What Is Furlough Adjustment On Payslip, Support In Payroll For Furloughed Workers Freeagent

What is furlough adjustment on payslip Indeed lately has been sought by users around us, maybe one of you. People now are accustomed to using the net in gadgets to view image and video data for inspiration, and according to the name of the article I will talk about about What Is Furlough Adjustment On Payslip.

- Furloughed Workers Moneysoft

- Covid 19 And Furloughed Employee Payroll Processing Changes Kashflow

- Support In Payroll For Furloughed Workers Freeagent

- Statutory Sick Pay Ssp Incl Coronavirus Update Moneysoft

- Calcpayhelp

- Confluence Mobile Infinet Cloud Knowledge Base

Find, Read, And Discover What Is Furlough Adjustment On Payslip, Such Us:

- How To Check If Your Employer Has Calculated Your Furlough Pay Correctly And 7 Things To Check Your Wage Slip For

- Http Media 12pay Co Uk Docs Furloughpayments Pdf

- Furloughed Workers Moneysoft

- What Furloughed Workers Need To Look Out For On Their Next Payslip Daily Record

- 1

If you re searching for Government Unemployment Insurance Tends To Quizlet you've arrived at the right place. We ve got 104 images about government unemployment insurance tends to quizlet adding images, photos, pictures, wallpapers, and more. In such page, we additionally provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

The type of furlough arrangement employers implement may affect raw payroll data in different ways.

Government unemployment insurance tends to quizlet. In other words the employee takes unpaid time off usually for a short. Is it clear anywhere whether furloughed pay is based on the february payslip or whether it is an average pay amount. Employers are no longer asking whether they can check the temperatures of their employees but instead are hyper focused on continuing critical business operations.

If it is the february pay slip what is to stop all the directors of limited companies with the notional salary and dividend model posting adjustments to their paye for february and march to the 2500 maximum the government will pay and then claiming this. If you chose to top up a furloughed employees wages ie. This is what you enter in your payroll as gross pay.

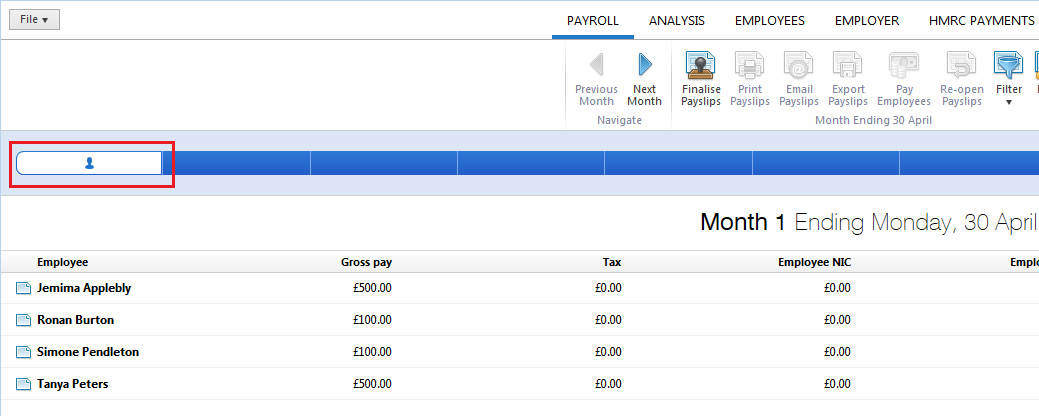

Generally the basis of premium for workers compensation insurance is payrollinitially on an estimated payroll at the beginning of an exposure period which is then trued up at the end of the period when actual payroll is known. So for someone on a 12000 salary ie. Viewing and editing furlough top up amounts in future changes you can also edit the furlough top up amount in the current period each time you run payroll.

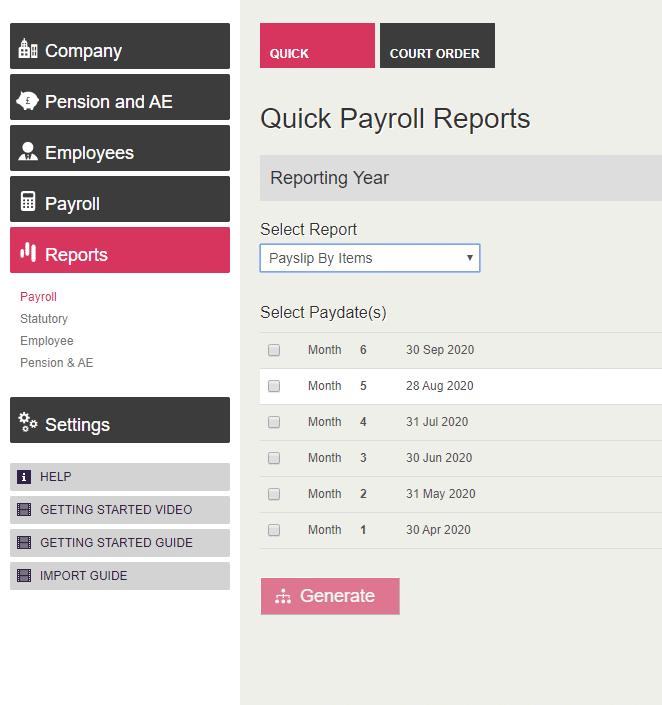

For claims dated up to 30th june 2020 you need to adjust the gross pay of any furloughed employees to reflect this in freeagents payroll. To pay the other 20 of their salary yourself for claims dated up to 30th june you wont need to adjust the employees gross pay. To edit the furlough top up amount simply click on the adjustment itself and this will open the form where the details can be changed for the current period only.

What to look out for in your payslip at the end of the month a week ago hmrc opened the portal for the furlough scheme allowing businesses to apply for funding to cover their wages. Tax ni and pension contributions will be calculated as normal. The payslip will also show the usual deductions for tax national insurance pension and any other deductions you have agreed that your employer can make for example to pay back a loan.

Employees can now be placed on furlough if they were on paye payroll on or before 19 march 2020 providing their employer had notified hmrc of them via an rti submission by this date. What is a furlough and how are furloughs and layoffs different.

More From Government Unemployment Insurance Tends To Quizlet

- Government Regulation Economics

- Furlough Scheme Extended To March

- Government Regulation In Lieu Of Law Perppu No 12020

- Government Yojna For New Born Baby

- Government Budget 2020 India

Incoming Search Terms:

- Emailing Payslips Brightpay Documentation Government Budget 2020 India,

- Seven Things Employers Need To Know About Flexible Furlough Personnel Today Government Budget 2020 India,

- How To Check If Your Tax Code Is Correct And Why Furloughed Workers Need To Be Vigilant This Is Money Government Budget 2020 India,

- Facing Furlough Here S What It Could Mean For You Aat Comment Government Budget 2020 India,

- 1 Government Budget 2020 India,

- Understanding Your Payslip Government Budget 2020 India,