Self Employed Ppp Loan Forgiveness Guidance, Ppp Loan Forgiveness Application Updated 6 16 2020 C Brian Streig Cpa

Self employed ppp loan forgiveness guidance Indeed lately has been hunted by users around us, maybe one of you. People now are accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the name of the article I will discuss about Self Employed Ppp Loan Forgiveness Guidance.

- Self Employment 1099s And The Paycheck Protection Program Bench Accounting

- Self Employed Guide To The Ppp Forgiveness Application Form 3508ez Bench Accounting

- Ppp Loan Forgiveness Guidance Released Windes

- Guidance For Self Employed Individuals Filing For Paycheck Protection Program Loans Whitinger Company

- Ppp Borrowers Get Concessions Additional Guidance On Forgiveness Brown Edwards

- Self Employed Here S What You Need To Know About Ppp Eidl Loans

Find, Read, And Discover Self Employed Ppp Loan Forgiveness Guidance, Such Us:

- Determining The Forgiveness Amount Of Your Paycheck Protection Program Ppp Loan Lexology

- Nav Releases Free Tool To Help Self Employed Business Owners Estimate Ppp Loan Forgiveness

- Sba And Treasury Issue New Guidance On Ppp Loan Forgiveness In The Form Of Faqs

- Nav Business Owners Estimate Ppp Loan Forgiveness

- Guidance For Self Employed Individuals Filing For Paycheck Protection Program Loans Whitinger Company

If you are looking for Self Employed Resume For Business Owner you've reached the right location. We have 102 graphics about self employed resume for business owner adding images, photos, pictures, backgrounds, and much more. In these page, we additionally have number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsmiv6m3wgwyg5nkw9jpfrzu54acku6udbwvh9dvtahglix3yl4 Usqp Cau Self Employed Resume For Business Owner

Updated Guidance Ppp Loan Forgiveness And Review Process R A Cpas Self Employed Resume For Business Owner

This is everything we know based on information directly from the sba and the 19th interim final rule ifr filed on june 19th 2020.

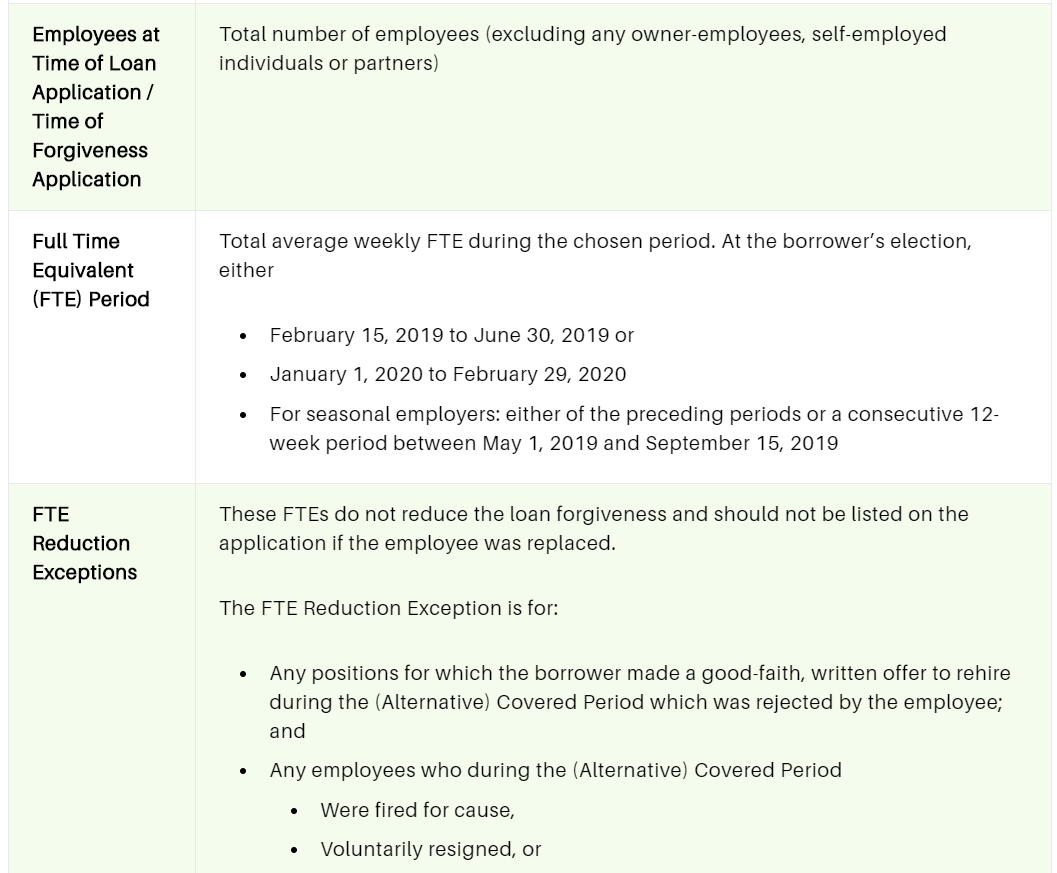

Self employed resume for business owner. As self employed individuals who received a paycheck protection program ppp loan look forward to maximizing their loan forgiveness. Ppp loan forgiveness requirements for solos. Even if you are currently working at home now you are not eligible to claim home mortgage interest payments for forgiveness.

