Self Employed Taxes Calculator Canada, Help Your Clients Plan For Tax Owing On Cerb Payments Investment Executive

Self employed taxes calculator canada Indeed lately has been sought by consumers around us, perhaps one of you. Individuals are now accustomed to using the net in gadgets to see video and image data for inspiration, and according to the name of this post I will discuss about Self Employed Taxes Calculator Canada.

- What Is Net Income H R Block Canada

- Publication 54 2019 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

- 2020 Tax Deadline Canada When Are Corporate And Personal Taxes Due Avalon Accounting

- Know Your Income Tax Using A Tax Calculator Business Module Hub

- Income Tax For Self Employed Persons Pdf Free Download

- Here S Everything You Need To Know About The Crb Including How It Will Affect Your Taxes Financial Post

Find, Read, And Discover Self Employed Taxes Calculator Canada, Such Us:

- 14 Tax Tips For The Self Employed Taxact Blog

- Https Catholicottawa Ca Documents Administration 121219 20notice 20to 20parishes 20for 20t4 20 20t4a 20fv Pdf

- Canadian Tax Brackets Marginal Tax Vs Average Tax Retire Happy

- Deducting Expenses As An Employee Pdf Free Download

- Publication 54 2019 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

If you are searching for Government News Articles 2020 you've reached the perfect place. We have 102 images about government news articles 2020 including images, photos, photographs, wallpapers, and more. In these webpage, we additionally have variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

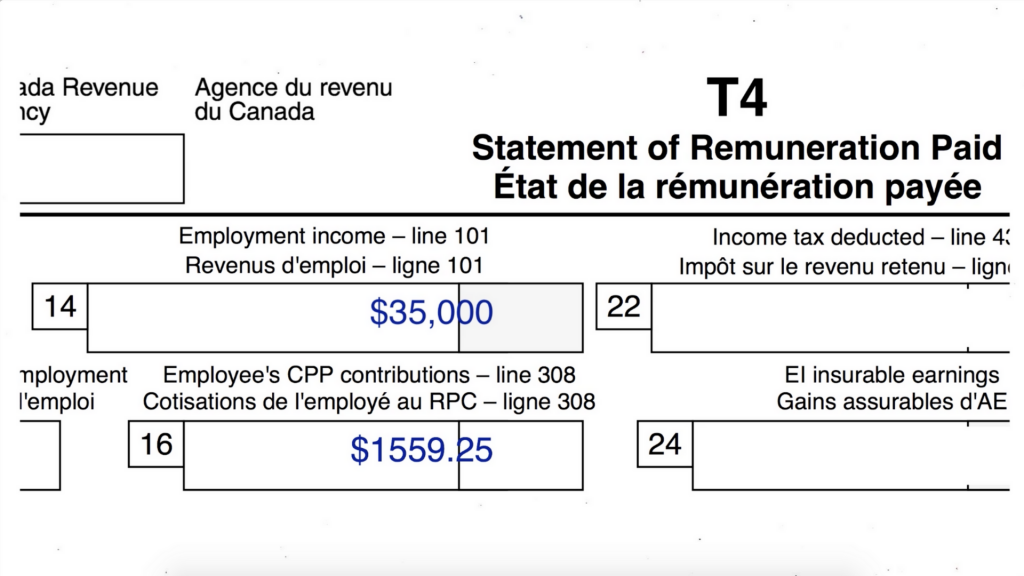

The checklist provides important tax information.

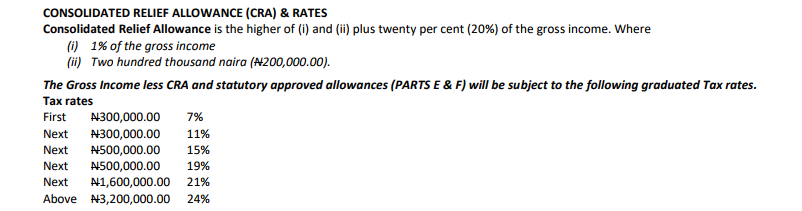

Government news articles 2020. Easily find and claim deductions for all self employed situations. 1 trusted by millions of canadians for over 20 years. With that calculator you can plug in your employment income and your estimation of self employed income it will give you an estimate of your average tax rate ie.

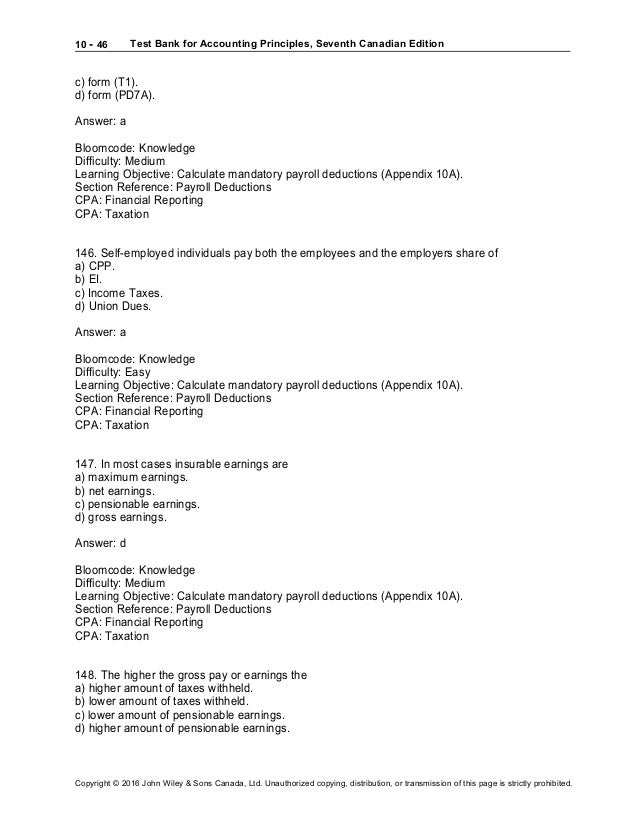

Self employment income this is income from a business a profession. The calculator includes most deductions and tax credits and can assist with your income tax planning. Get step by step guidance with your return so you can find and claim more self employed expenses.

