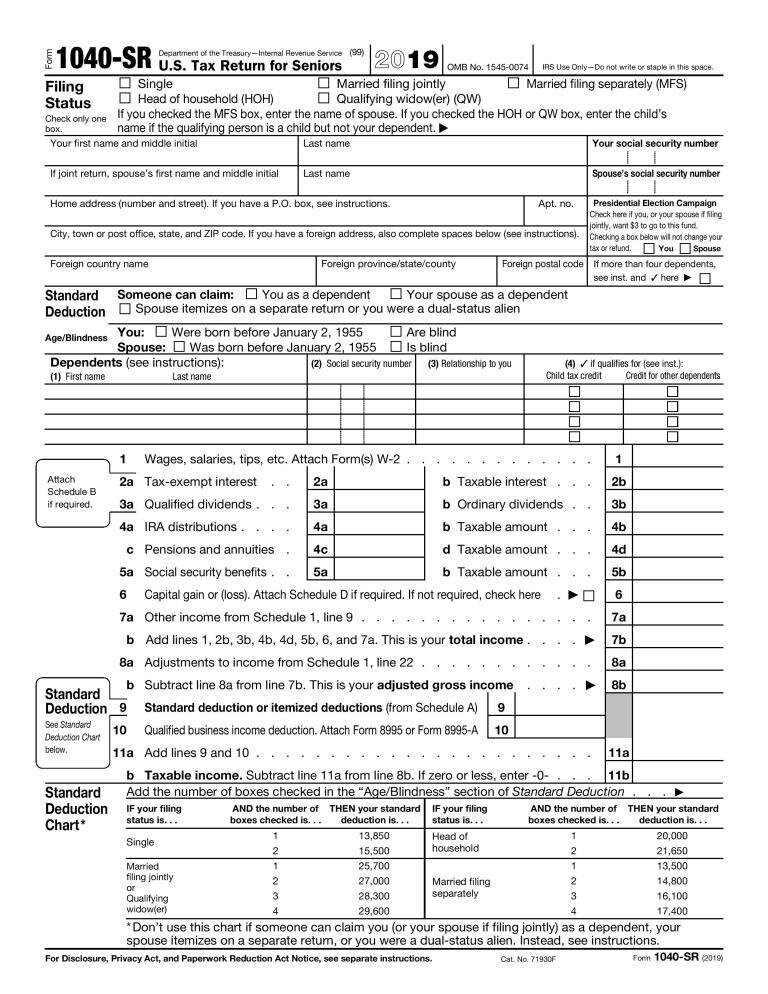

1040 Tax Self Employed Tax Return Example, The New 2019 Form 1040 Sr U S Tax Return For Seniors Generally Mirrors 2019 Form 1040 Conejo Valley Guide Conejo Valley Events

1040 tax self employed tax return example Indeed recently has been sought by consumers around us, perhaps one of you. Individuals are now accustomed to using the net in gadgets to see video and image data for inspiration, and according to the title of the post I will discuss about 1040 Tax Self Employed Tax Return Example.

- Let S Talk Tax Returns Emily Caryl Ingram

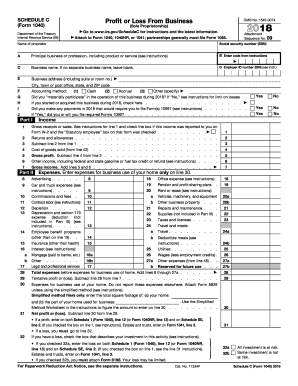

- Schedule C Income Mortgagemark Com

- Use This Tax Form To Fill Out A 2017 Tax Form Chegg Com

- What Is Self Employment Tax And Schedule Se Stride Blog

- Example 1040 Form Filled Out Unique Self Employed Tax Return Form Example Unique Tax Return Spreadsheet Models Form Ideas

- Form 1040 Wikipedia

Find, Read, And Discover 1040 Tax Self Employed Tax Return Example, Such Us:

- Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

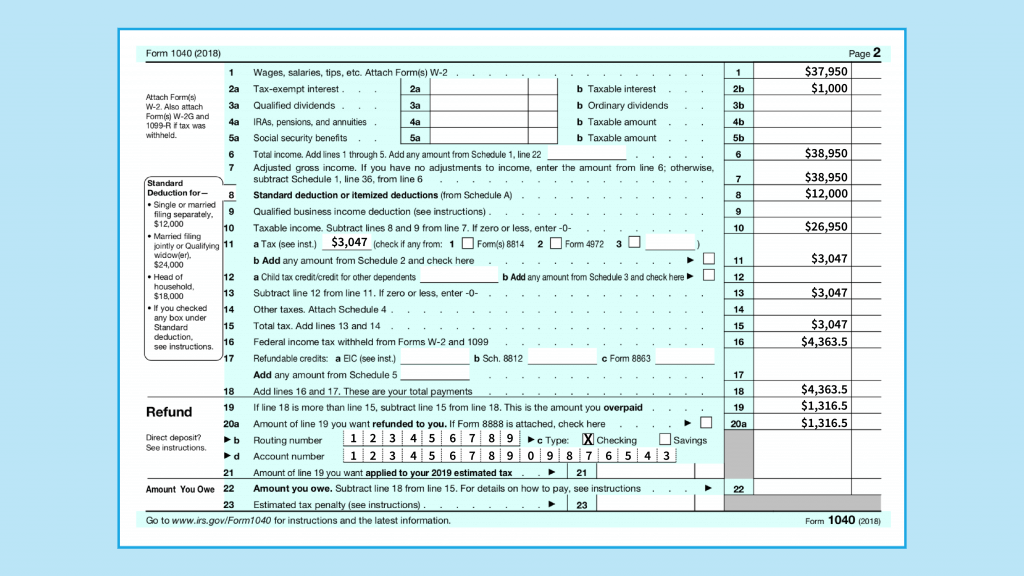

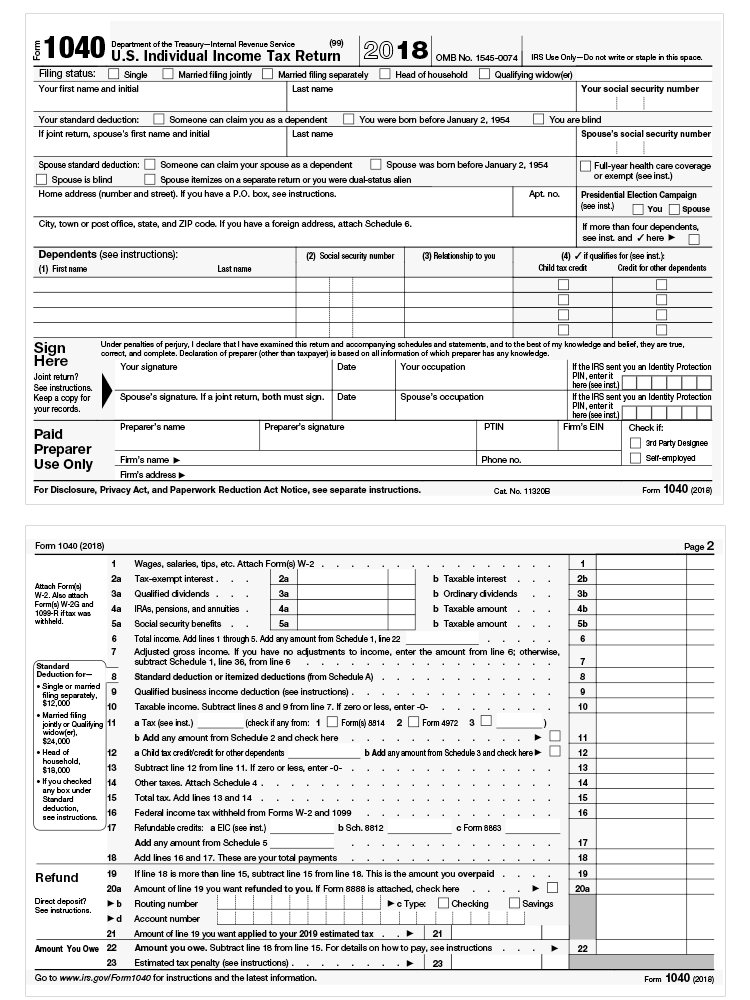

- Completing Form 1040 With A Us Expat 1040 Example

- How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

- Basics Of Self Employed Taxes The Official Blog Of Taxslayer

- Let S Talk Tax Returns Emily Caryl Ingram

If you are looking for Uk Government Spending Pie Chart 2019 you've come to the ideal place. We ve got 104 graphics about uk government spending pie chart 2019 adding pictures, pictures, photos, backgrounds, and more. In such page, we additionally have variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

Form 1040 Gets An Overhaul Under Tax Reform Putnam Wealth Management Uk Government Spending Pie Chart 2019

The threshold requiring you to file a form 1040 if youre self employed is 400.

Uk government spending pie chart 2019. Those complex form 1040 instructions can be an especially large headache for small business owners and the self employed. This tax return preparation is provided by businessaccountantco. Information about schedule se form 1040 or 1040 sr self employment tax including recent updates related forms and instructions on how to file.

