Self Employed Canada Taxes, 10 Things To Know About Freelance Taxes In Canada

Self employed canada taxes Indeed lately has been hunted by users around us, perhaps one of you. Individuals now are accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the name of this post I will talk about about Self Employed Canada Taxes.

- Self Employed Here Are 6 Steps To Get Your Taxes Right Globalnews Ca

- Self Employed Taxes In Canada How Much To Set Aside For Cpp Ei Income Tax Jessica Moorhouse

- Https Www Incometaxottawa Ca Self Employed Business Tax Preparation Checklist

- Self Employed Taxes In Canada How Much To Set Aside For Cpp Ei Income Tax Income Tax Business Tax Finance Saving

- Are You Getting The Best Return On Your Self Employed Taxes Taxplan Canada

- Http Citeseerx Ist Psu Edu Viewdoc Download Doi 10 1 1 587 1476 Rep Rep1 Type Pdf

Find, Read, And Discover Self Employed Canada Taxes, Such Us:

- The Canadian Employer S Guide To The T4 Bench Accounting

- Self Employed Taxes In Canada How Much To Set Aside For Cpp Ei Income Tax Income Tax Business Tax Finance Saving

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqofqr5qg98o7d26wwcm88rnlprgaaj9zixcs7d1klrwejfc3vy Usqp Cau

- Getting Started On Your Taxes Q A With Turbotax Canada Youtube

- Canadian Taxes Posts Facebook

If you re looking for Local Government Vacancies 2020 Mauritius you've come to the right place. We have 101 graphics about local government vacancies 2020 mauritius including pictures, photos, pictures, wallpapers, and much more. In these page, we also provide variety of images out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

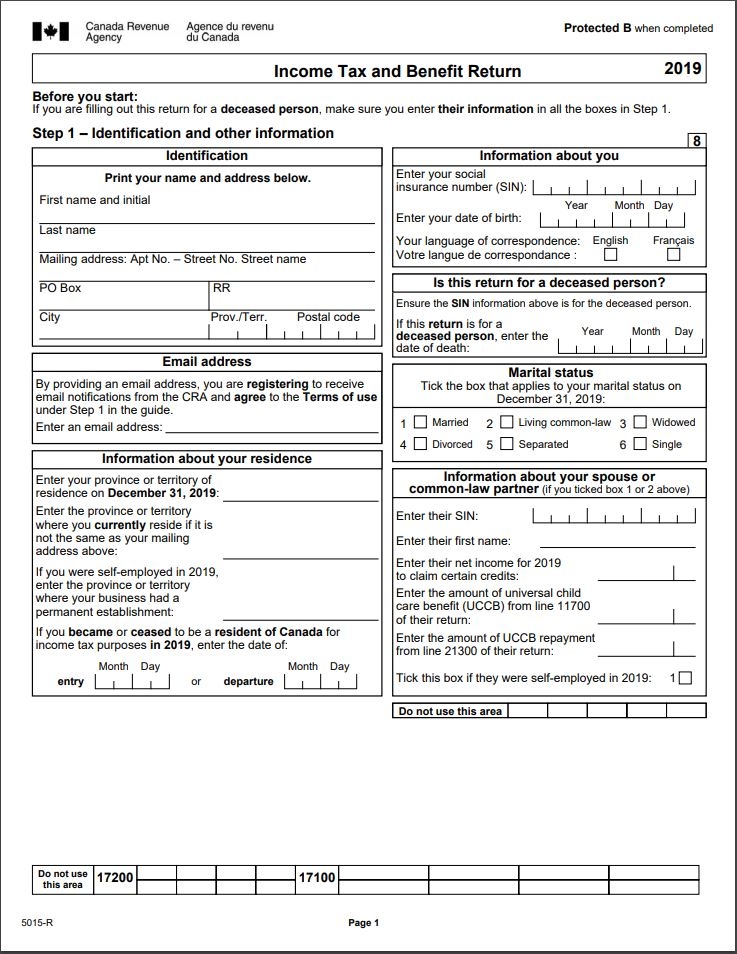

Self employed individuals including those earning income from commissions.

Local government vacancies 2020 mauritius. The t2125 also provides self employed canadians with the opportunity to deduct allowable expenses from your gross income to lower your taxable income so you pay less in income taxes. If you are incorporated this information does not apply to you. As a self employed worker doing your taxes is unlikely to be the most enjoyable part of your work.

