Self Employed Deductions Irs, Your 2020 Guide To Tax Deductions The Motley Fool

Self employed deductions irs Indeed recently is being hunted by consumers around us, maybe one of you. Individuals now are accustomed to using the net in gadgets to view video and image data for inspiration, and according to the name of this post I will discuss about Self Employed Deductions Irs.

- Don T Let Tax Season Stress You Out With Help From The Tax Experts At Timber Tax We Compiled A List Of Tax Resource Getting Things Done Tax Refund Tax Season

- Schedule Se 1040 Year End Self Employment Tax

- Are You Eligible For The Irs Home Office Deduction Fox Business

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctnksu1wkyndbghyghnd3ezseffntdo Ww Ab1ioiivm50lp7kj Usqp Cau

- Helpful Guideline Of Self Employed Tax Deduction

- Amazon Com 475 Tax Deductions For Businesses And Self Employed Individuals An A To Z Guide To Hundreds Of Tax Write Offs 9781589796621 Kamoroff C P A Bernard B Books

Find, Read, And Discover Self Employed Deductions Irs, Such Us:

- Insurance Self Employed Deduction

- Publication 587 2018 Business Use Of Your Home Internal Revenue Service

- Home Office Deduction The Irs Self Employed Home Office Deduction

- Https Www Irs Gov Pub Irs Wd 0524001 Pdf

- How Much Did Your Parents Pay To Their Ira Or Keogh Federal Student Aid

If you are searching for Government Pronunciation American you've come to the right place. We have 104 graphics about government pronunciation american adding images, photos, photographs, wallpapers, and much more. In these web page, we additionally have number of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

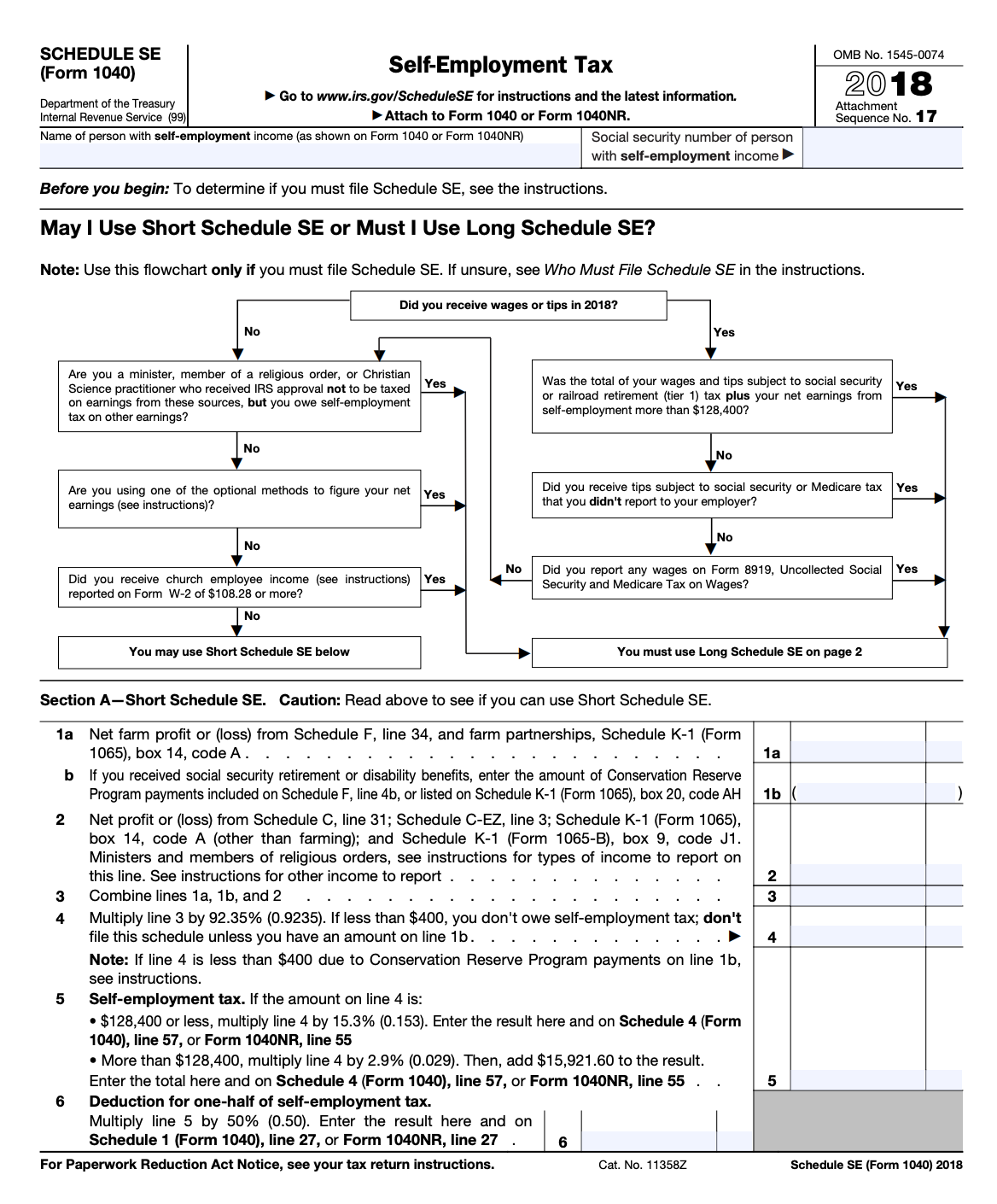

Self employed individuals generally must pay self employment tax se tax as well as income tax.

