Self Employed Furlough Scheme Universal Credit, Covid 19 Further Measures Announced To Help Businesses Freeagent

Self employed furlough scheme universal credit Indeed lately has been hunted by consumers around us, maybe one of you personally. People are now accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the title of the article I will discuss about Self Employed Furlough Scheme Universal Credit.

- 2

- New To Claiming Universal Credit Here Are Its Worst Flaws

- Universal Credit Uk 10 Big Changes To Benefit Claims In Covid 19 Pandemic Birmingham Live

- Universal Credit Uk Gov Rule Change Could Mean Self Employed Lose Hundreds Of Pounds From November Hertslive

- The Self Employment Income Support Scheme Explained

Find, Read, And Discover Self Employed Furlough Scheme Universal Credit, Such Us:

- Over One Million Self Employed Are Not Eligible For Government S Coronavirus Income Support Scheme

- The Self Employment Income Support Scheme Explained

- Coronavirus Self Employment Income Support Scheme What You Need To Know Sage Advice United Kingdom

- Self Employment Understanding Universal Credit

- Universal Credit Is One Of The Success Stories Of The Coronavirus Crisis

If you re looking for Hp 241 Government Laptop you've reached the perfect place. We ve got 100 graphics about hp 241 government laptop adding images, photos, photographs, backgrounds, and more. In these page, we also provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

950 000 Apply For Universal Credit In Two Weeks Of Uk Lockdown World News The Guardian Hp 241 Government Laptop

How To Claim Universal Credit If You Re Self Employed Or Have Lost Your Job Hp 241 Government Laptop

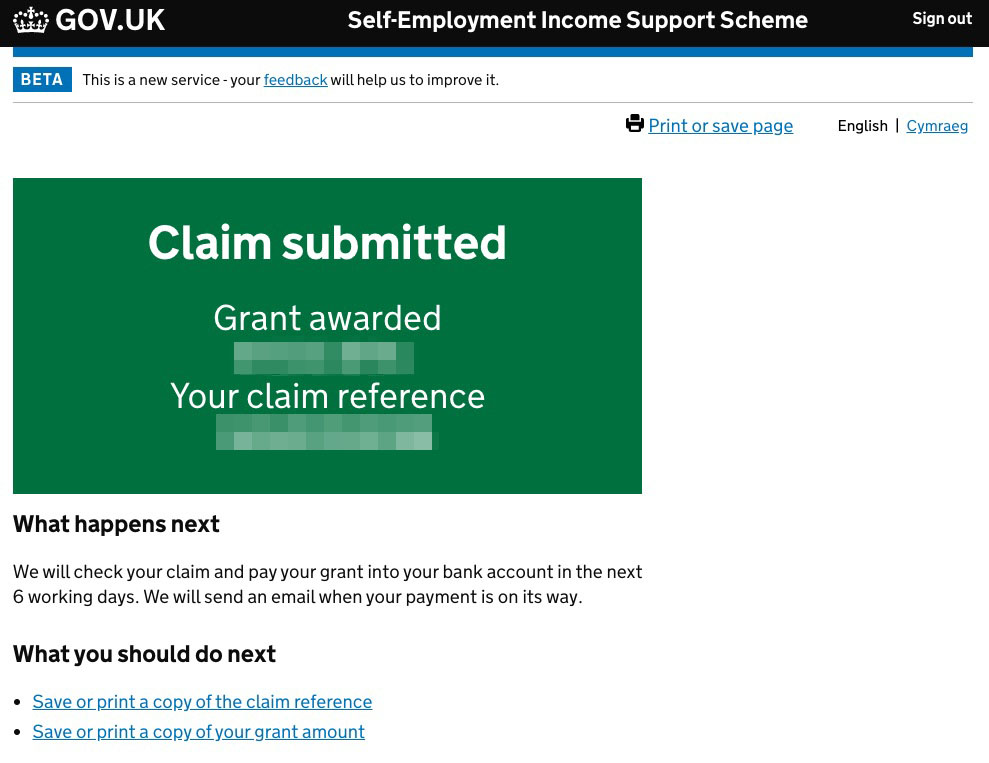

Self employment income support scheme seiss you can no longer make a claim for the first two seiss grants.

Hp 241 government laptop. Usual payday is mid of each month. However from 1 november the scheme will be extended. The scheme has helped millions keep afloat during the coronavirus.

