Government Expenditure Multiplier In An Open Economy, Hubbard Macro6e Ppt Ch16

Government expenditure multiplier in an open economy Indeed lately is being sought by users around us, maybe one of you. Individuals now are accustomed to using the net in gadgets to see image and video data for inspiration, and according to the name of the post I will talk about about Government Expenditure Multiplier In An Open Economy.

- Keynesian Economy And Multiplier Macroeconomics Study Deeper In 2020 Economics Notes Macroeconomics Economy

- The Economy Unit 14 Unemployment And Fiscal Policy

- Explaining The Multiplier Effect Economics Tutor2u

- Calculating The Spending Multiplier Macroeconomics Youtube

- Keynesian Cross And The Multiplier Video Khan Academy

- Keynesian Multiplier Ubc Wiki

Find, Read, And Discover Government Expenditure Multiplier In An Open Economy, Such Us:

- Https Www Jstor Org Stable 23271745

- The Economy Unit 14 Unemployment And Fiscal Policy

- Intermediate Macro How To Derive Government Spending And Tax Multipliers Youtube

- The Spending Multiplier In The Income Expenditure Model Macroeconomics

- Https Nanopdf Com Download Ch 28 Solutions Pdf

If you re searching for Furlough Extension Uk Aviation you've arrived at the ideal location. We have 104 images about furlough extension uk aviation including images, photos, pictures, backgrounds, and more. In these webpage, we also have variety of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

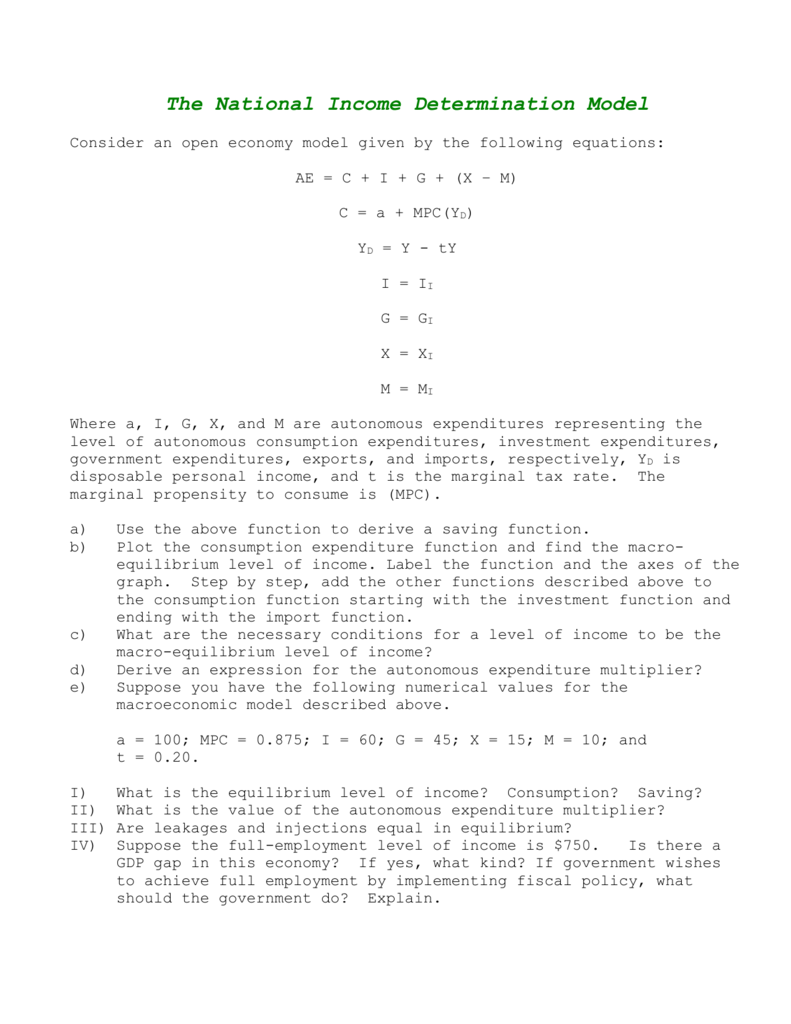

Where mpc is marginal propensity for saving and mpm is marginal propensity for import.

