Self Employed Tax Form, Preparation Calculating Correct Entries For Self E Chegg Com

Self employed tax form Indeed recently has been hunted by users around us, maybe one of you. People are now accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the name of this post I will talk about about Self Employed Tax Form.

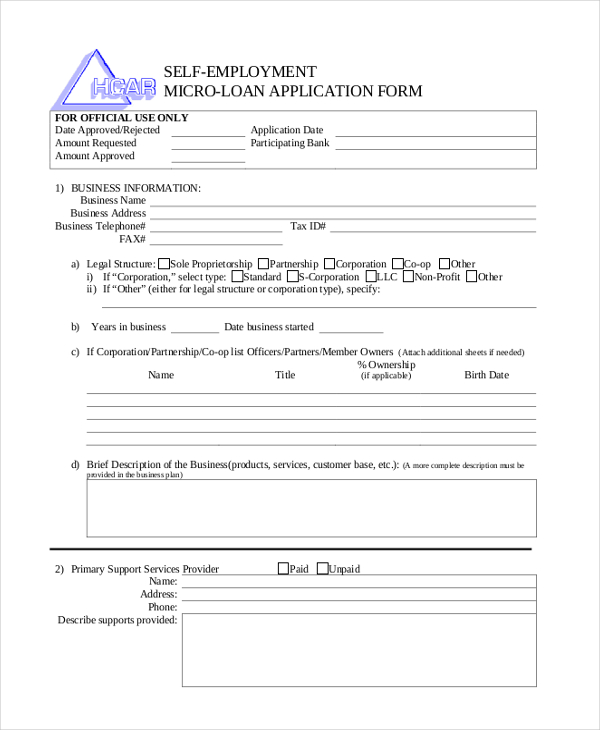

- Self Employment Tax The Benefit Bank Self

- What Is Schedule Se The Tax Form For The Self Employed

- Free 6 Sample Self Employment Tax Forms In Pdf

- Free 11 Sample Self Employment Forms In Pdf Word Excel

- Self Employed Word On Tax Form Business Finance Stock Image 193448069

- Self Employed

Find, Read, And Discover Self Employed Tax Form, Such Us:

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrkeioaygqk31pbtx8ajvjwrrk7hgul Zfzejrqorgy7u0dvzll Usqp Cau

- Self Employment Tax Basics

- Self Employed Vita Resources For Volunteers

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcr4k30v Qtl Wpxrh2oelleonkeep Aj Cgq5or0eqiqiez69tz Usqp Cau

- If You Are Self Employed Or Do Not Have Maryland Income Taxes Withhel

If you are looking for Government Exams 2020 Notification you've arrived at the ideal place. We ve got 104 images about government exams 2020 notification adding pictures, pictures, photos, backgrounds, and more. In these web page, we additionally provide variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

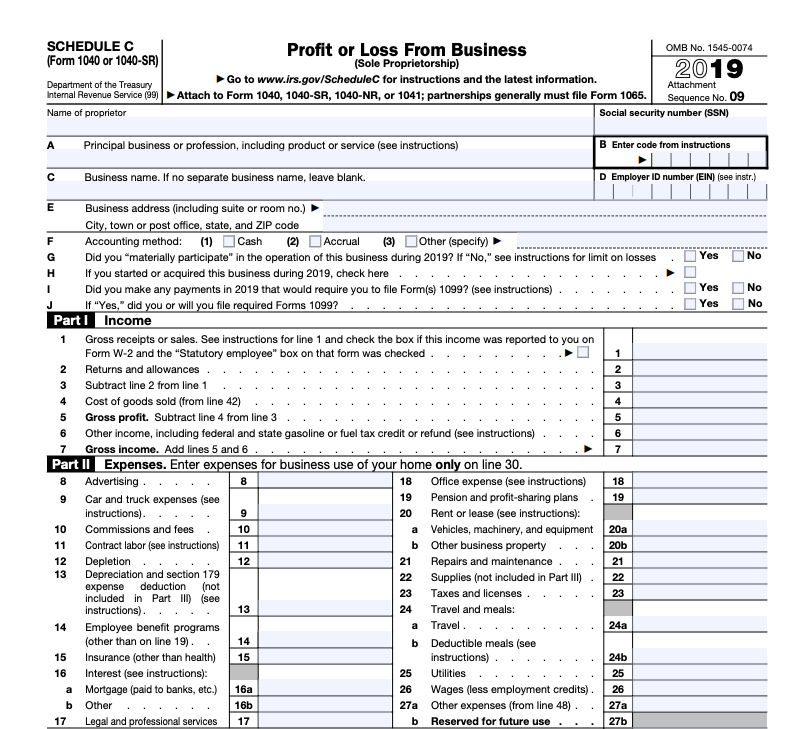

Form 1040es estimated tax for individuals.