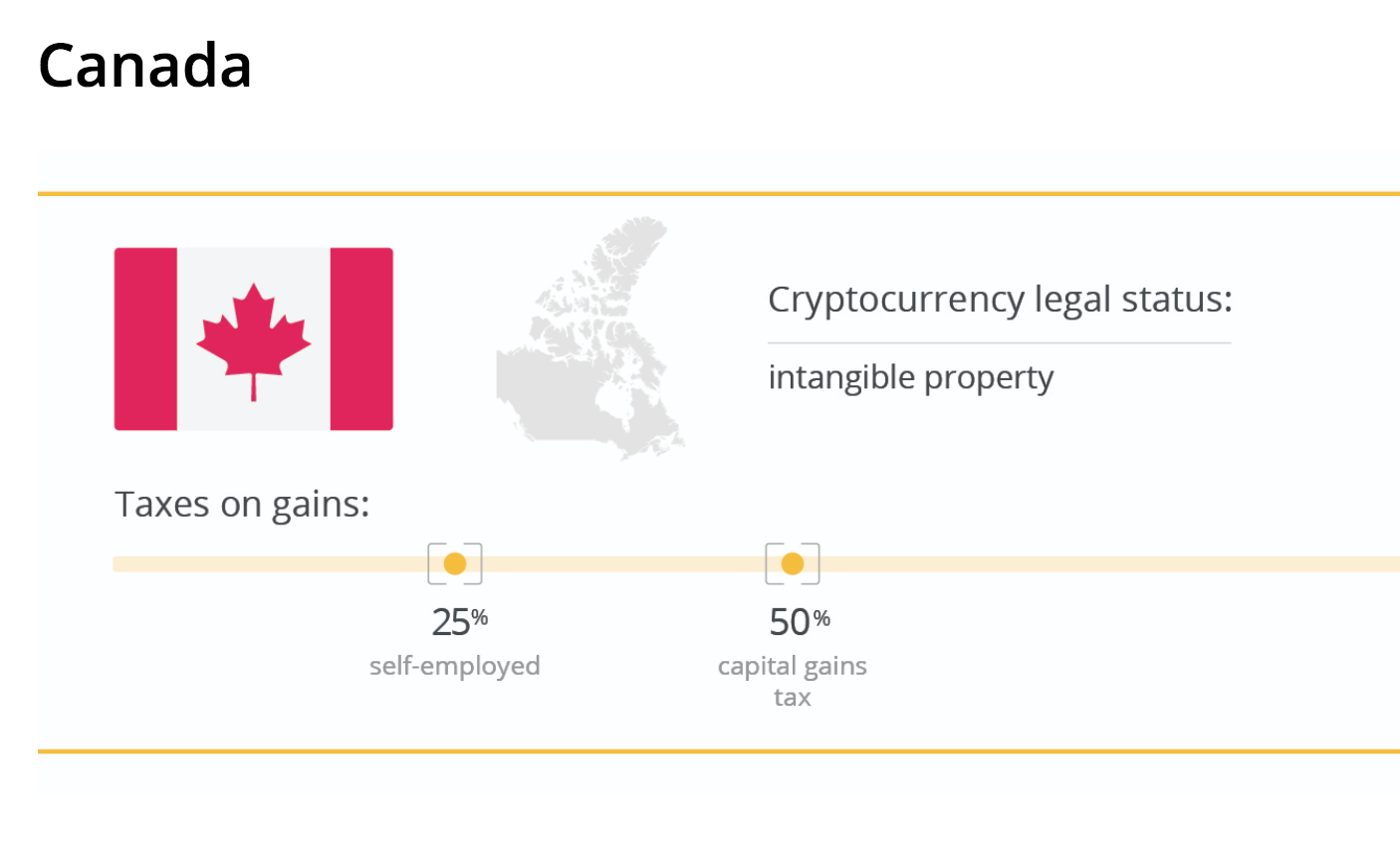

Employees have half that amount withheld from their paycheck while their employer pays the other half. This 99 only applies to part of your incomea range of 3500 55300. If you are starting a small business see the checklist for new small businesses.

However by keeping on top of the tax you need to pay throughout the year and retaining all of your documentation as evidence you shouldnt have any nasty surprises when it comes to filing and paying your self employed taxes. Canada has a progressive income tax and the federal tax rate on personal income for 2018 tax year is as follows. The first 45282 of taxable income is taxed at 15 percent.

So you need to pay the full 99. The checklist provides important tax information. Instead go to corporations.

If you make under 3500 you cant contribute to cpp. Whats new for small businesses and self.

More From Local Government Vacancies 2020 Mauritius

- Government Has Or Have

- Self Employed Unemployment California Cares Act

- Government X Ray Technician Jobs

- List Of Competitive Exams For Government Jobs In India

- Government Yojana For Girl Child In Hindi

Incoming Search Terms:

- Tax Accountant Ajax Government Yojana For Girl Child In Hindi,

- All The Tax Filing Deadlines You Need To Know Government Yojana For Girl Child In Hindi,

- Self Employed Taxes In Canada How Much To Set Aside For Cpp Ei Income Tax Youtube Government Yojana For Girl Child In Hindi,

- I M Self Employed Where Do I Enter My Income And Expenses H R Block Canada Government Yojana For Girl Child In Hindi,

- 10 Things To Know About Freelance Taxes In Canada Government Yojana For Girl Child In Hindi,

- Tax Tips For Canadians Who Work For U S Companies Mileiq Canada Government Yojana For Girl Child In Hindi,