Government pronunciation american. Its one of few above the line tax deductions reducing your adjusted gross income agi. A document published by the internal revenue service irs that provides information on how taxpayers who use. Se tax is a social security and medicare tax primarily for individuals who work for themselves.

Theyre found on a wide variety of different tax forms and apply in different situations. Personal versus business expenses. Self employed individuals calculating your own retirement plan contribution and deduction accessed.

You can elect to deduct or amortize certain business start up costs. They swoop in lower your tax bill and save your wallet from some serious destruction. In general anytime the wording self employment tax.

Effect on itemized deductions. The rules in the publication apply to individuals. Effect on self employment tax.

Qualified long term care insurance contract. Deducting health insurance premiums if youre self employed accessed dec. If youre self employed its important to take the time to fully understand self employment tax deductions so you dont miss deductions that could significantly lower your tax bill.

Tax deductions for the self employed are not necessarily self evident. Its also important to develop a system to file and track your receipts and expenses so that you are organized when it comes to tax time. Self employed health insurance deduction.

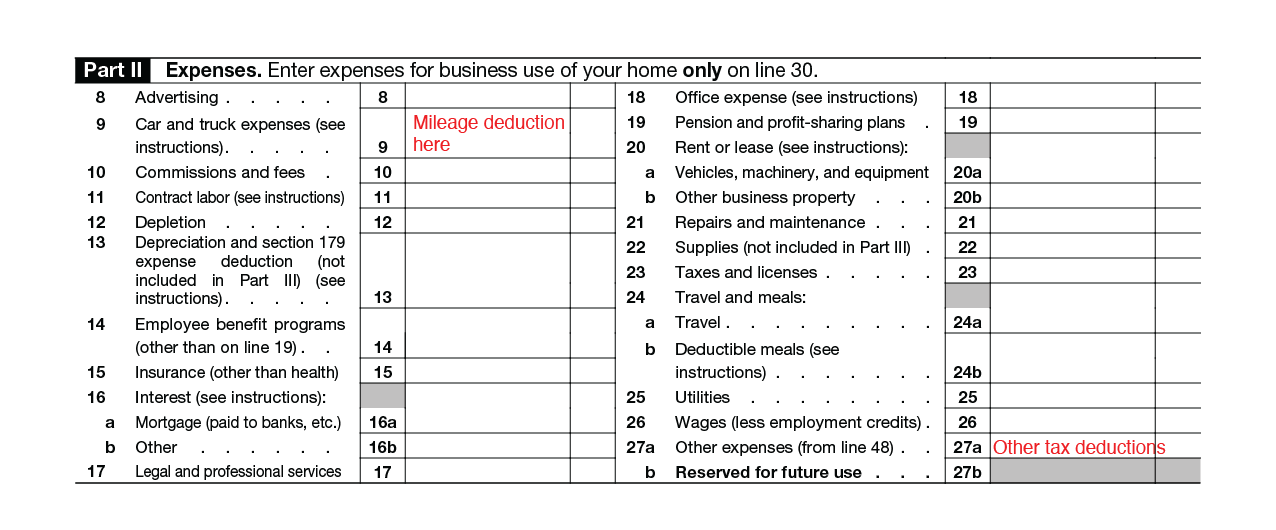

Where to deduct your expenses including form 8829 expenses for business use of your home required if you are self employed and claiming this deduction using the regular method. Records you should keep. Tax implications of selling a home that was used partly for business.

Generally you cannot deduct personal living or family expenses. It is similar to the social security and medicare taxes withheld from the pay of most wage earners. Business use of your home including use by day care providers.

Your self employment tax deduction would be 7500 15000 seca tax liability x 50 deduction. Self employed health insurance deduction worksheet. While schedule c is an important tax form for the independent contractor you should be aware of self employment deductions that you can take in other parts of your income tax return.

But before you can reap the benefits of tax write offs you need to know what expenses are tax deductible if you work from home. Self employed tax deductions are the superheroes of your business taxes. Small business health care tax credit and the shop marketplace accessed dec.

Refer to chapters 7 and 8 of publication 535 business expenses.

More From Government Pronunciation American

- Government Issues In The Philippines Today

- Can Self Employed Be Furloughed Till October

- Government Owned Companies In The Philippines

- Government Newspapers In Sri Lanka

- Furlough Leave Uk Extension

Incoming Search Terms:

- Https Www Irs Gov Pub Irs Prior I1040sc 2016 Pdf Furlough Leave Uk Extension,

- How To File Taxes As An Independent Contractor A Guide Benzinga Furlough Leave Uk Extension,

- Personal Finance Another Perspective Ppt Download Furlough Leave Uk Extension,

- 4 Deductions Every Small Business Owner Should Know Tax Tips For The Self Employed For Many Bei Business Tax Business Tax Deductions Small Business Tax Furlough Leave Uk Extension,

- 15 Big Self Employment Tax Deductions In 2020 Nerdwallet Furlough Leave Uk Extension,

- 1040 2019 Internal Revenue Service Furlough Leave Uk Extension,