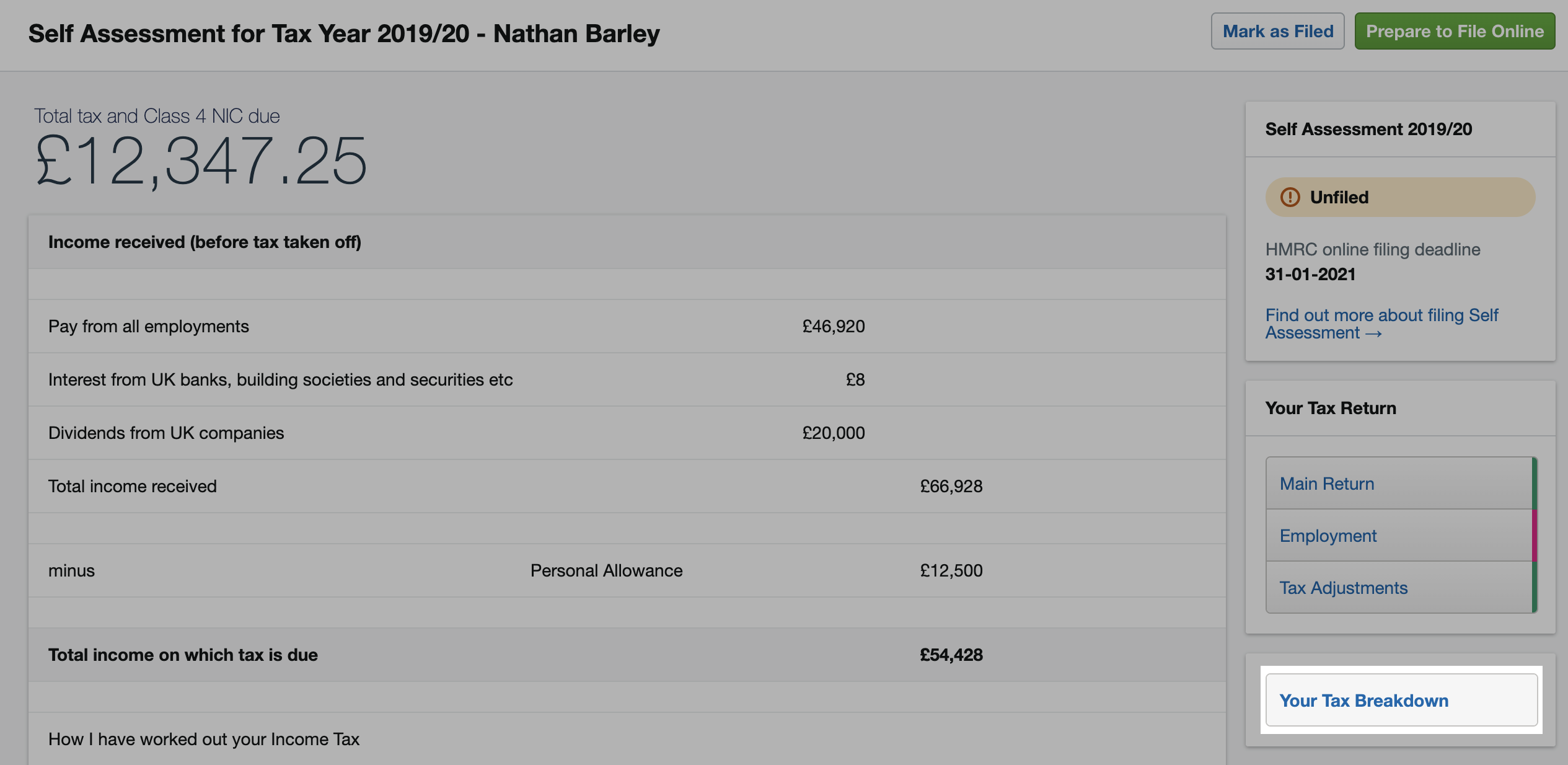

What are the self employed income tax rates and how do self employed people pay income tax in the uk.