Government exams 2020 notification. Income section blong schedule se part i self employment tax. In general anytime the wording self employment tax. Those who earn 400 or more from self employment have to pay self employment tax to the government.

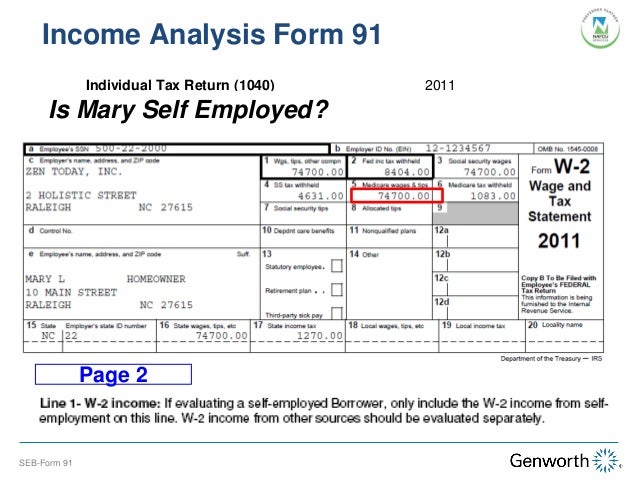

This form also becomes the basis of the social security administration in calculating social security taxes. Form 1040 or 1040 sr schedule h household employment taxes. Also see instructions for the.

Se tax is a social security and medicare tax primarily for individuals who work for themselves. Self employed tax forms unlike other jobs being self employed grants you the opportunity to earn from numerous sources of income. It is similar to the social security and medicare taxes withheld from the pay of most wage earners.

Name of person with self employment income as shown on form 1040 1040 sr or 1040 nr social security number of person with. Form 945 annual return of withheld federal income tax. Source income of foreign persons.

Church employee income see instructions. Who can use self employment tax forms. Form 1042 annual withholding tax return for us.

The self employment short form and notes have been added for tax year 2019 to 2020. Anyone who is running a small business is self employed an independent contractor or a freelance worker can use self employment tax forms and other self employment formsalthough there are guidelines and information on the forms it would also help to check the irs website so that you can calculate the exact amount of taxes you have to pay so that. The self employment short form and notes have been added for tax year 2018 to 2019.

Today as a matter of fact most people are self employed and for the most of them they have made it. The social security administration uses the information from schedule se to figure your benefits under the social security program. Self employment forms and guidance check how to register and file your self assessment tax return apply to reduce payments and find information on keeping records.

Schedule se serves as the basic irs form that determines the tax self employed individuals have to pay. This tax applies no matter how old you are and even if you are already getting social security or medicare benefits. Self employed individuals generally must pay self employment tax se tax as well as income tax.

More From Government Exams 2020 Notification

- Self Employed Relief

- Ra 9184 Philippine Government Procurement Process Flow Chart

- Government Revenue Econ Graph

- What Is The Furlough Payment Percentage

- Government Finance Statistics Yearbook 2018 Pdf

Incoming Search Terms:

- How To Fill Out Schedule Se Irs Form 1040 Youtube Government Finance Statistics Yearbook 2018 Pdf,

- Self Employment Tax Form Editable Forms Government Finance Statistics Yearbook 2018 Pdf,

- Customizing You To Your Market Home Business Business Tax Return Government Finance Statistics Yearbook 2018 Pdf,

- Free 6 Sample Self Employment Tax Forms In Pdf Government Finance Statistics Yearbook 2018 Pdf,

- Self Employment Tax The Benefit Bank Self Government Finance Statistics Yearbook 2018 Pdf,

- Opinion New Postcard Sized Tax Form More Complicated Costly Government Finance Statistics Yearbook 2018 Pdf,