Self Employed Tax Form W 9, Irs Form W 9 Everything You Need To Know Community Tax

Self employed tax form w 9 Indeed lately has been sought by consumers around us, maybe one of you personally. People are now accustomed to using the net in gadgets to see image and video data for inspiration, and according to the name of the post I will talk about about Self Employed Tax Form W 9.

- How To Complete A W 9 Tax Form 9 Steps With Pictures Wikihow

- Who Should Get A 1099

- Understanding Your Doordash 1099

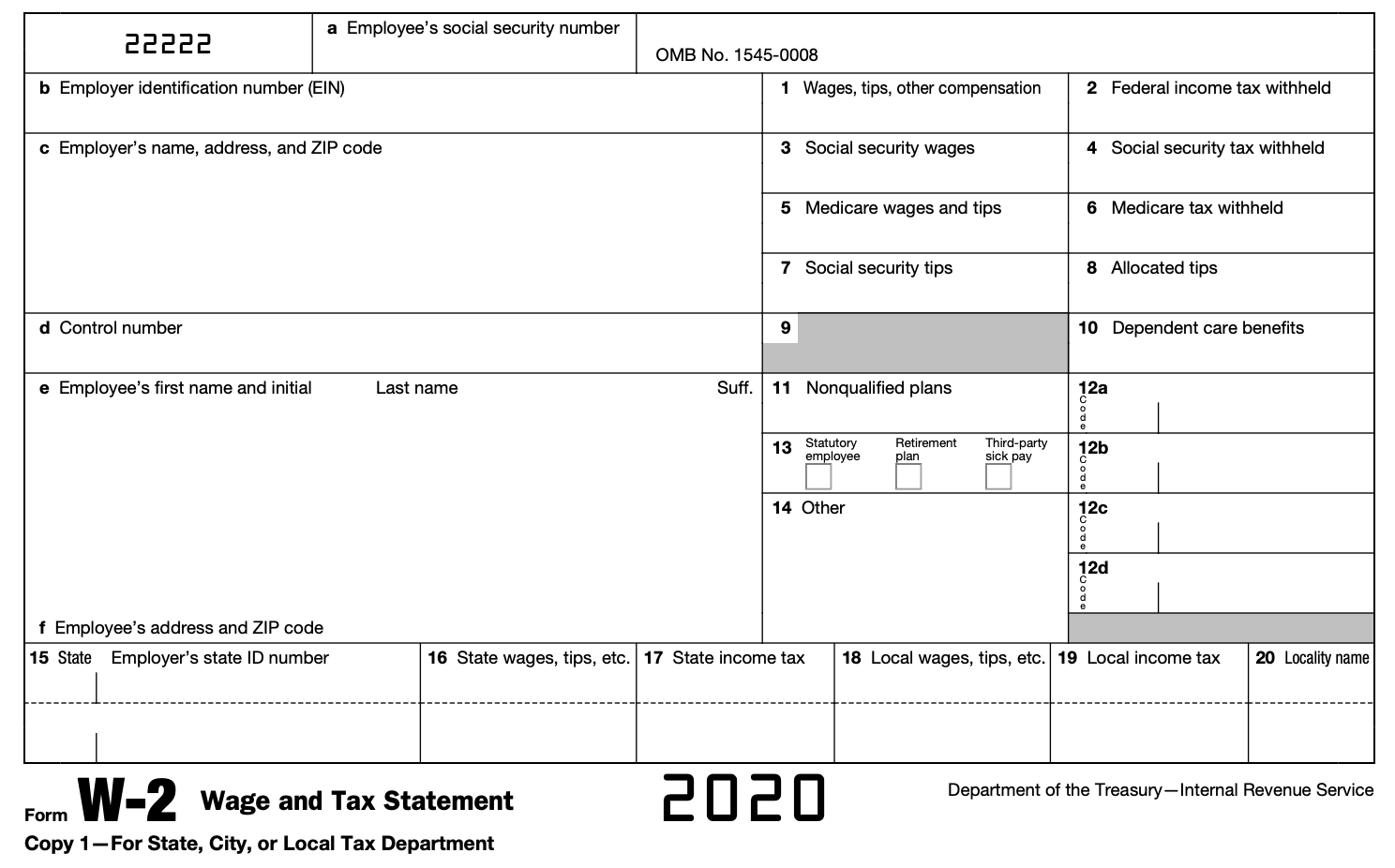

- Solved 14 If An Employer Discovers An Error On A Previou Chegg Com

- 10 Things You Should Know About 1099s

- What Do I Do With My Self Employed Taxes Drive Now Network

Find, Read, And Discover Self Employed Tax Form W 9, Such Us:

- W 9 Tax Form What To Consider Before You Sign

- Other Income On Form 1040 What Is It

- W 9 Form What Is It And Why Do You Need To Fill One Out

- What Is A 1099 Form And How Do I Fill It Out Bench Accounting

- 2018 2020 Form Irs W 9 Fill Online Printable Fillable Blank Pdffiller

If you are looking for Minister Office Government Office Interior Design you've reached the ideal place. We have 104 graphics about minister office government office interior design adding images, photos, pictures, backgrounds, and more. In these webpage, we also have number of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

Publication 926 2020 Household Employer S Tax Guide Internal Revenue Service Minister Office Government Office Interior Design

How To Fill Out A W9 Tax Form Correctly In 2020 Youtube Minister Office Government Office Interior Design