This calculator provides an estimate of the self employment tax social security and medicare and does not include income tax on the profits that your business made and any other income. It will confirm the deductions you include on your official statement of earnings. If you are self employed use this simplified self employed tax calculator to work out your tax and national insurance liability.

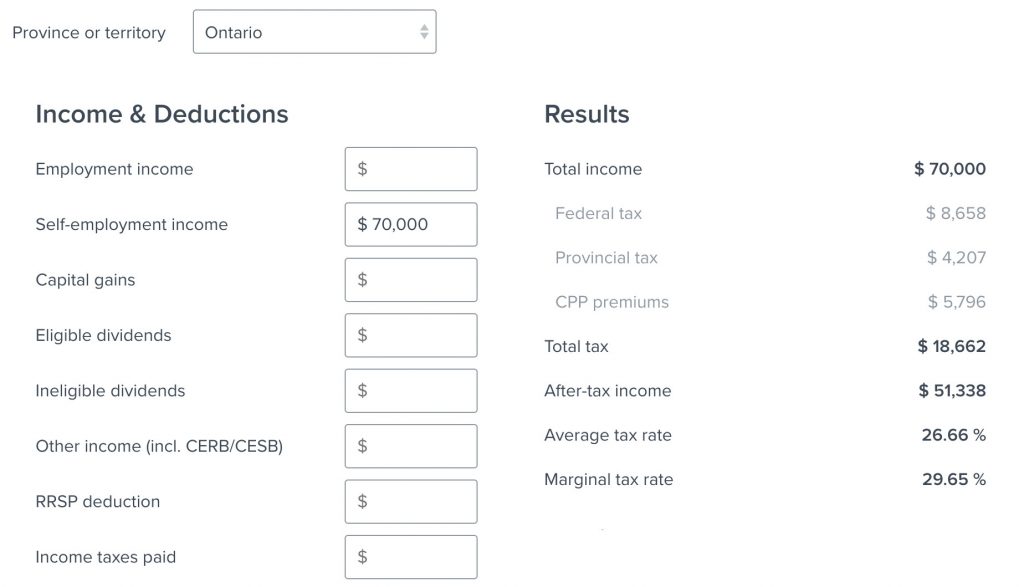

Rates are up to date as of april 28 2020. The calculations provided should not be considered financial legal or tax advice. File your personal and self employed tax returns online.

After tax income is your total income net of federal tax provincial tax and payroll tax. The basic personal tax amount cppqpp qpip and ei premiums and the canada employment amount. These calculations are approximate and include the following non refundable tax credits.

More information about the calculations performed is available on the details page. Select your filing status. Use the below calculator to get an estimate of your se taxes.

Whats new for small businesses and self. Canadas 1 tax software. You assume the risks associated with using this calculator.

If you are incorporated this information does not apply to you. New connect to a live product specialist for one on one help with your tax return using smartlook. The calculator uses tax information from the tax year 2020 2021 to show you take home pay.

Use the payroll deductions online calculator pdoc to calculate federal provincial except for quebec and territorial payroll deductions. For a more robust calculation please use quickbooks self employed. Instead go to corporations.

If you are starting a small business see the checklist for new small businesses. Since the self employed income capital gains eligible and non eligible dividends and other income are taxed differently this calculator will show you how much taxes youll have to pay. Use our income tax calculator to quickly estimate your federal and provincial taxes and your 2020 income tax refund for tax year 2019.

25 and then that should be the percentage you set aside from your self employed income.

More From Government News Articles 2020

- Self Employed On Resume Examples

- Government Scholarship Form Pdf

- Government Guaranteed Bonds Malaysia

- Furlough Scheme Uk Part Time

- Ei For Self Employed Canada

Incoming Search Terms:

- Taxation Our World In Data Ei For Self Employed Canada,

- Taxtips Ca Td1 Forms For Employees Make Sure They Are Up To Date Ei For Self Employed Canada,

- Iguideline On The Mac App Store Ei For Self Employed Canada,

- When Are Canadian Self Employment Taxes Due Mileiq Canada Ei For Self Employed Canada,

- Https Intellexsystems Com Wp Content Uploads 2020 04 200415 Rsm Tax Measures Updated Pdf Ei For Self Employed Canada,

- Personal Income Tax Alice Yi Xu November Outline Basic Info Why When What Who How Tax Calculation Formula Income Deduction Credits Things You May Ppt Download Ei For Self Employed Canada,

/USvsCanadataxes-e237ead6b9fa46b6b5d6b5375bc60641.jpg)

/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-e59e69ce6941454cb1025178eab3574d.png)