Self Employed Taxes 2020, Insiders Guide To Self Employed Income Proof For Home Loans

Self employed taxes 2020 Indeed lately is being sought by consumers around us, perhaps one of you. People are now accustomed to using the net in gadgets to see video and image data for inspiration, and according to the name of the post I will discuss about Self Employed Taxes 2020.

- Self Employed Tax Calculator

- Covid 19 Update Self Employed Income Scheme 09 04 2020 Business Wales

- Coronavirus Ntuc Website Taken Offline To Build I

- How To Avoid Self Employment Tax While Working Abroad

- Hammond Plans To Toughen Self Employed Tax Rules In Budget Buzzfeed

- Quickbooks Self Employed In 2020 Reviews Features Pricing Comparison Pat Research B2b Reviews Buying Guides Best Practices

Find, Read, And Discover Self Employed Taxes 2020, Such Us:

- 2020 Tax Year Deadlines For Freelancers And Self Employed Mark You Calendars Now Kontist

- Pdf Where Lies The Compliance A Value Chain Analysis Of Tax Morale And Compliance Among Self Employed Taxpayers In A Developing Economy

- Paycheck Protection Program Self Employment Income Fraser Stryker Pc Llo

- Putin Extends Law On Self Employment Taxes In 19 New Regions Russia Business Today

- Mega Backdoor Roth Conversions For Self Employed Business Owners 2020 Update Newfocus Financial Group

If you re looking for Guardian Furlough Extension you've come to the right location. We have 104 graphics about guardian furlough extension adding images, photos, pictures, wallpapers, and more. In these web page, we also provide number of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Income tax loss relief for self employed.

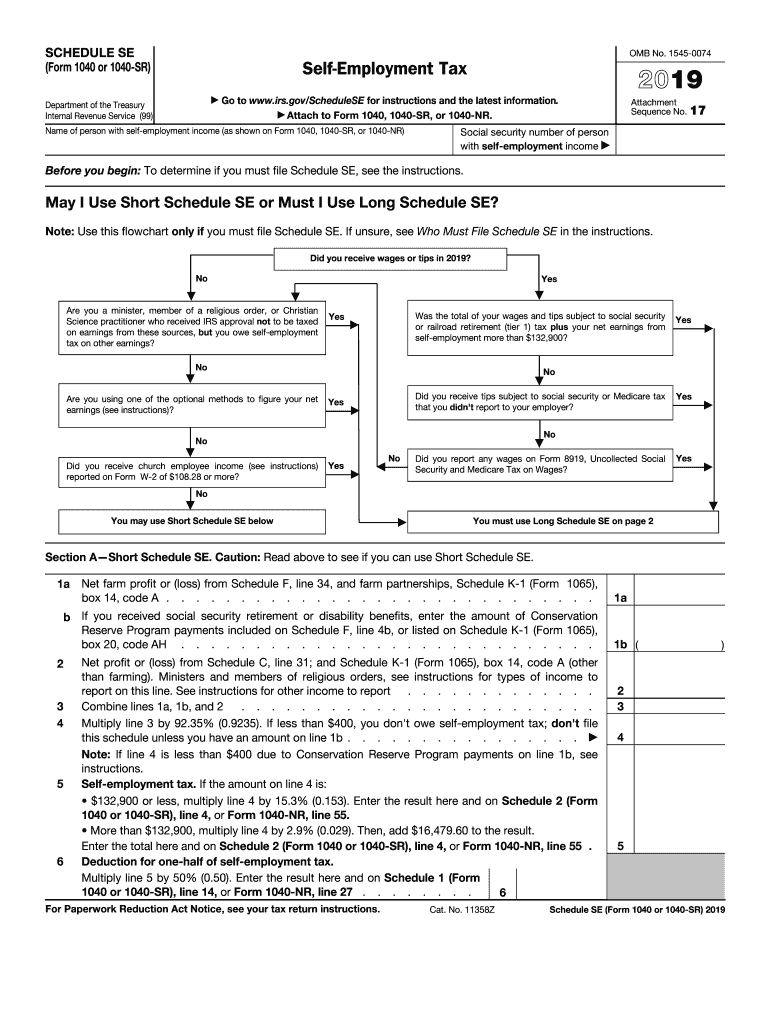

Guardian furlough extension. Use this calculator to estimate your self employment taxes. However if you are self employed operate a farm or are a church employee you may owe self employment taxes. As noted the self employment tax rate is 153 of net earnings.

March 2 2020 february 28 2020 by prashant thakur. 2020 self employment tax calculator. On 23 july 2020 the government announced the introduction of a new once off income tax relief measure.

The number of people who now file a self assessed tax return has shot up by 112000 in the last five years. The way the reimbursement works is that you multiply your total annual business mileage by the standard rate. Say you owe 15000 in self employment taxes from last years earnings.

Self employed national insurance threshold rise. Both employed workers and self employed workers who pay class 4 contributions will be able to earn up to 9500 in 2020 21 up from 8632 in 2019 20 before they have to pay. The self employed tax calculator is a quick tool based on internal revenue code 1401 to help a freelancer or self employed taxpayer to compute two taxes the social security tax and medicare tax.

