Government Deficit Spending, Federal Spending Drives Budget Deficit In 2018 Craig Eyermann

Government deficit spending Indeed recently has been sought by users around us, maybe one of you personally. Individuals now are accustomed to using the net in gadgets to see video and image data for inspiration, and according to the title of the post I will discuss about Government Deficit Spending.

- The Origin And Implications Of The Federal Budget Deficit Jul 30 2009

- How Important Is The Budget Deficit Economics Help

- Data Lab Federal Deficit Trends U S Treasury Data Lab

- How Worried Should You Be About The Federal Deficit And Debt

- Canada S Deficits And Surpluses 1963 To 2015 Cbc News

- Policies To Reduce A Budget Deficit Economics Help

Find, Read, And Discover Government Deficit Spending, Such Us:

- U S Government Budget Surplus Or Deficit 2025 Statista

- Us Federal Deficit For Fy2021 Will Be 966 Billion According To Federal Budget

- Federal Government Receives Warning From Canadian Banks On Out Of Control Deficit Spending The Deep Dive

- Treasury 2018 Deficit Was 779 Billion Committee For A Responsible Federal Budget

- Federal Spending Drives Budget Deficit In 2018 Craig Eyermann

If you re looking for Self Employed Tax Rates Ireland 2020 you've arrived at the right place. We have 104 graphics about self employed tax rates ireland 2020 including pictures, photos, photographs, wallpapers, and more. In these webpage, we additionally have number of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

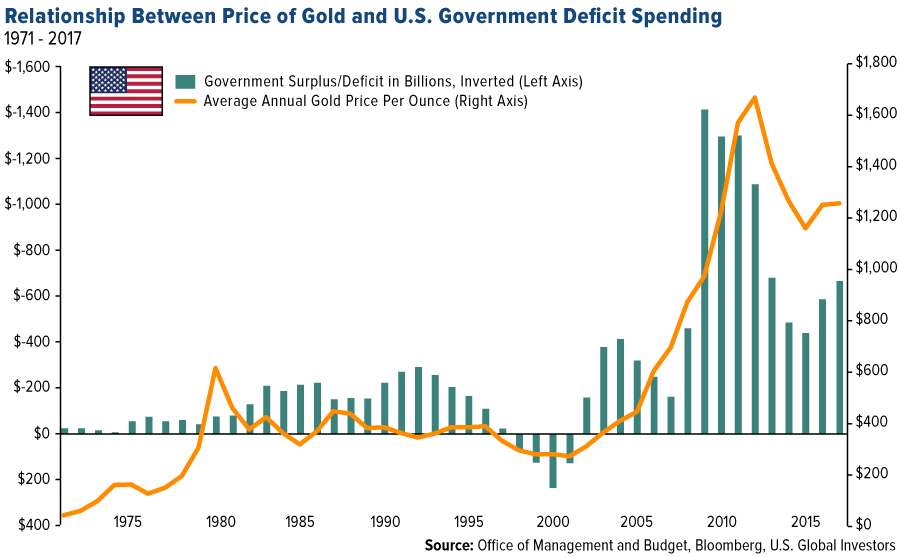

Increased government deficit spending creates opportunities and threats.

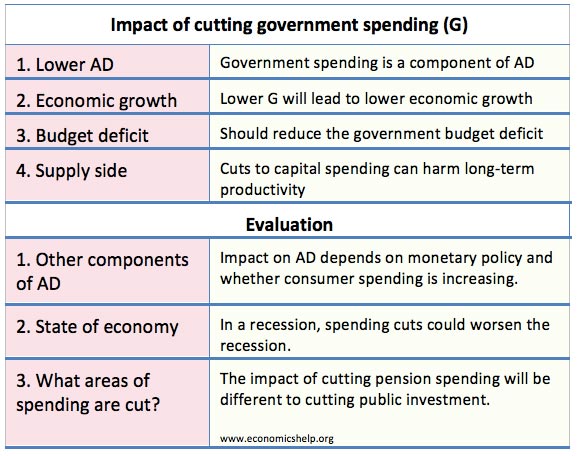

Self employed tax rates ireland 2020. Cutting spending also has pitfalls. Deficit spending leads to a budget deficit. The government budget balance also alternatively referred to as general government balance public budget balance or public fiscal balance is the overall difference between government revenues and spending.

