Self Employed Vs Limited Company Calculator, Income Tax Calculator Calculate Taxes Online Fy 2019 20

Self employed vs limited company calculator Indeed lately has been sought by users around us, maybe one of you. Individuals are now accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the name of the article I will talk about about Self Employed Vs Limited Company Calculator.

- 14 Tax Tips For The Self Employed Taxact Blog

- Contractor Calculator Tools Dividend Tax Salary Ir35 Limited Company

- How Much Does A Small Business Pay In Taxes

- Limited Company Tax Calculators Company Bug

- Understanding Vat For The Self Employed

- Self Employed Grant When Can I Claim The Third Installment And How Much Will I Get

Find, Read, And Discover Self Employed Vs Limited Company Calculator, Such Us:

- Accountants York

- Self Employed Taxes In Canada How Much To Set Aside For Cpp Ei Income Tax Jessica Moorhouse

- Best Uk Tax Software 2020 Self Employed Tax Returns For Hmrc Techradar

- Sole Trader V Ltd Company Tax Calculator Start Up Donut

- Sole Trader V Ltd Company Tax Calculator Start Up Donut

If you re searching for Furlough Extended March 2021 you've come to the right location. We ve got 100 graphics about furlough extended march 2021 including images, photos, photographs, wallpapers, and more. In these web page, we also provide number of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

View all business and tax news.

Furlough extended march 2021. Some of these factors are listed below. The employee is now paying employees ni at 12 on earnings within this threshold amounting to 464. Well advise you on whether you should trade as a sole trader or limited company.

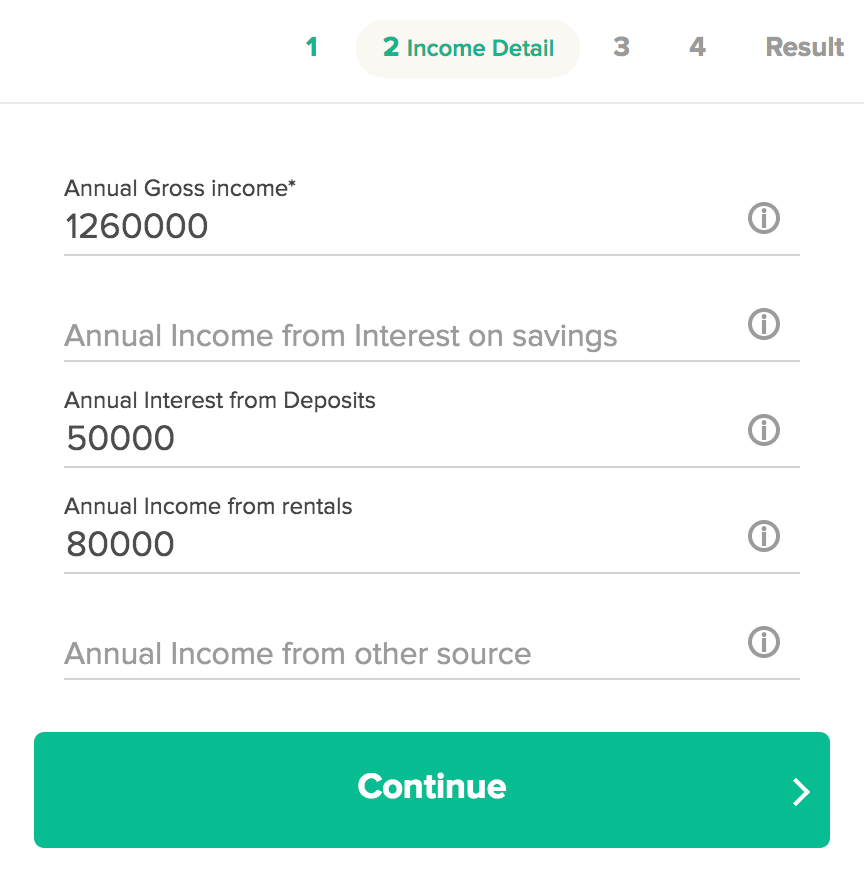

Employed and self employed uses tax information from the tax year 2020 2021 to show you take home pay. 02102019 calculating company car tax. But first remember there are factors other than tax to consider when comparing a sole trader vs limited company.

New dividend tax calculator for sole trader vs limited. To answer this question there are many different factors to consider but the one major factor that is likely to attract freelancers is the tax saving that can be made by trading through a limited company as opposed to becoming self employed. Please choose 201920 202021.

28102020 clawbacks of self employment support grants. Well help you consider the other factors not just the result of the tax calculator. See what happens when you are both employed and self employed at the same time with uk income tax national insurance student loan and pension deductions.

2020 2021 values are used to show you how much you get to keep. The sole trader vs limited company tax calculator is below. 02102019 shiny new tax tools for autumn.

Once youre happy to proceed contact us for our free company incorporation service and our accountancy services from 50pm for companies. The limited company tax calculator allows you to see a breakdown of your tax if you are self employed through a limited company. Figures are based on a full tax year.

Latest from our blog. Just complete the first 3 boxes then go down and click calculate my tax. The contractor pays more to hmrc.

Or if youre already a sole trader enter your annual profits to calculate the amount you might save by incorporating a limited company. So for example looking at this table comparing the tax rates on sole trader or limited company you can see that for profits of 40000 the tax and ni for a sole trader totals 86k compared to the combined tax of a limited company corporation tax on profits and income tax on dividends totalling 75k so there is a 11k saving by using a limited company. The same goes for the contractor whose company pays them a salary of 8424.

Estimate your annual profits to work out if registering your business as a limited company or as a sole trader is more tax efficient. At this point the contractors company has paid corporation tax at 19 on earnings amounting to 735. 21072019 how does ir35 impact take home pay use our new calculator to see.

Should i be self employed or a limited company. 23102020 calculators for increased support announced by chancellor. More information about the calculations performed is available on the details page.

More From Furlough Extended March 2021

- Self Employed Jobs

- Government College University Faisalabad Sahiwal Campus

- What Is Earliest Furlough Date

- Government Name Meaning

- Furlough Rules Ni

Incoming Search Terms:

- Sole Trader Vs Limited Company What Is The Best Option Company Formation Madesimple Furlough Rules Ni,

- The Entrepreneur Salary How Much Should A Business Owner Make Infographic Furlough Rules Ni,

- Limited Company Tax Calculators Company Bug Furlough Rules Ni,

- Health Insurance Marketplace Calculator Kff Furlough Rules Ni,

- Self Employed Income Tax Calculator 2020 21 Transferwise Furlough Rules Ni,

- Limited Company Tax Calculator Employed And Self Employed Furlough Rules Ni,