2020 Self Employed Sss Contribution Table 2020 For Employees, Philhealth Contribution Table 2020 A Guide To Contributions And Payment

2020 self employed sss contribution table 2020 for employees Indeed lately has been hunted by consumers around us, maybe one of you. People now are accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the name of the post I will talk about about 2020 Self Employed Sss Contribution Table 2020 For Employees.

- Sss Contribution Table Payment Schedule 2020 Bir Tax Information Business Solutions And Professional System

- Sss Contribution Table 2017 Sss Answers

- Contributions Social Security Board Belize

- Sss Contributions Table And Payment Deadline 2020 Sss Inquiries

- Updated Sss Contribution Table 2020

- Sss Contributions Schedule 2019 Sss Inquiries

Find, Read, And Discover 2020 Self Employed Sss Contribution Table 2020 For Employees, Such Us:

- Comprehensive Guide To Pag Ibig Contribution Online Verification And Loans In 2020

- Sss Contributions Table And Payment Deadline 2020 Sss Inquiries

- Complete Guide To Philhealth Contribution 2018

- Updated Sss Contribution Table For 2019 Howtoquick Net

- Philhealth Contribution Table And Payment Schedule For 2020 Tech Pilipinas

If you are looking for When Will The Furlough Scheme Start you've arrived at the right location. We ve got 104 images about when will the furlough scheme start including images, photos, photographs, backgrounds, and much more. In such page, we additionally have variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

The pag ibig fund uses php 5000 as the maximum income for computing a self employed members contribution.

When will the furlough scheme start. Php 5000 x 002 php 100. Table of sss contributions for ofws voluntary self employed and employed members. Summary of expanded withholding tax creditable sss contribution table payment schedule 2020.

If you want to download the sss contributions table 2020 then you may double click this image and save on your phone for your handy reference here is the new sss contributions table for employed self employed voluntary and non working spouse sss members for ofw members. In this way theyll be able to understand if theyre under over or just right in paying. Sss contribution table 2020.

Php 1500 x 001 php 15. The sss contribution table for 2020 is located below specifically created for those who are self employed voluntary or are overseas filipino workers. Surrender all unusedunissued principal and supplementary receiptsinvoices.

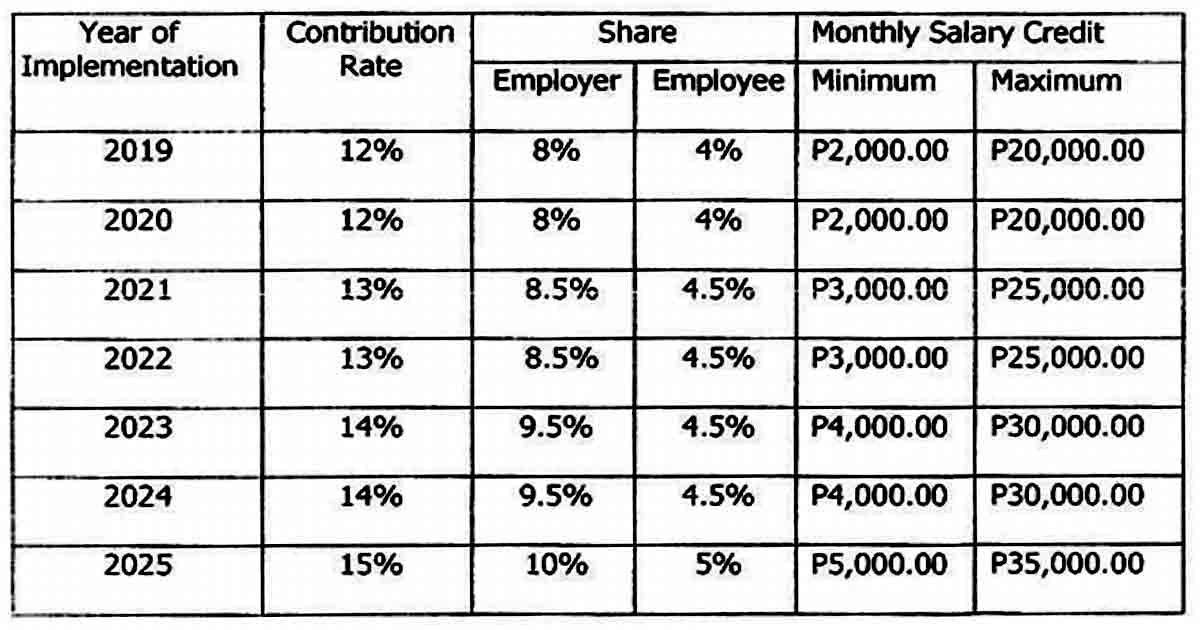

Sss contribution table for self employed voluntary and ofw members. The employer pays 8 while the employee pays 4. R3 file generator sss monthly contribution report program less than 10 employee.