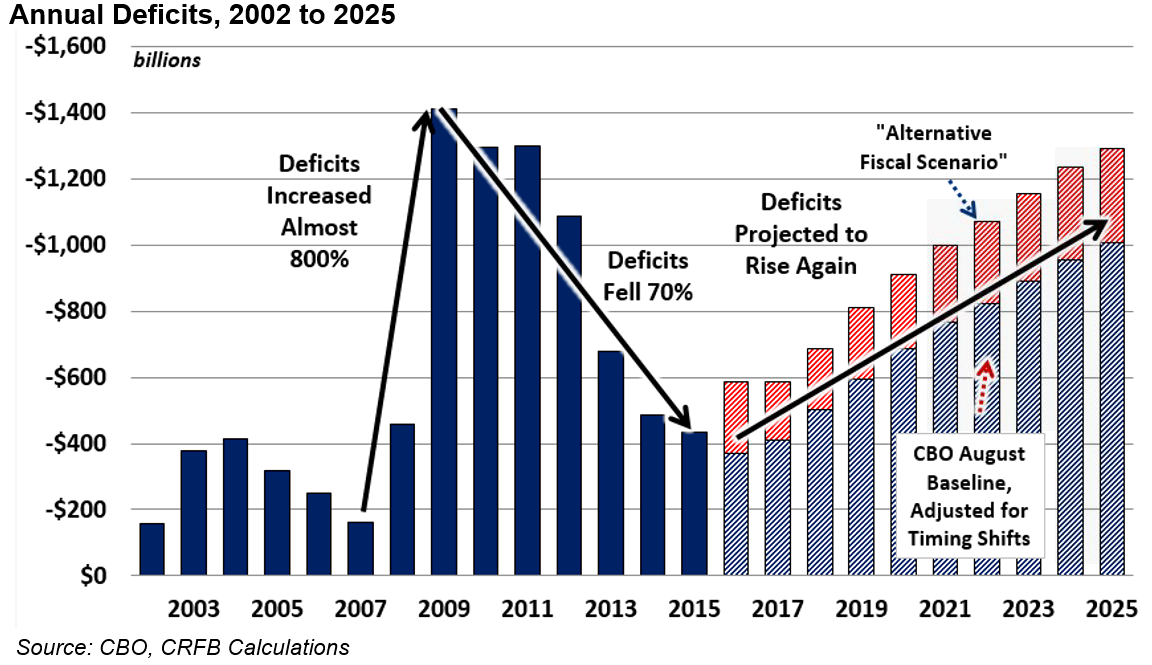

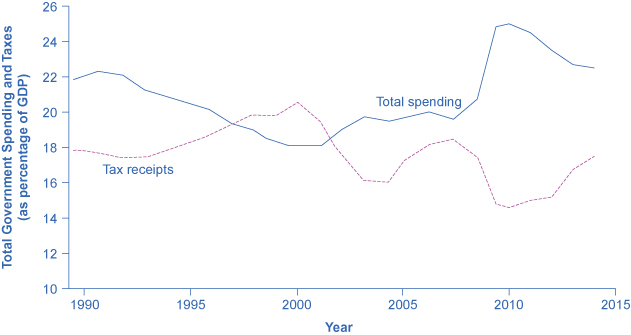

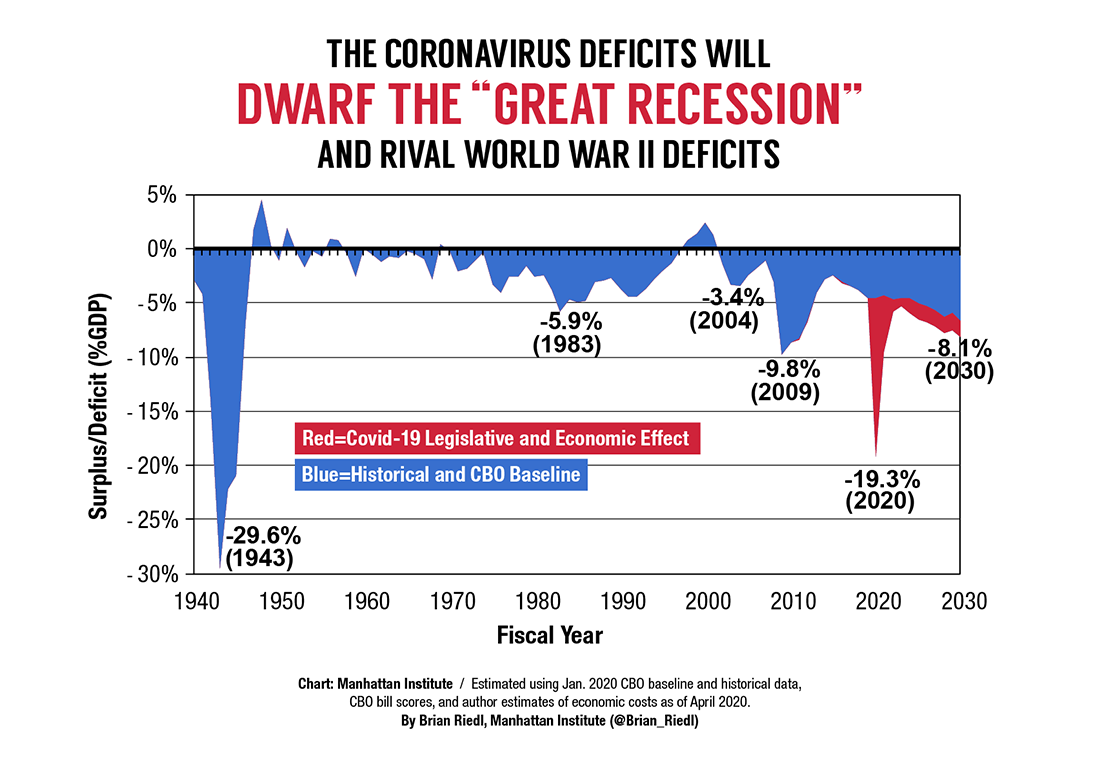

The congressional budget office cbo predicted that the covid 19 pandemic would raise the fiscal year fy 2020 deficit to 37 trillion. A budget deficit is the annual shortfall between government spending and tax revenue. A budget deficit typically occurs when expenditures exceed revenue.

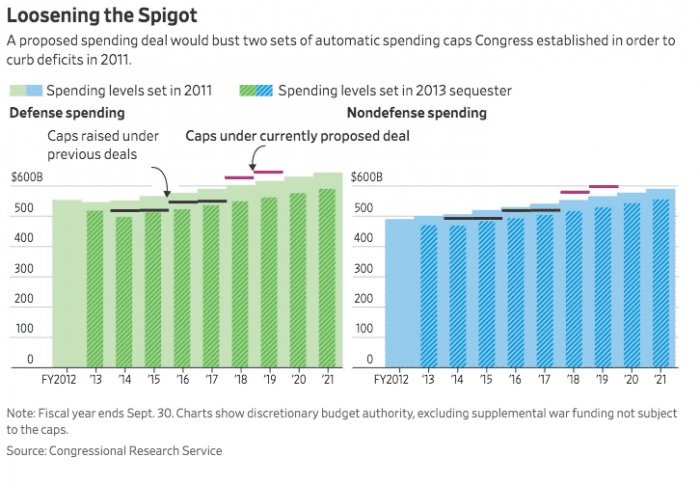

Summary of effects of a budget deficit. The deficit is primarily funded by selling government bonds gilts to the private sector. The best solution is to cut spending on areas that do not create many jobs.

Unpaid deficits turn into debt and according to trading economics the united states government debt to gdp stood at 10690 in 2019 and is expected to reach 12000 by the end of 2020. That leads to lower revenues and potentially a larger deficit. Deficit spending is the amount by which spending exceeds revenue over a particular period of time also called simply deficit or budget deficit.

The interest rates matter as well and a higher interest will force them to think of plans to pay back the debt as soon as possible. Budget deficit by year is how much more the federal government spends than it receives in revenue annually. The term is typically used to refer to government spending and national debt.

