Self Employed Tax Rates 2021, What S New For The 2020 2021 Tax Year How Does It Affect You

Self employed tax rates 2021 Indeed recently is being hunted by consumers around us, perhaps one of you. People are now accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the name of this post I will talk about about Self Employed Tax Rates 2021.

- Tax Calculator And Refund Estimator 2019 2020 Turbotax Official

- Uk Self Employed Tax Rates 2020 21 At A Glance Small Business Toolbox

- Tax Rates In Europe Wikipedia

- Budget 2021 Everything You Need To Know

- Tax Rates For Individuals

- Tax Calculator Uk Tax Calculators

Find, Read, And Discover Self Employed Tax Rates 2021, Such Us:

- Your First Look At 2021 Tax Rates Projected Brackets Standard Deductions More

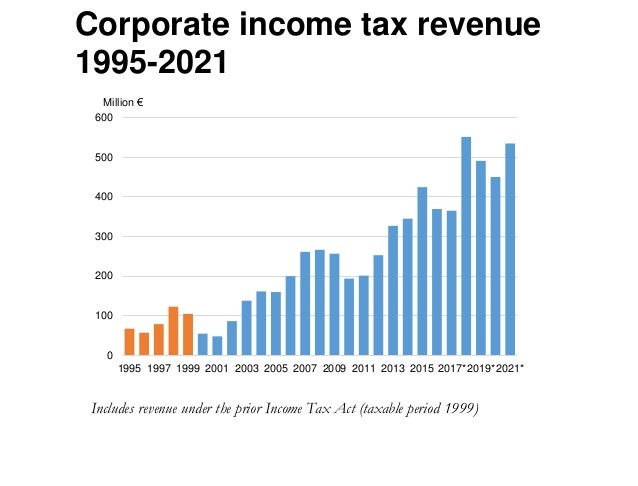

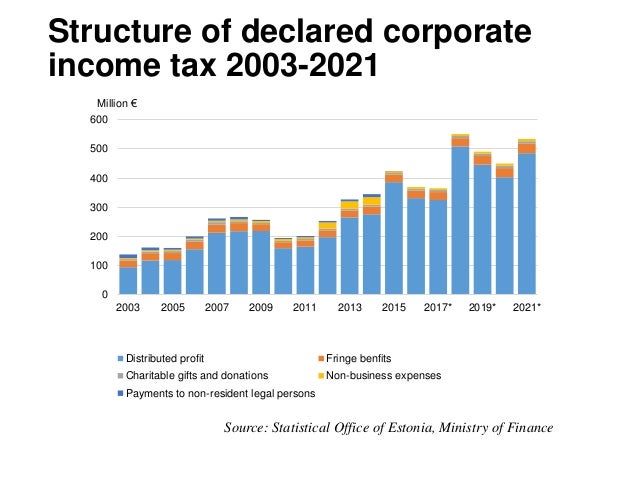

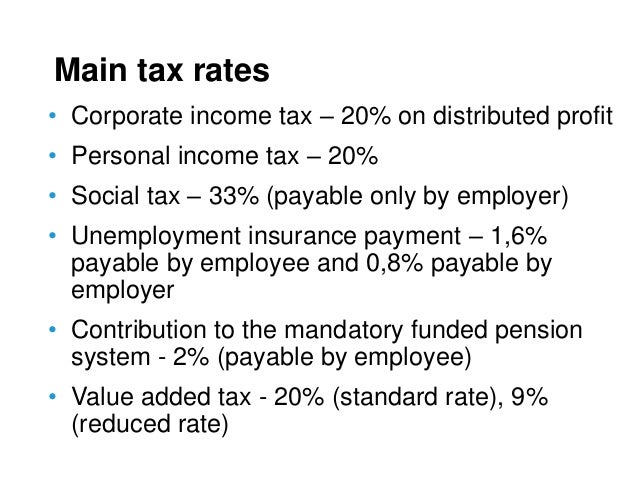

- Estonian Taxes And Tax Structure As Of 1 July 2017

- Estonian Taxes And Tax Structure As Of 1 July 2017

- Important Tax Year 2020 21 Dates Alexander Co

- How To Germany Paying Taxes In Germany

If you re searching for Does Furlough Extension Include Self Employed you've come to the ideal location. We ve got 104 graphics about does furlough extension include self employed including pictures, photos, photographs, backgrounds, and much more. In such page, we additionally have number of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More Does Furlough Extension Include Self Employed

The tax rate is currently 153 of your income with 124 going to social security and 29 going to medicare.

Does furlough extension include self employed. The self employment tax is calculated on 9235 of your total income. 40 50001 150000 personal savings allowance. Tax on this income.

Normally when there is an employer and an employee it is split between them. This rate is derived from the fact that self employed taxpayers can deduct the employers portion of the tax which is 765. Lets start off with a bit of a basic overview of self employment taxes.

Resident tax rates 202021. Income tax rates and bands. Self employment taxes are there so that the federal government can get all the payroll taxes theyre owed.

202021 tax rates for self employed in the uk. Normal salaried employees see their employer withholding money for these taxes. What are the self employed income tax rates for 2020 21.

You can use our 2020 21 income tax calculator to find out how much youll pay. 5092 plus 325 cents for each 1 over 45000. The current tax year is from 6 april 2020 to 5 april 2021.

1000 visit this page. So the employer and the employee both pay 62 of the social security tax. 6th april 2020 to 5th april 2021.

Social security tax and medicare tax. 51667 plus 45 cents for each 1 over. Here are some tax reforms you will need to learn about for 2020 2021 including new tax rates and thresholds for self employed individuals.

You must pay all of your self employment tax. When it comes to paying income tax there arent any differences in the tax rates you pay compared to employees. The 124 percent applies to a maximum of 137700 in.

The rates are 124 for social security and 29 for medicare. 19 cents for each 1 over 18200. 2021 self employment tax rates.

The self employment tax is made up of two different taxes. 29467 plus 37 cents for each 1 over 120000. In the 2020 21 tax year self employed and employees pay.

0 on the first 12500 you earn. The total rate is 765. 20 12501 50000 higher tax rate.

Ir35 postponed threshold rise for self employed national insurance capital gains tax deduction and adjustments in bill payments isa allowance. 1000 visit this page trading allowance. Your first 1000 of income from self employment this is your trading allowance.

The employer then matches that 765. Class rate for tax year 2020 to 2021.

More From Does Furlough Extension Include Self Employed

- Uk Furlough Scheme Introduced

- Types Of Government Worksheet Answer Key

- Government Law College Kozhikode

- E Government Di Indonesia

- Government Employee Sample Retirement Letter

Incoming Search Terms:

- Your First Look At 2021 Tax Rates Projected Brackets Standard Deductions More Government Employee Sample Retirement Letter,

- Finance Act 2019 Acca Global Government Employee Sample Retirement Letter,

- Income Tax Rates For Individual For Ay 2021 22 Old Vs New Government Employee Sample Retirement Letter,

- Furloughed Brits May Pay Too Much Tax While Self Employed Can Defer To 2021 Your Money Government Employee Sample Retirement Letter,

- What S New For The 2020 2021 Tax Year How Does It Affect You Government Employee Sample Retirement Letter,

- Income Tax Calculator Calculate Taxes Online Fy 2019 20 Government Employee Sample Retirement Letter,