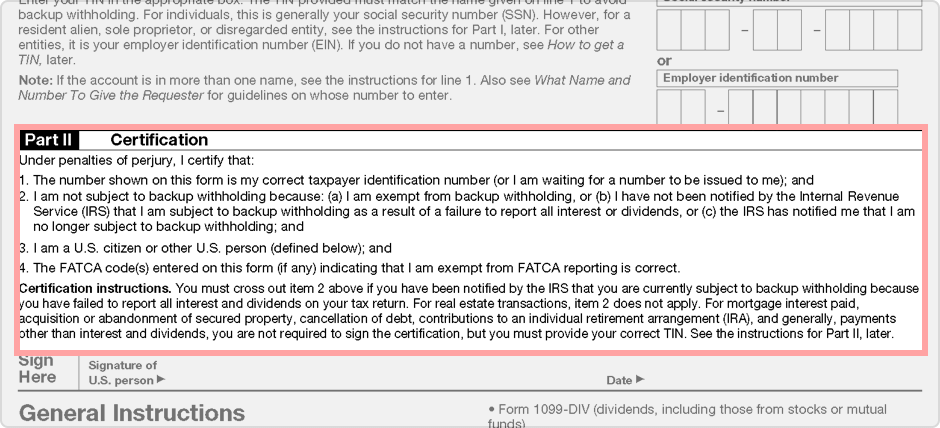

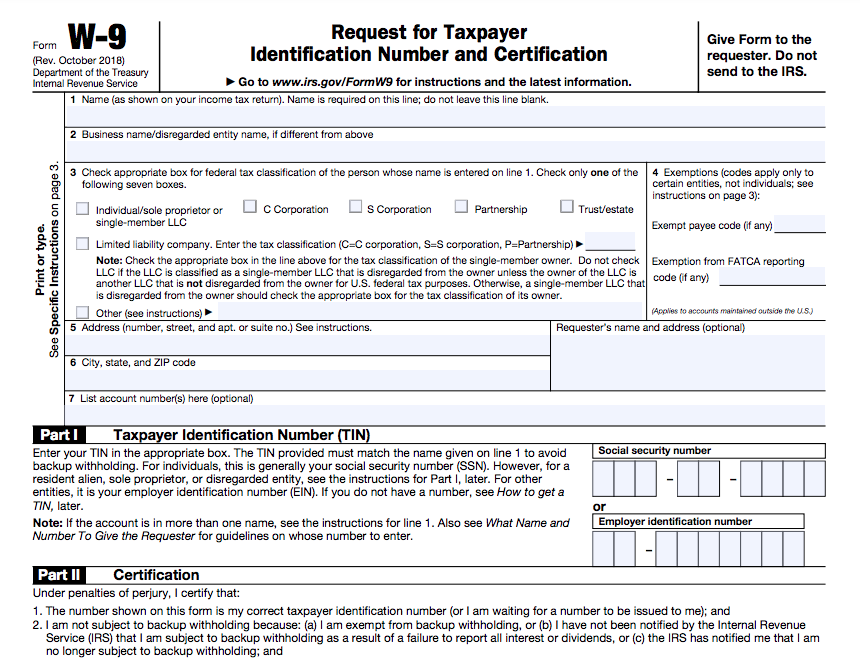

This starts with having you fill out a form w 9 offering your social security number and basic contact information.

:max_bytes(150000):strip_icc()/irsformw-9-4f99b4002b434b53a6535c25092b3318.jpg)

Minister office government office interior design. Self employment forms register if youre self employed or a. Schedule se form 1040 or 1040 sr self employment tax pdf instructions for schedule se form 1040 or 1040 sr self employment tax pdf schedule k 1 form 1065 partners share of income credits deductions etc. Businesses must report payments to any person they paid 600 or more during the tax year.

The companies you work with do not have to withhold paycheck taxes for you and the w 9 serves as an agreement that you are responsible for paying those taxes on your own. If you work for multiple clients during the. See what else you can do.

A w 9 form is crucial to filing your taxes if youre a contract worker a freelancer or self employed. Companies use w 9s to file form 1099 nec or form 1099 misc both of which notify the irs how much theyve paid to non employees during a tax year. Self employed individuals generally must pay self employment tax se tax as well as income tax.

Just provide your name and social security number or the name and fein of your business. A business may send you a blank w 9 to fill out if you or your business is hired to provide services. In general anytime the wording self employment tax.

Form w 9 is an irs form that is filled out by self employed workers for companies they are providing services for. For example if a disregarded entity llc that is owned by an individual is required to provide a form w 9 request for taxpayer identification number tin and certification the w 9 should provide the owners ssn or ein not