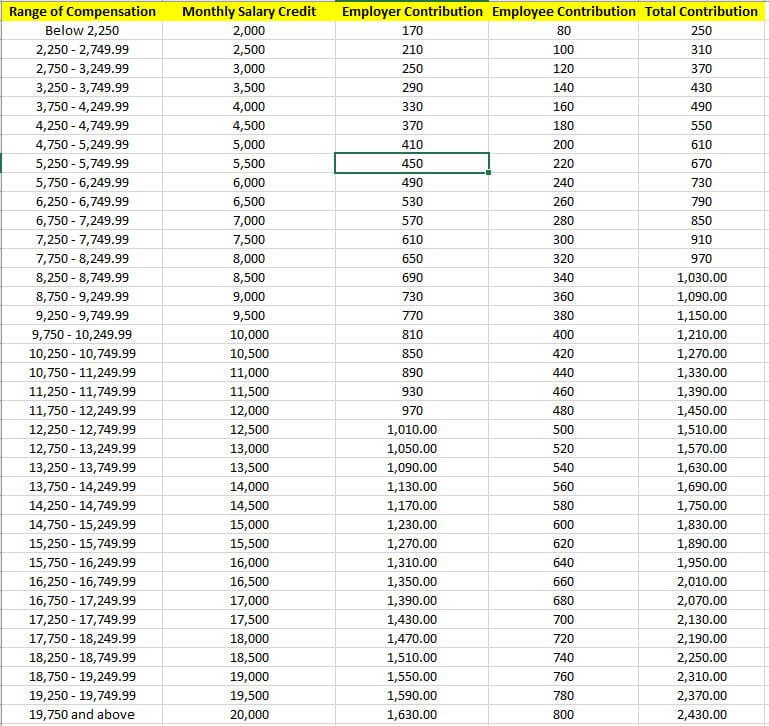

The sss contribution table above and the succeeding ones can be used only from april 2019 to the end of 2020 as the contribution rate will increase again in 2021 onwards. Sss contribution table for employed members in 2020. There are basically two types of sss members employees and self employed voluntary member or overseas filipino worker sevmofw.

For employed members the minimum monthly salary credit is php 2000 with a total contribution of php 250 while the maximum monthly salary credit is php 20000 with a total contribution of php 2430. Effective april 2019 below is the new sss contribution table for employed self employed voluntary members and non working spouses. Sss contributions january 2014 to march 2019.

Employed members are required to pay 12 of their monthly salary credit msc not exceeding p20000. The updated sss contribution table starting april 2020 for employees and employers voluntary self employed ofw and kasambahay or household workers to have at least a rough idea on how much contributions are. If youre an ofw the minimum monthly salary credit is p5000.

Difference between rr rmo rmr rmc rb ruling. For sss members who are self employed or overseas filipino workers kindly check this contribution table for reference. Sample computation for a self employed member with php 1500 monthly income.

Sample computation for self employed members with at least php 5000 monthly income.

More From When Will The Furlough Scheme Start

- Will Furlough Scheme Be Extended Past October

- Government Shutdown 2019 Reason

- Types Of Government Vocabulary

- Self Employed Insurance

- Government Grants For Homeownership

Incoming Search Terms:

- New Sss Contribution Table 2020 Sss Answers Government Grants For Homeownership,

- Register New Employees With Sss Philhealth And Pag Ibig Fund Government Grants For Homeownership,

- New Sss Contribution Table 2019 Sss Contribution Party Printables Free Government Grants For Homeownership,

- Sss Online Registration And Steps To Check Sss Your Contribution Online Government Grants For Homeownership,

- New Sss Contribution Table Effective April 1 2019 Serve Pinoy Government Grants For Homeownership,

- The New And Updated Sss Contribution Table To Be Effective In April 2019 Government Grants For Homeownership,