Self Employed Taxes Calculator, Sa302 Tax Calculation Request Form Tax Self Assessment This Or That Questions

Self employed taxes calculator Indeed lately is being hunted by consumers around us, maybe one of you personally. Individuals now are accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the title of the post I will discuss about Self Employed Taxes Calculator.

- Sa302 Tax Calculation Request Form Tax Self Assessment This Or That Questions

- Kra Paye Tax Calculator Kenya For Android Apk Download

- Income Tax Calculator Calculate Taxes Online Fy 2019 20

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctw7rwjhqvgpuzhoimbk04bp1 H 6gjv1nh Btkch8o6odh0gpz Usqp Cau

- Free Download Software Tax Software For Self Employed Income Tax Calculator 2012 13

- How To Get Your Sa302 Form Online Or By Phone Goselfemployed Co

Find, Read, And Discover Self Employed Taxes Calculator, Such Us:

- Freelance Target Income Calculator By Paul Millerd Reimagine Work Medium

- Tax Calculator Uk Tax Calculators

- Self Employment Tax Calculator For 2020 Money Sense Self Employment Self

- Tax Calculations And Tax Year Overviews For Self Employed Mortgages Amortgagenow

- How To Calculate Fica For 2020 Workest

If you are looking for Non Government Company Meaning In Hindi you've arrived at the ideal place. We have 104 images about non government company meaning in hindi adding pictures, photos, pictures, wallpapers, and much more. In these webpage, we also provide variety of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctngz1jcyz2cwjasjb T3teahnuzdaybmimhw Xqlixbmk1krrd Usqp Cau Non Government Company Meaning In Hindi

Thesis On Self Employment Tax Calculator 2015 California Cleanilstasdic Non Government Company Meaning In Hindi

If you are self employed your social security tax rate is 124 percent and your medicare tax is 29 percent on those same amounts of earnings but you are able to deduct the employer portion.

Non government company meaning in hindi. Use the below calculator to get an estimate of your se taxes. The self employment tax is calculated on 9235 of your total income. For a more robust calculation please use quickbooks self employed.

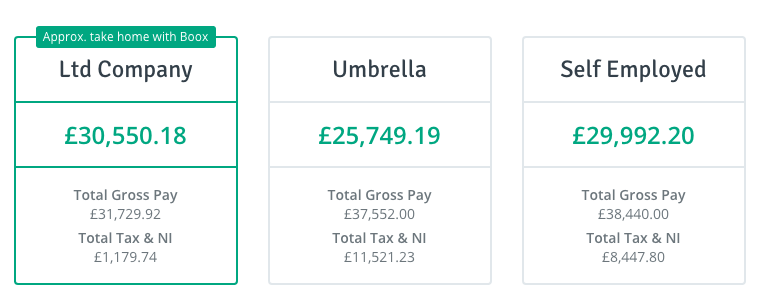

Dont feel so intimidated by your tax liability after using our free 1099 taxes calculator. Normally these taxes are withheld by your employer. With our employed and self employed tax calculator you can very quickly find out how much income tax and national insurance you should expect to pay as well as the impact this will have on your pension.

If you 1 are self employed as a sole proprietorship an independent contractor or freelancer and 2 earn 400 or more you may need to pay se tax. This will be used to determine if you owe the additional. Do i have to pay self employment tax.

To pay self employed taxes you are required to have a social security number and an individual taxpayer identification number. 2018 self employed tax calculator. You are required to pay self employed tax if you earned 400 and above.

If youre a church worker your church employee income should be at least 10828 before you are required to file self employed tax. The results also include the calculations from the form 1040 es estimated tax for individuals worksheet for the 2020 tax year for your reference. However if you are self employed operate a farm or are a church employee you may owe self employment taxes.

The self employment tax applies evenly to everyone regardless of your income bracket. This calculator provides an estimate of the self employment tax social security and medicare and does not include income tax on the profits that your business made and any other income. Use this calculator to estimate your self employment taxes.

This rate is derived from the fact that self employed taxpayers can deduct the employers portion of the tax which is 765. Select your filing status. If you receive a form 1099 you may owe self.

Self employed individuals are responsible for paying both portions of the social security 124 and medicare 29 taxes. Employed and self employed tax calculator. For the social security portion of self employment taxes the 150000 in regular job income counts against the 137700 limit leaving you with no self employment tax for the social security portion.

Please note that the self employment tax is 124 for the federal insurance contributions act fica portion and 29 for.

Http Www2 Eastriding Gov Uk Easysiteweb Gatewaylink Aspx Alid 175379 Non Government Company Meaning In Hindi

More From Non Government Company Meaning In Hindi

- Government College University Lahore Logo

- Government Job Funny Quotes

- Us Government Printing Office Style Manual Pdf

- Government Nursing Colleges Application Forms 2021 Pdf

- Self Employed Hmrc Contact Number

Incoming Search Terms:

- Self Employed Tax Calculator Self Employed Hmrc Contact Number,

- Are You Self Employed And Need An Income Tax Return Do It Yourself Online Even If You Are Not An Accountant Neotax Self Employed Hmrc Contact Number,

- Self Employed Face Big Tax Bills Which Fail To Reflect 2020 Reduced Profits Your Money Self Employed Hmrc Contact Number,

- Self Employed Calculate Your Quarterly Estimated Income Tax Xendoo Self Employed Hmrc Contact Number,

- Employed And Self Employed Tax Calculator Taxscouts Self Employed Hmrc Contact Number,

- Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting Self Employed Hmrc Contact Number,