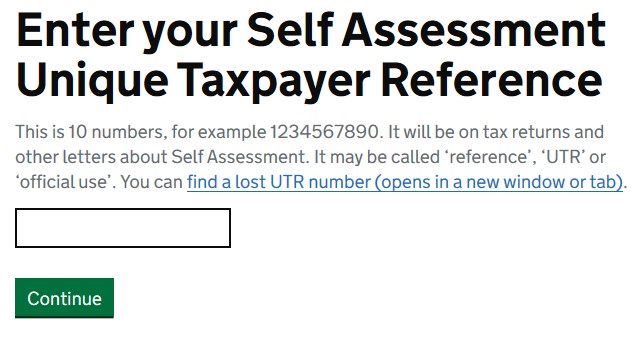

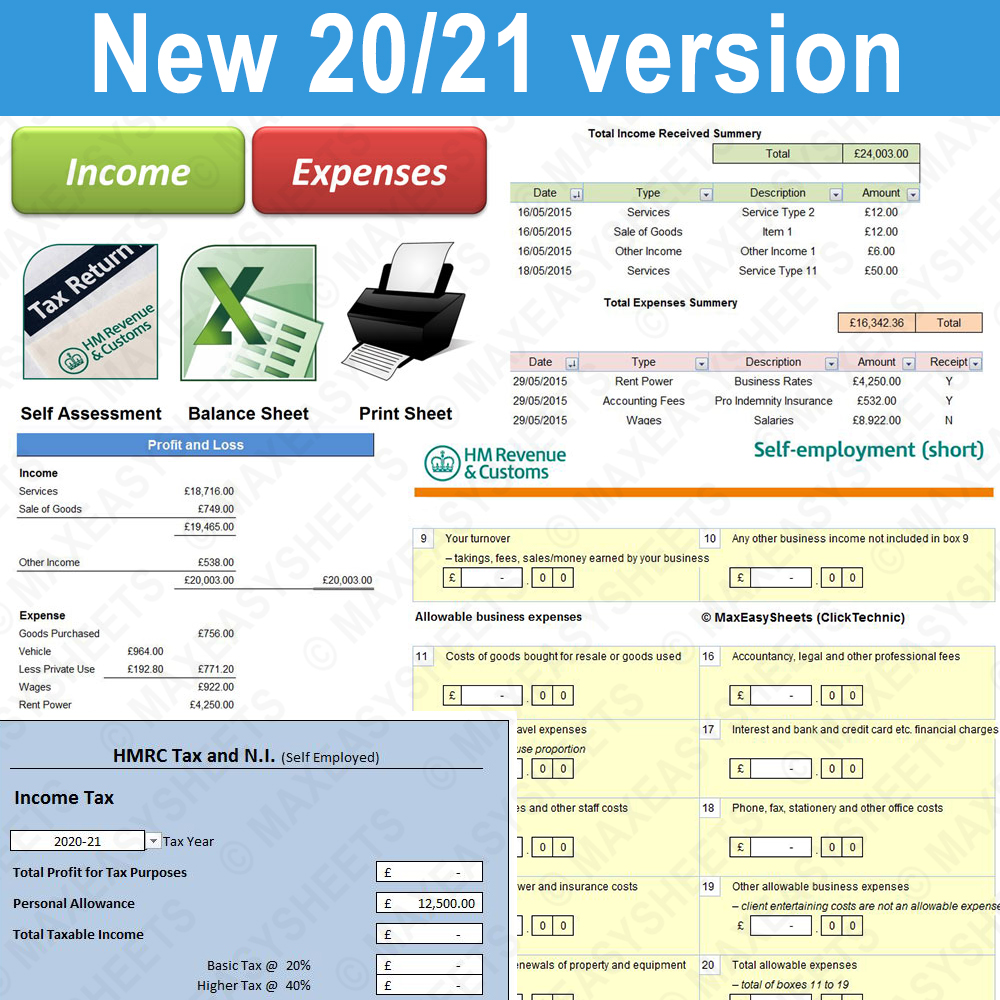

Government intervention economics help. Calculate the tax implications of being both employed and self employed using the latest tax information from the tax year 2020 2021as well as having deductions made by your employer through paye you will have to tell hmrc about your self employed income and you may have to make additional tax and national insurance contributions. Employed and self employed uses tax information from the tax year 2020 2021 to show you take home pay. Hm revenue customs department for work and pensions department for business energy industrial strategy office of tax simplification.

Employed and self employed. A guide to income tax for the self employed. See what happens when you are both employed and self employed at the same time with uk income tax national insurance student loan and pension deductions.

More information about the calculations performed is available on the details page. Yes most self employed people pay class 2 nics if your profits are at least 6475 during the 202021 tax year or 6365 in the 201920 tax year.

Employment Status Tool Is Good For The Low Paid Accountingweb Government Intervention Economics Help

More From Government Intervention Economics Help

- Government By The People

- Government Grants Meaning In Hindi

- Ukraine Government Logo

- Government Loans For Small Businesses Start Up

- Government Intervention In The Marketplace Can Contribute To All Of The Following Except

Incoming Search Terms:

- Self Employed Tax Explained Goselfemployed Co Coaching Business Self Tax Government Intervention In The Marketplace Can Contribute To All Of The Following Except,

- Government Scraps National Insurance Tax Cut For Uk Self Employed Mileiq Uk Government Intervention In The Marketplace Can Contribute To All Of The Following Except,

- Hmrc Fake Grant Scam Tax Mail Claims Self Employment Grant Has Been Approved Government Intervention In The Marketplace Can Contribute To All Of The Following Except,

- Complete Your Self Assessment Tax Return Video Nibusinessinfo Co Uk Government Intervention In The Marketplace Can Contribute To All Of The Following Except,

- Self Employed National Insurance Class 2 And Class 4 Rates Government Intervention In The Marketplace Can Contribute To All Of The Following Except,

- 5 Ways To Streamline Your Self Assessment Tax Return Alexander Co Government Intervention In The Marketplace Can Contribute To All Of The Following Except,