Your taxable profit is 100000. Self employed tax deductions are the superheroes of your business taxes. Your self employment tax deduction would be 7500 15000 seca tax liability x 50 deduction.

Lets do an example together so you can see how self employment taxes and income taxes work in real life. For 2020 the rate is 575 cents per mile. The self employment tax rate for 2019 and 2020.

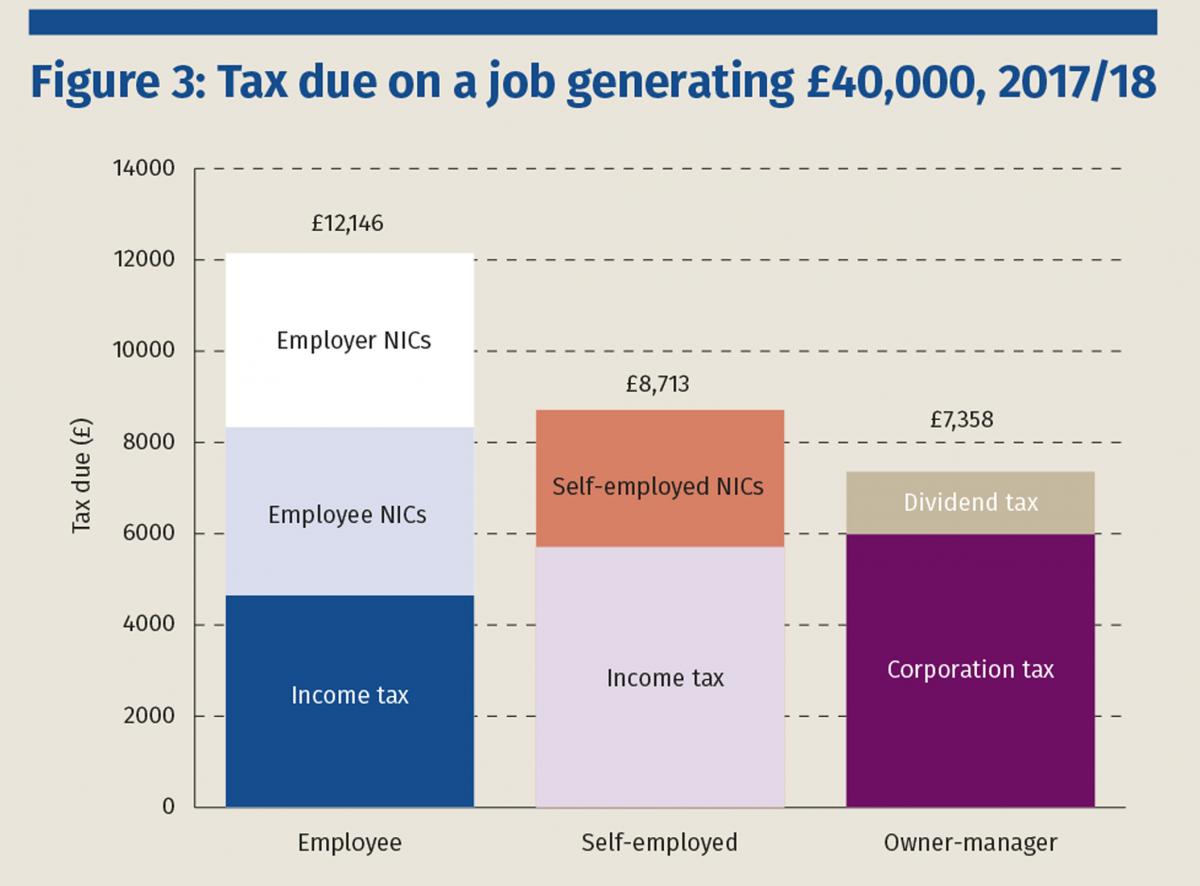

It is intended to benefit self employed people who were profitable in 2019 but as a result of the covid 19 pandemic will make a loss in 2020. Some 730000 were expected to file a tax return last year according to taxback. While typical employees pay half the social security and medicaid taxes split with their employer self employment taxes take out the full lot altogether or 124 for social security and 29.

2020 self employed tax calculator. Say your annual gross revenue is 130000 and you have 30000 in tax deductions. Normally these taxes are withheld by your employer.

That rate is the sum of a 124 social security tax and a 29 medicare tax on net. Please note that the self employment tax is 124 for the federal insurance contributions.

More From Guardian Furlough Extension

- Uk Furlough Scheme Budget

- Self Employed Relief Loan

- Government Meaning In Urdu

- Government Loans For Small Business In Tamilnadu

- Self Employed Resume Template

Incoming Search Terms:

- Self Employment Tax On Foreign Income When Working Abroad Online Taxman Self Employed Resume Template,

- 3 Self Employed Resume Template,

- Self Employed Income Protection Money Savings Advice Self Employed Resume Template,

- Uk Tax Rates For Employers Small Businesses And The Self Employed In 2020 21 The Accountancy Partnership Self Employed Resume Template,

- Uk 2020 Self Assessment Tax Return If You Re Self Employed Youtube Self Employed Resume Template,

- Self Employed Income Support Scheme Now Open For Applications Self Employed Resume Template,