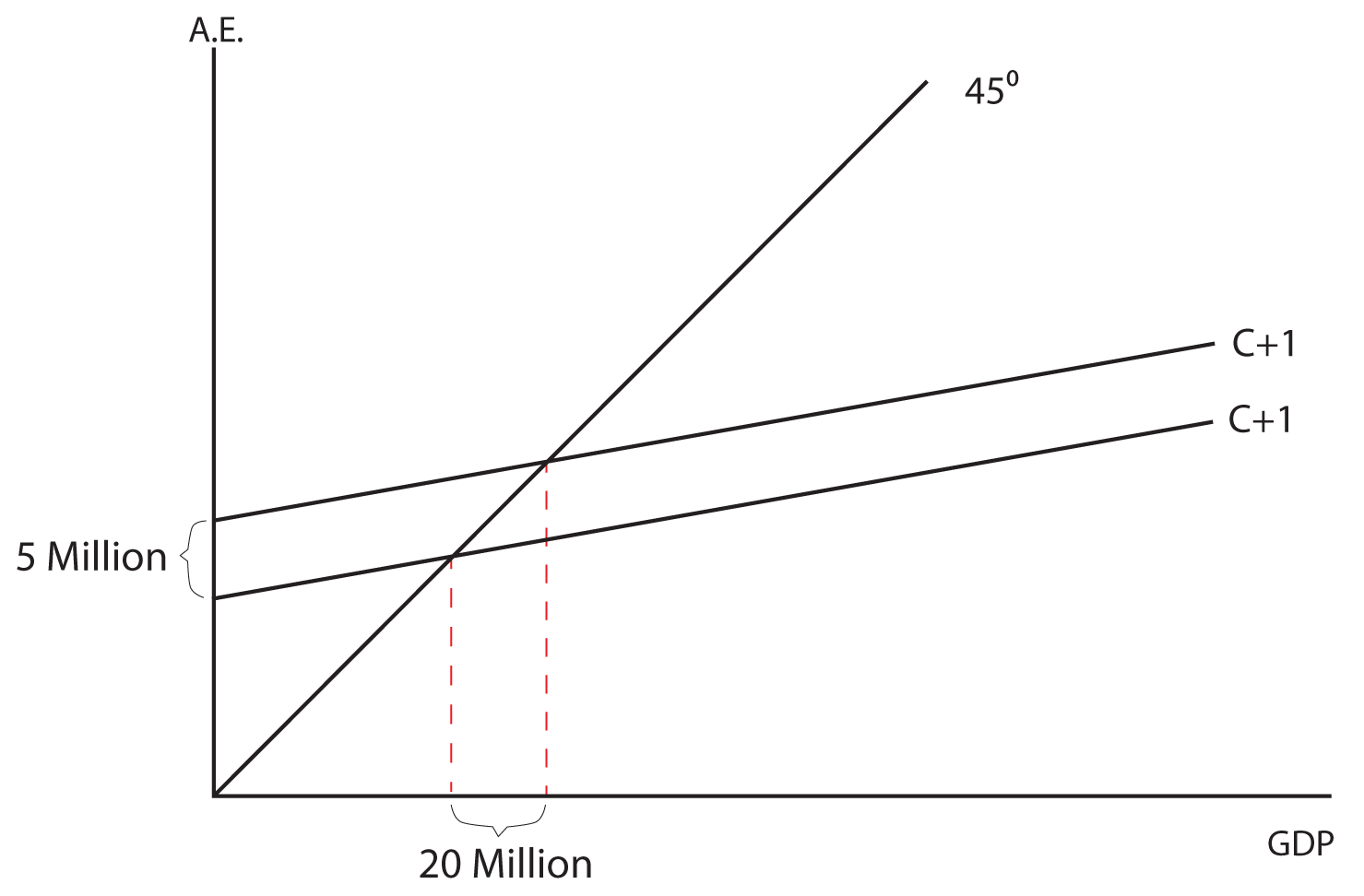

Furlough extension uk aviation. Ae c i g x m imports are now related to disposable income by the import function. A full open economy has all sectors and therefore three withdrawals savings taxation and imports. This is due to the multiplier effect which depends upon the value of mpc or mps where mpc or mps 1.

