Self Employed Eidl Loan, Cares Act For Small Businesses Loans And Grants Now Available For Small Business Self Employed And Gig Workers Signals Az

Self employed eidl loan Indeed recently is being hunted by consumers around us, maybe one of you. People are now accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the name of this article I will discuss about Self Employed Eidl Loan.

- How To Apply For A Ppp Loan When Self Employed Divvy

- Self Employed And Need A Ppp Loan The Sba Just Issued New Guidance For You

- Eidl Approval Time For Coronavirus Loans What To Expect

- Economic Injury Disaster Loan Eidl For Self Employed Course Interactive Video Academy

- Sba And Eidl Forms To Complete For Small Business Self Employed Homeowners Renters Youtube

- Cares Act For Small Businesses Loans And Grants Now Available For Small Business Self Employed And Gig Workers Signals Az

Find, Read, And Discover Self Employed Eidl Loan, Such Us:

- Business Owners What The Covid 19 Relief Legislation Means For You Edward Jones

- Covid 19 Loans For Self Employed Where To Apply

- Eidl Loans Vs Ppp Loans What You Need To Know

- Https Www Foxrothschild Com Content Uploads 2020 04 Cares Act Sba Loan Programs Chart Pdf

- Sba Disaster Recovery Loan Covering Economic Injury Eidl Detailed For Self Employed Independent

If you are searching for Hp 246 Government Laptop Battery you've arrived at the right location. We ve got 104 images about hp 246 government laptop battery including pictures, photos, pictures, backgrounds, and much more. In these web page, we also have number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

The eidl is a disaster relief loan that was quickly dried up near the beginning of the covid 19 pandemic.

Hp 246 government laptop battery. Low interest 375 275 nfp. If you are self employed with employees and did not receive a ppp loan or if you are in need of additional financing due to covid 19 you may want to consider applying for an eidl through the federal small business administration sba. Self employed independent contractor.

Under the eidl program those who apply for a loan can also request an advance of up to 1000 per employee for up to 10 employees and those grants dont need to be repaid. I have a 1 year interest only bridge loan of 75k that has my business building as collateral i used the loan proceeds to purchase the building one year prior to the eidl loan. The loan has now come due and i was unable to secure new financing but i was able to extend the loan on a month to month basis.

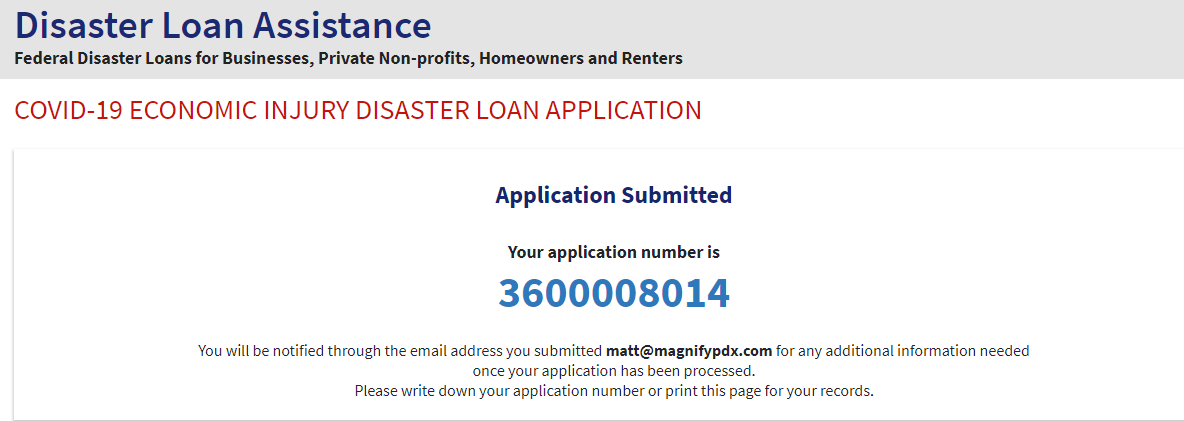

Economic injury disaster loans. Economic injury disaster loan eidl. This loan provides economic relief to small businesses and non profit organizations that are currently experiencing a temporary loss of revenue.

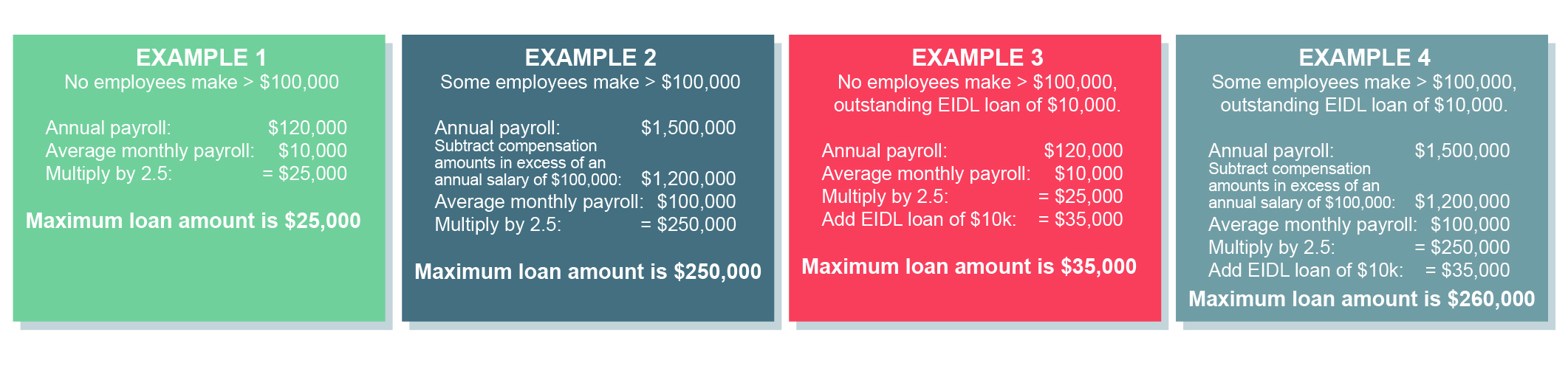

Because the two programs are so new detailed rules and procedures are still being created and published. Covid 19 related eidl loans include an up to 10000 forgivable advance. Economic injury disaster loan eidl and paycheck protection program ppp.

But as of june 15 2020 the eidl has re opened to all small businesses including sole props and the self employed. Small business owners and the self employed who have not applied for an economic injury disaster loan may still want to do so even though the grant is not available. Self employed individuals and economic injury disaster loans.

As of june 15 2020 the sba is once again accepting eidl advance and loan applications from all eligible borrowers. Join our facebook group economic injury disaster loans still available.

More From Hp 246 Government Laptop Battery

- Government Anarchy Examples

- Furlough And Unemployment Pay Oregon

- Government Relations Officer Part Time

- Letter To Government Malaysia

- Self Employed Adalah

Incoming Search Terms:

- Corona Stimulas Package For Small Business Self Employed Adalah,

- North Country Chamber Cares Act2 Self Employed Adalah,

- Use Sba Loans To Keep Retail Store Open Asd Market Week Self Employed Adalah,

- Paycheck Protection Program How It Works Funding Circle Self Employed Adalah,

- Cares Act For Small Businesses Loans And Grants Now Available For Small Business Self Employed And Gig Workers Signals Az Self Employed Adalah,

- Farmers Wanting To Apply For Next Round Of Funds Need To Act Now Self Employed Adalah,