Given the fluid nature of the ppp program and the ambiguity that still exists around the process for applying for ppp loan forgiveness it is essential that self employed individuals who have participated in the program continue to monitor additional changes and keep track of ppp related expenses in order to maximize loan forgiveness and avoid unwelcome and unexpected repayment obligations next tax season. Repayment dates have been clarified. We created a comprehensive comprehensible guide all about ppp loan forgiveness for the self employed sole proprietors and independent contractors.

For sole proprietors or independent contractors with no employees the maximum possible ppp loan is therefore 20833 and the entire amount is automatically eligible for forgiveness as owner compensation replacement. The unpublished version of the update ensures full forgiveness for self employed freelancers and independent contractors who took the maximum loan amount based on 25 times their 2019 monthly. If you are self employed but received a ppp loan through multiple businesses you are capped at 20833 in owner compensation across all the businesses youve received a ppp loan through.

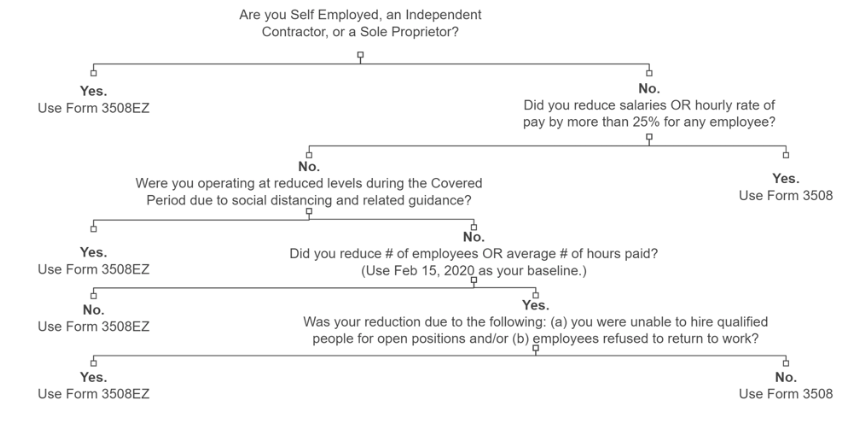

We now have more clarity on the paycheck protection program ppp loan forgiveness for the self employed with no employees. The new law paycheck protection program flexibility act of 2020 creates a 24 week period for spending your ppp loan proceeds. A new simple streamlined application is available for certain loan recipients.

Forgiveness eligibility requirements have expanded for certain loan recipients. Ppp loan forgiveness application guidance for the self employed freelancers and contractors brian thompson senior contributor opinions expressed by forbes contributors are their own. The ppp limits compensation to an annualized salary of 100000.

Government clarifies ppp loan forgiveness for the self employed. Ppp self employed loan forgiveness as of 6102020 items noted with an will be updated once further guidance is provided related to hr. Below are some facts that are 100 sole proprietor specific and some that.

The sba has recently released new guidance on ppp loan forgiveness. If you have not yet read our previous post on the general information regarding the paycheck protection program loans click here.

Sba Issues New Ppp Loan Forgiveness Applications And Guidance Self Employed Resume For Business Owner

More From Self Employed Resume For Business Owner

- Government Exams After Graduation 2021

- Lenovo B490 Government Laptop Price

- Self Employed Second Grant Martin Lewis

- What Is Changing With Furlough

- Government Nursing Jobs Washington Dc

Incoming Search Terms:

- Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments Government Nursing Jobs Washington Dc,

- Ppp Borrowers Get Concessions Additional Guidance On Forgiveness Brown Edwards Government Nursing Jobs Washington Dc,

- Paycheck Protection Program Ppp Loan Forgiveness Guidance For Smbs Government Nursing Jobs Washington Dc,

- Ppp Loan Forgiveness Application Guidance For The Self Employed Freelancers And Contractors Government Nursing Jobs Washington Dc,

- Ppp Loan Forgiveness Steps To Getting Your Ppp Loan Forgiven Government Nursing Jobs Washington Dc,

- Government Clarifies Ppp Loan Forgiveness For Self Employed Barron Co Government Nursing Jobs Washington Dc,