The simple answer to this question is yes almost certainly. For example if you made 10000 in the most recent year as a self employed worker you would be exempt from filing a federal tax return. On schedule c report your income or losses from a business you operated or a profession you practiced as a sole proprietor or freelancerif you accrued expenses of 5000 or less you might be eligible for the schedule c ez short form.

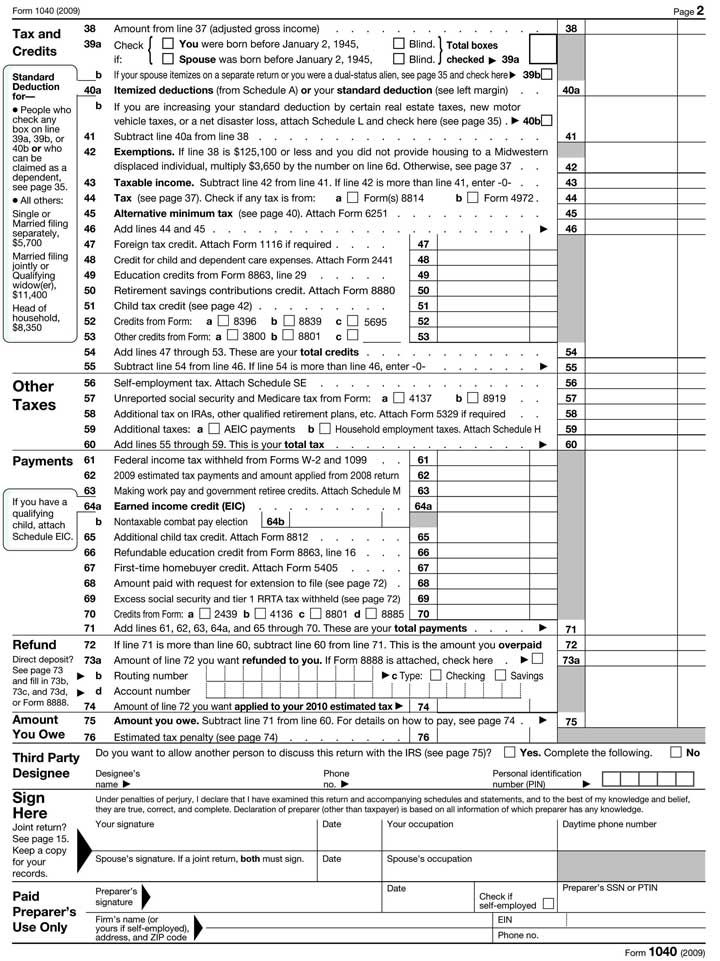

Form 1040 is required for individuals who are self employed because it accounts for the self employment tax. You can deduct one half of your self employment tax on line 27 of form 1040. This is the self employment tax section of a 1040 tax return.

So for example if your schedule se says you owe 2000 in self employment tax for the year youll need to pay that money when its due during the year but at tax time 1000 would be. Schedule se form 1040 is used by self employed persons to figure the self employment tax due on net earnings. After students have completed the tax tutorial self employment income and the self employment tax simulation 14a using 1099 int to complete schedule c schedule se and form 1040 and simulation 14b using 1099 misc to complete schedule c ask whether they have questions about self employed workers and how they report their income expenses and profit.

When the end of the tax year rolls around the process of trying to figure out taxes can be frustrating overwhelming and time consuming. Any personal property tax imposed by a state or local government on property used in your business can be deducted.

More From Uk Government Spending Pie Chart 2019

- Self Employed Grant Scheme November

- Government Deficit Spending

- Government Laptop 2019 Model

- Furlough Rules Holiday

- Self Employed Free Profit And Loss Statement Pdf

Incoming Search Terms:

- 2 Self Employed Free Profit And Loss Statement Pdf,

- How To Fill Out Irs Form 1040 What Is Irs Form 1040 Es Self Employed Free Profit And Loss Statement Pdf,

- 1 Self Employed Free Profit And Loss Statement Pdf,

- Basics Of Self Employed Taxes The Official Blog Of Taxslayer Self Employed Free Profit And Loss Statement Pdf,

- Completing Form 1040 With A Us Expat 1040 Example Self Employed Free Profit And Loss Statement Pdf,

- How To Make Quarterly Estimated Tax Payments For Ministers The Pastor S Wallet Self Employed Free Profit And Loss Statement Pdf,

/i-received-a-1099-misc-form-what-do-i-do-with-it-35d7e9d37e8949de8c556777494dde39.png)