Self Employed Taxes, Self Employment Tax For U S Citizens Abroad

Self employed taxes Indeed recently is being sought by consumers around us, perhaps one of you personally. People now are accustomed to using the net in gadgets to see image and video information for inspiration, and according to the name of the article I will discuss about Self Employed Taxes.

- Who S Required To Fill Out A Schedule C Irs Form

- Infographic How To Calculate Self Employment Tax Taxact Blog

- Self Employed In Ireland A Guide To Your Taxes Part 2

- Self Employed Tax Ideas Useful Advice During Duty Time

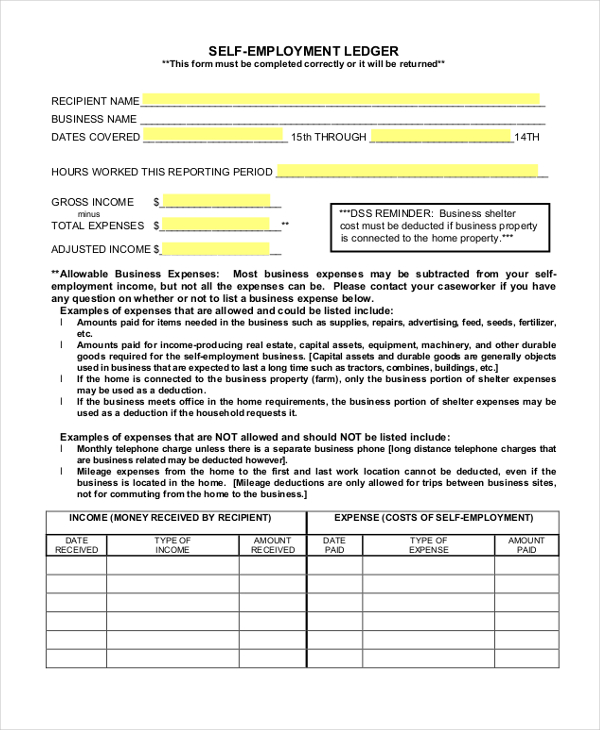

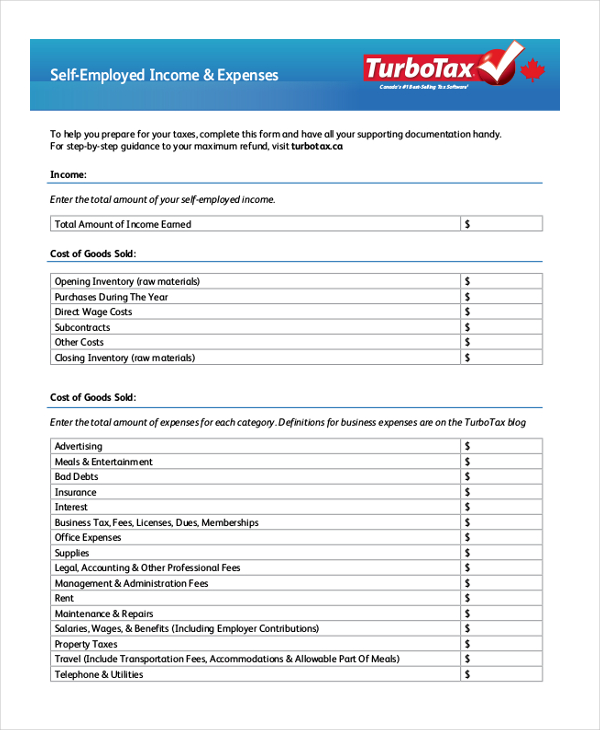

- Free 11 Sample Self Employment Forms In Pdf Word Excel

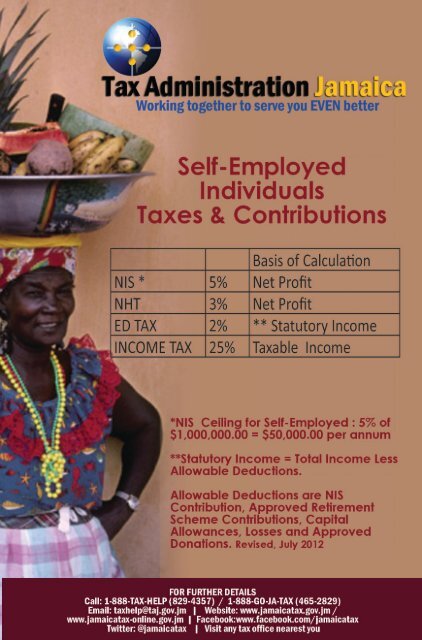

- Taxes For Self Employed Individuals In The Philippines

Find, Read, And Discover Self Employed Taxes, Such Us:

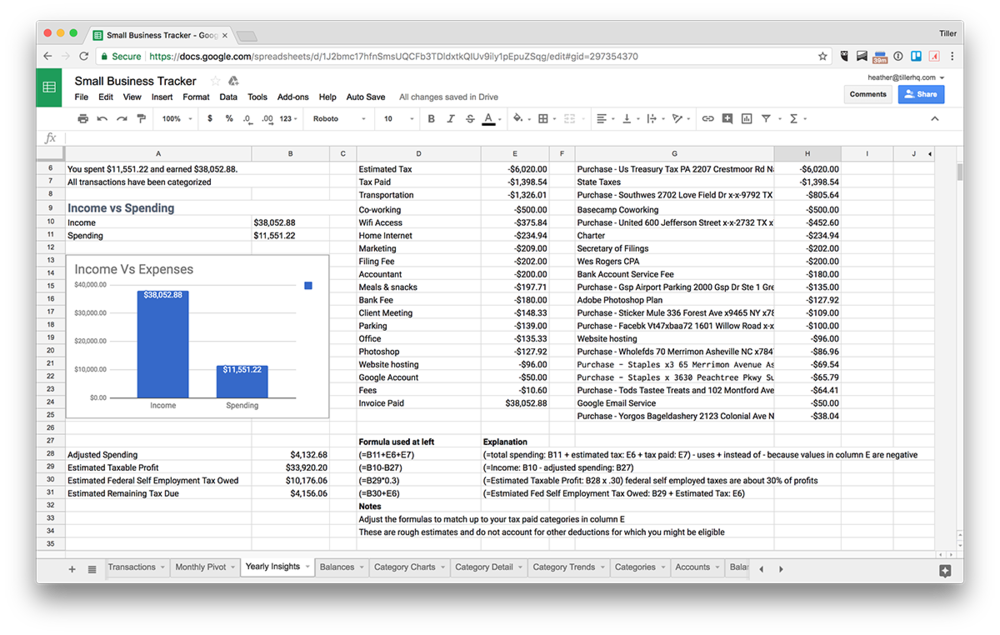

- How Much Should You Budget For Taxes As A Freelancer

- Self Employment Taxes And Seca 2020 Guide Fundera

- Turbotax Tax Reform For Self Employed The Turbotax Blog

- What Is The Self Employment Tax In 2020 Thestreet

- Self Employed People Taxes Stock Vector Royalty Free 1285669126

If you are looking for Hp 246 Government Laptop Specification you've arrived at the perfect place. We ve got 104 images about hp 246 government laptop specification including images, pictures, photos, backgrounds, and much more. In these page, we also have number of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

The medicare tax rate is 29.

Hp 246 government laptop specification. If youre over this limit you will pay 3 a week or 156 a year for the 201920 tax year and 305 a week or 15860 a year for the 202021 tax year. Self employment taxes are taxes paid by self employed business owners to the social security administration for social security and medicare based on earnings from a business you own not a corporation. Business use of your home including use by day care providers.

The self employment tax rate is 153. Self employment tax is a tax consisting of social security and medicare taxes primarily for individuals who work for themselves. Self employed individuals generally must pay self employment tax se tax as well as income tax.

It is similar to the social security and medicare taxes withheld from the pay of most wage earners. A document published by the internal revenue service irs that provides information on how taxpayers who use. That rate is the sum of a 124 for social security and 29 for medicare.

Hm revenue customs department for work and pensions department for business energy industrial strategy office of tax simplification. Self employment tax applies to net earnings what. It is similar to the social security and medicare taxes withheld from the pay of most wage earners.

Self employment tax is also called seca tax from the self employed contributions act. Yes most self employed people pay class 2 nics if your profits are at least 6475 during the 202021 tax year or 6365 in the 201920 tax year. You figure self employment tax se tax yourself using schedule se form 1040 or 1040 sr.

However the taxable self employment earnings of 27705 are still subject to medicare taxes working out to self employment tax of 803 and a 402 deduction against your income tax liability. A self employed person having net income of exactly 132900 in. Self assessment is a system hm revenue and customs hmrc uses to collect income taxtax is usually deducted automatically from wages pensions and savings.

What is self employment tax.

More From Hp 246 Government Laptop Specification

- Government Quotation

- Will The Furlough Scheme Be Extended Beyond June

- Government Intervention In The Market

- Government Plant Nursery Near Me

- Local Government Functions Pdf

Incoming Search Terms:

- 1 Local Government Functions Pdf,

- I M Self Employed Where Do I Enter My Income And Expenses H R Block Canada Local Government Functions Pdf,

- What Are The Self Employed Tax Deductions For 2020 Benzinga Local Government Functions Pdf,

- How To Be Self Employed With Pictures Wikihow Local Government Functions Pdf,

- Self Employment Tax Explained And What This Means For You If You Are Self Employed Atkins E Corp Local Government Functions Pdf,

- Taxes For The Self Employed And Independent Contractors Local Government Functions Pdf,