the llcs ein. If youve made the determination that the person youre paying is an independent contractor the first step is to have the contractor complete form w 9 request for taxpayer identification number and certificationthis form can be used to request the correct name and taxpayer identification number or tin of the workerthe w 9 should be kept in your files for four years for.

A 09 additional medicare tax may also apply if your net earnings from self employment exceed 200000 if youre a single filer or 250000 if youre filing jointly. It is similar to the social security and medicare taxes withheld from the pay of most wage earners. Most often a w 9 form is sent to independent contractors consultants and other self employed workers.

For certain employment tax and excise tax requirements discussed below the ein of the llc must be used. Being self employed doesnt release those who pay you from reporting the amount to the irs. Filling out a w 9 is straightforward.

More From Minister Office Government Office Interior Design

- Government Gazette South Africa

- Majority And Minority Government Difference

- New Furlough Rules Uk

- Indonesia Form Of Government

- Government Consulting Jobs Chicago

Incoming Search Terms:

- What You Need To Know About Form W 9 Resources Pdfrun Government Consulting Jobs Chicago,

- What Is A W 9 Form How Do I Fill Out A W 9 Gusto Government Consulting Jobs Chicago,

- Solved Problem 6 16 Algorithmic Self Employment Tax Lo Chegg Com Government Consulting Jobs Chicago,

- Self Employed Tax High Resolution Stock Photography And Images Alamy Government Consulting Jobs Chicago,

- W 9 Form What Is It And How Do You Fill It Out Smartasset Government Consulting Jobs Chicago,

- 10 Things You Should Know About 1099s Government Consulting Jobs Chicago,

/w2-9ca13523f4d74e958b821aab63af2e60.png)