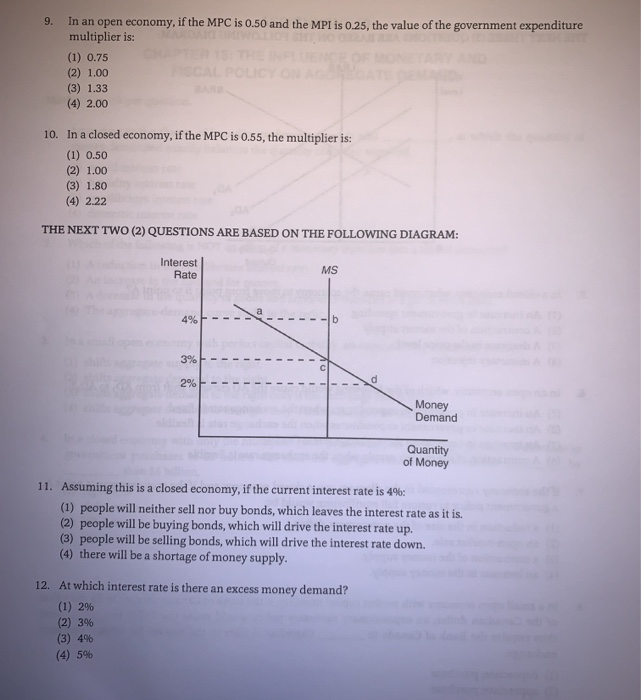

It should be noted that by adding government expenditure to consumption and investment expenditure c i the national income increases by yy 1 which is more than the government expenditure yg in panel a of the figure. The multiplier effect in an open economy. But the multiplier in an open economy 1 1 mpcmim where mimmarginal to import.

The multiplier in a closed economy11 mpc. 1 1mpc gm the government spending multiplier and the tax multiplier the following formula gives the impact on rgdp of a change in g. Multiplier formula denotes an effect which initiates because of increase in the investments from the government or corporate levels causing the proportional increase in the overall income of the economy and it is also observed that this phenomenon works in the opposite direction too the decrease in income effects a decrease in the overall spending.

If g is the component of a that changes then the government spending multiplier gm is given by the multiplier we derived above 20. As well as calculating the multiplier in terms of how extra income gets spent we can also measure the multiplier in terms of how much of the extra income goes in savings and other withdrawals. The keynesian investment multiplier is in fact expenditure multiplier which measures the rate of change in income due to a change in autonomous consumption expenditure and autonomous investment expenditure k 11 c similarly government expenditure multiplier kg is a change in income due to a change in autonomous government expenditure.

So suppose there is an open economy were only the goods market exists. Investment and government spending added up together6. C06y t t025y imports02y exchange rate1.

More From Furlough Extension Uk Aviation

- Highest Paying Government Jobs In India

- Government Exams 2020 Full List

- Government Regulation

- Government Departments In The Philippines

- Self Employed Jobs From Home In Mumbai

Incoming Search Terms:

- The Multiplier Effect Economics Help Self Employed Jobs From Home In Mumbai,

- Macroeconomic Policies Self Employed Jobs From Home In Mumbai,

- Determination Of National Income Of A Country Self Employed Jobs From Home In Mumbai,

- Solved Consider A Hypothetical Closed Economy In Which Ho Chegg Com Self Employed Jobs From Home In Mumbai,

- Problem Set 2 Macroeconomics Ub Studocu Self Employed Jobs From Home In Mumbai,

- Solved Stranglethorn Has An Open Economy With Government Chegg Com Self Employed Jobs From Home In Mumbai,