The deficit is the annual amount the government need to borrow. Government deficit spending is a central point of controversy in economics as discussed below. Running a budget deficit assures that the government bodies think twice before making unnecessary investments.

A budget deficit is an indicator of financial health. This is often done intentionally to stimulate the economy. Deficit spending occurs whenever a governments expenditures exceed its revenues over a fiscal period.

Rise in national debt. Government spending is a component of gdp. At the end of the day we believe deficits do matter.

The opposite of budget surplusthe term may be applied to the budget of a government private company or individual. If the government cuts spending too much economic growth will slow.

More From Self Employed Tax Rates Ireland 2020

- Self Employed Canada Taxes

- Buatlah Roadmap Pengembangan E Government Di Indonesia

- Government Teaching Vacancies 2020 Sri Lanka

- Self Employed Proof Of Income Letter Template

- Furlough Workers Extended

Incoming Search Terms:

- Debt Vs Deficits What S The Difference Furlough Workers Extended,

- How Important Is The Budget Deficit Economics Help Furlough Workers Extended,

- Impact Of Cutting Government Spending Economics Help Furlough Workers Extended,

- How Worried Should You Be About The Federal Deficit And Debt Furlough Workers Extended,

- Fy 2015 Deficit Falls To 439 Billion But Debt Continues To Rise Committee For A Responsible Federal Budget Furlough Workers Extended,

- Debt Vs Deficits What S The Difference Furlough Workers Extended,