Self Employed Tax Return, Filing Your Tax Return Online For The First Time Be Clear On The Registration Process Low Incomes Tax Reform Group

Self employed tax return Indeed recently is being hunted by consumers around us, maybe one of you. People now are accustomed to using the net in gadgets to view image and video information for inspiration, and according to the name of the post I will discuss about Self Employed Tax Return.

- Calameo Self Assessment Services With Royds Accountancy

- Do I Need To Complete A Tax Return Low Incomes Tax Reform Group

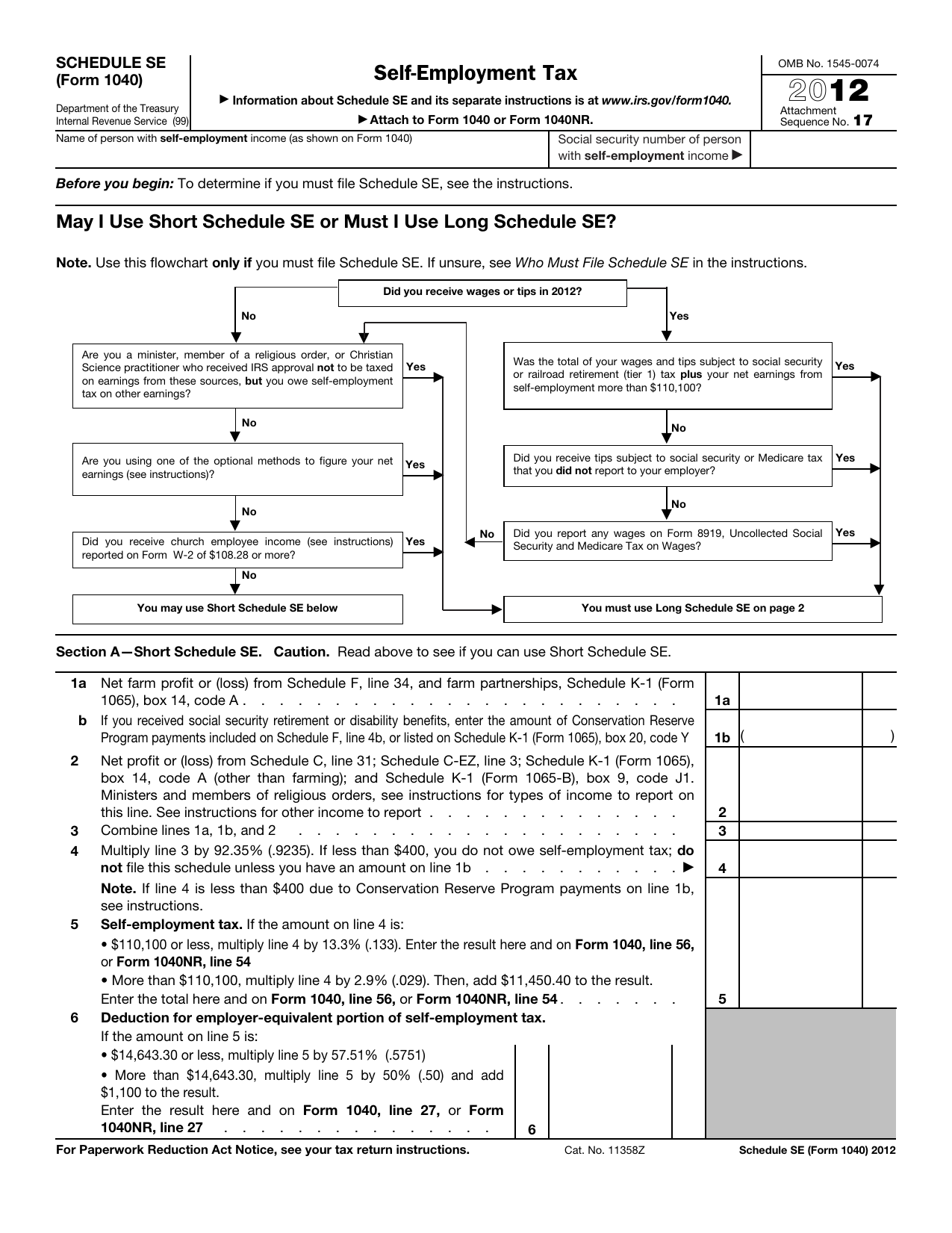

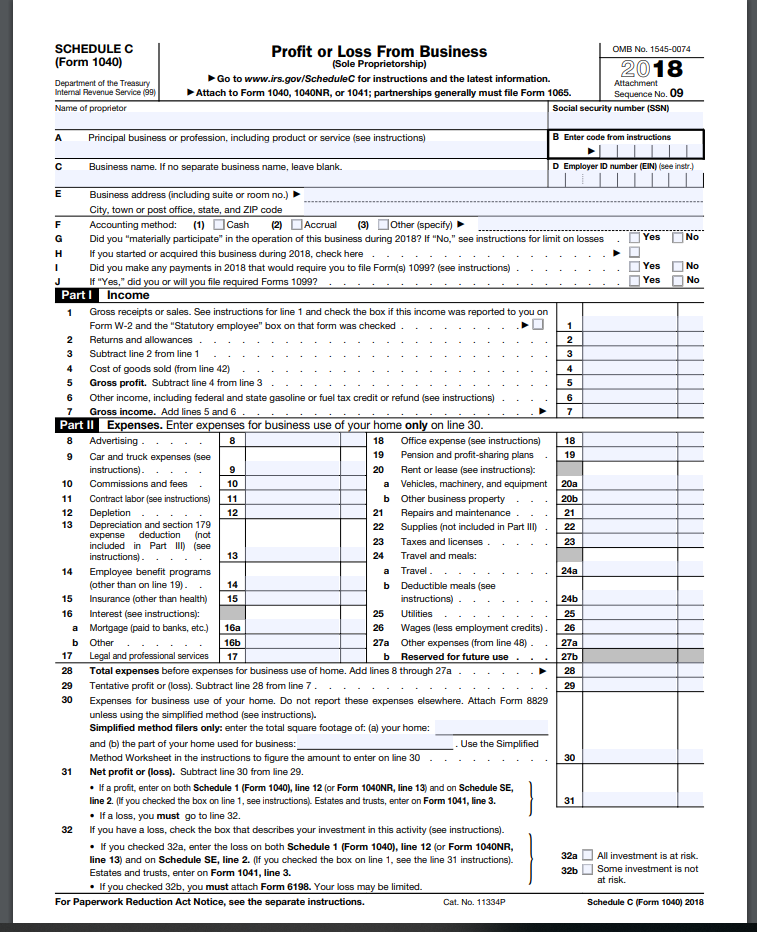

- Free 6 Sample Self Employment Tax Forms In Pdf

- Filling In The Inland Revenue Self Assessment Online Tax Form

- Hmrc Self Employed Tax Return Paperwork Stock Photo Alamy

- Self Assessment Tax Return High Resolution Stock Photography And Images Alamy

Find, Read, And Discover Self Employed Tax Return, Such Us:

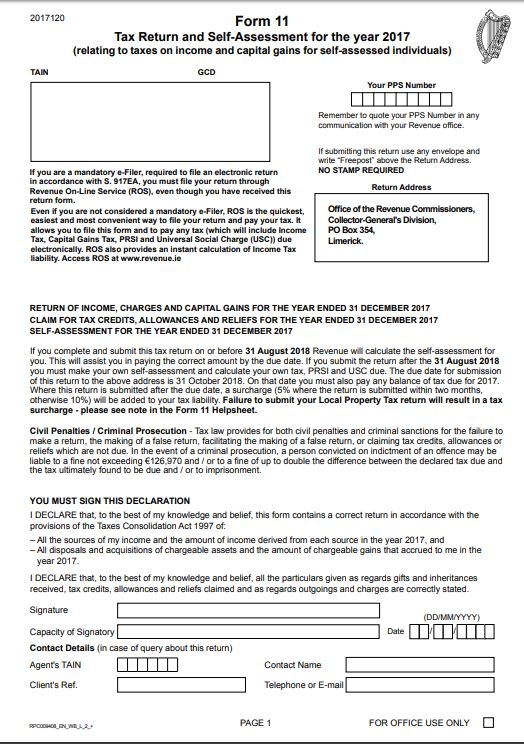

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

- Self Employed Tax Form Accounting And Self Assessment Tax Return

- Paper Self Assessment Tax Return Deadline

- Self Employment Tax For U S Citizens Abroad

- Basetax Accounting And Tax Services Sole Trader Self Employed Tax Return Facebook

If you are searching for Self Employed Register For Paye you've reached the perfect location. We ve got 104 images about self employed register for paye including images, photos, pictures, wallpapers, and more. In such webpage, we also have number of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Do Uk Self Assessment Return For Employed And Self Employed By Tax Expert Ltd Self Employed Register For Paye

Many self employed people do not receive any tax refund.

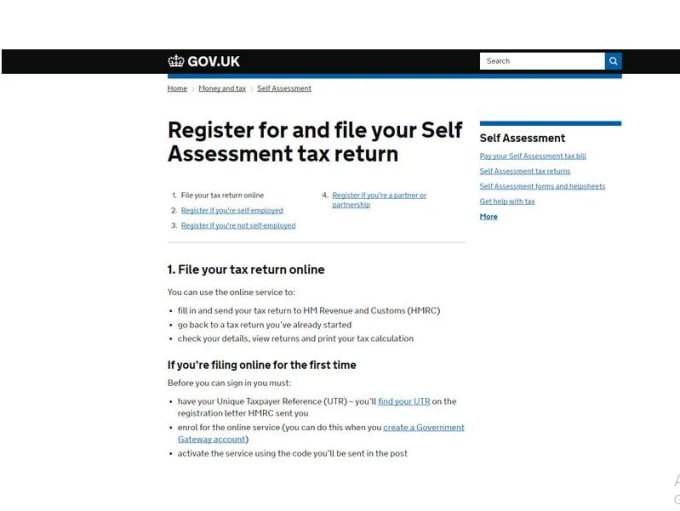

Self employed register for paye. Self assessment is a system hm revenue and customs hmrc uses to collect income taxtax is usually deducted automatically from wages pensions and savings. As noted the self employment tax rate is 153 of net earnings. Benefits including state pension child benefit and blind persons allowance.

If you are self employed however taxes may not be withdrawn from your pay which limits the amount of your refund. Self employment tax is not the same as. There are two sections to a self assessment tax return.

When you work for an employer you often get a tax refund based on the overpayment of taxes withdrawn from your regular paycheck. Se tax is a social security and medicare tax primarily for individuals who work for. Self employed individuals generally must pay self employment tax se tax as well as income tax.

How to fill in a self assessment tax return. As a self employed individual generally you are required to file an annual return and pay estimated tax quarterly. What are my self employed tax obligations.

Taxed and untaxed income in the form of dividends and interest.

More From Self Employed Register For Paye

- Self Employed Professional Liability Insurance

- Self Employed Disability Insurance

- Government Systems Map

- Furlough Rules New York

- Furlough Rules Ni

Incoming Search Terms:

- End Of Year Accounts Template For Self Employed Small Business No Hassle Accounting Furlough Rules Ni,

- 12 Things To Know About Your Self Employed Tax Return For 2017 18 Which News Furlough Rules Ni,

- Https Taxvol Org Uk Wp Content Uploads 2019 10 Completing Your Online Tax Return 2020 Pdf Furlough Rules Ni,

- Schedule Se Self Employment Form 1040 Tax Return Preparation Youtube Furlough Rules Ni,

- Tax Online Tax Online Self Assessment Furlough Rules Ni,

- Self Employment Tax Form Sample Forms Furlough Rules Ni,