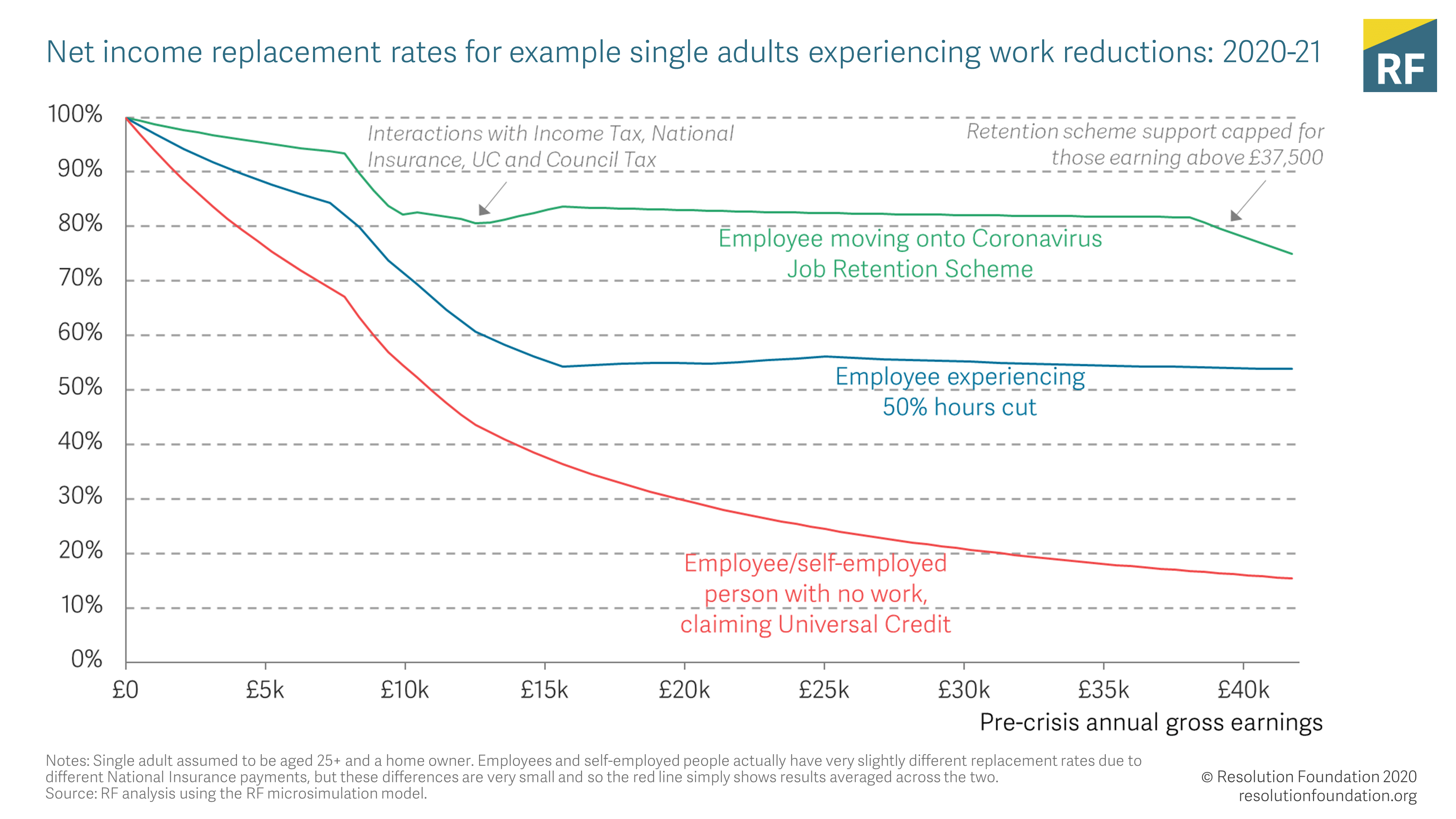

Ingram explains that claimants may continue to work but will receive a deduction from the amount of uc they receive depending on their profits. The suns welfare expert explains all you need to know about claiming universal credit and self employed grants credit. Weve explained how furlough affects your benefits and universal credit payments credit.

Alamy under the scheme businesses across the uk can claim 80 per cent of your wages up to 2500 a. Up to 512 per month may be earned 292 pm if in receipt of housing benefit with no deduction from uc. If you were employed and on the payroll on 28 february 2020 but were made redundant or stopped working for your employer after that date you can qualify for the scheme if your employer re employs you and puts you on furlough.

If you are self employed this limits the. Anyway im panicking that my uc application will affect my furlough payment now and wondering whether to cancel the claim. They say theyre waiting for hmrc to confirm the scheme.

More on the interaction between universal credit and the self employed grant scheme. If you get the grant. If your business has been affected by coronavirus covid 19 you may be able to get a grant through the self employment income support scheme.

For more about any aspect of universal credit see the understanding universal credit website including information about universal credit and self employment. There will be changes to the furlough scheme universal credit and new rules for anyone who has a credit card loan or overdraft. Apply for universal credit.

You applied for universal credit since 23 september 2020 and are in your 12 month grace period. Self employed avoid big cut to universal credit after return of the minimum income floor. From 23 september all self employed people making a new universal credit claim have been given a 12 month grace period before the minimum income floor kicks in even if theyve been self employed for more than a year.

At the same time.

More From Hp 241 Government Laptop

- Self Employed Or Limited Company Calculator

- Karnataka State Government Holidays 2020 Notification

- Government Budget Deficit Equation

- Government Shutdown Chart

- Chancellor Extends Furlough Scheme To End Of June

Incoming Search Terms:

- 2 Chancellor Extends Furlough Scheme To End Of June,

- Universal Credit Uk 10 Big Changes To Benefit Claims In Covid 19 Pandemic Birmingham Live Chancellor Extends Furlough Scheme To End Of June,

- Seiss Second Grant Now Open Dental Medical Financial Chancellor Extends Furlough Scheme To End Of June,

- Masses Of Artists Rejected By Uk Government S Self Employment Support Scheme The Art Newspaper Chancellor Extends Furlough Scheme To End Of June,

- Self Employed Invited To Get Ready To Make Their Claims For Coronavirus Covid 19 Support Gov Uk Chancellor Extends Furlough Scheme To End Of June,

- How To Claim Universal Credit If You Re Self Employed Or Have Lost Your Job Chancellor Extends Furlough Scheme To End Of June,