Self Employed Tax Form Schedule C, What Is A Schedule C Form With Pictures

Self employed tax form schedule c Indeed lately has been hunted by users around us, perhaps one of you. Individuals are now accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the name of this article I will discuss about Self Employed Tax Form Schedule C.

- Irs Audit Irs Examination Schedule C Audit Audit Red Flags Tax Payer Resolution

- 334 Preparing The Return For Susan J Brown

- Stew Beauf Is A Self Employed Surfboard Maker In 2 Chegg Com

- How To File Taxes On Part Time Income Earned On Hubpages And Other Internet Marketing Sites Toughnickel Money

- How To Report 1099 Misc Box 3 Payments On Your 1040

- Self Employed Vita Resources For Volunteers

Find, Read, And Discover Self Employed Tax Form Schedule C, Such Us:

- Sole Proprietorship Taxes A Simple Guide Bench Accounting

- Stew Beauf Is A Self Employed Surfboard Maker In 2 Chegg Com

- Use The Information Provided Below To Prepare Schedule C And Form 4562 For Tax Year 2017 Homeworklib

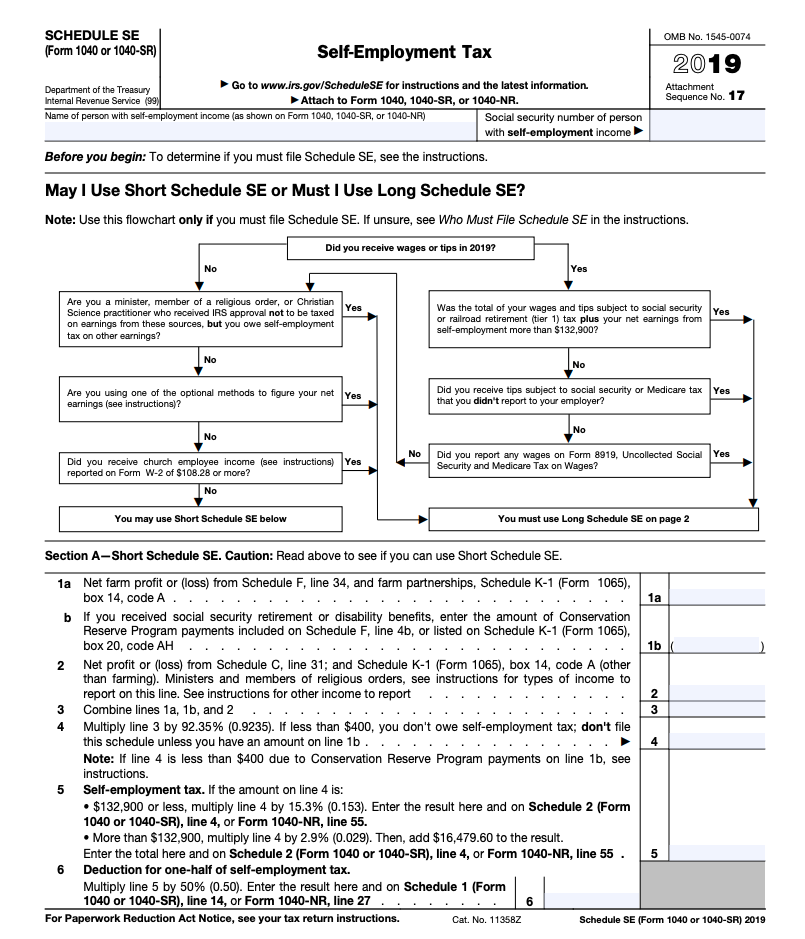

- What Is Self Employment Tax And Schedule Se Stride Blog

- 1040 U S Individual Income Tax Return With Schedule C

If you are searching for Communicating With Government Officials Definition you've arrived at the ideal location. We ve got 104 images about communicating with government officials definition adding images, photos, pictures, wallpapers, and much more. In these page, we also have variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

However you still need to complete a separate section if you claim expenses for a vehicle.

/i-received-a-1099-misc-form-what-do-i-do-with-it-35d7e9d37e8949de8c556777494dde39.png)

Communicating with government officials definition. To enter the data in the program. This must be reported on schedule c and self employment tax will apply. Se tax is 15.

Use the income or loss calculated on schedule c to calculate the amount of social security and medicare taxes you should have paid during the. Important distinction for claiming contributions. Self employed individuals often have more than one activity going at onceyou can report closely related activities together on one schedule c.

For self employed business owners deductions are taken on a schedule c profit or loss from business or a schedule c ez for tax filers with deductions totaling less than 5000. If you are self employed and have to purchase your own health insurance you can deduct that from your taxable income for income taxes. For these businesses your income is calculated using schedule c.

Schedule c self employed. In order to report your social security and medicare taxes you must file schedule se form 1040 or 1040 sr self employment tax pdf. Self employment income is reported on schedule c and the net profit or loss is reported on irs schedule 1 form 1040 line 12.

It will not reduce your profit and thus will not reduce your self employment tax. It also means youll pay self employment tax in addition to ordinary income tax on your net profits. From within your taxact return online or desktop click federal.

If the total of your net earnings from self employment from all businesses is 400 or more use schedule se form 1040 or 1040 sr self employment tax to figure your net earnings from self employment and tax owed. How self employed people report business income on schedule c a self employed person reports income and business expenses on schedule c attached to form 1040. You do not report the employee portion of the solo 401k contribution on schedule c.

Using schedule c ez instead for tax years prior to 2019 many sole proprietors are able to use a simpler version called schedule c ez. Start with line 1 gross receipts which includes all of the money you received from doing business during the year. Self employed record keeping checklist.

If you have unrelated activities however you must report them on separate schedule cs. For the self employed the combination of self employment taxes and income taxes can easily add up to be the biggest single expense you will face in your annual budget. Being self employed means you can deduct any expenses you had such as travel equipment etc.

This form omits a lot of the detail in the full schedule c and just asks for your total business receipts and expenses. Schedule c instructions pdf may be helpful in filling out this form.

More From Communicating With Government Officials Definition

- Western Cape Government Vacancies July 2020

- Government Furlough Scheme Start

- Government Website Template Wordpress

- Government Vouchers Malta Expiry Date

- Government Monopoly

Incoming Search Terms:

- 2 Government Monopoly,

- Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Moneypixels Government Monopoly,

- Self Employment Tax Form 2017 Inspirational Schedule C Tax Form 2018 Irs Form 1040 Fresh Schedule C Tax Form Models Form Ideas Government Monopoly,

- Self Employment Tax Basics Government Monopoly,

- How To Report And Pay Taxes On 1099 Income Government Monopoly,

- What Is A Schedule C Tax Form H R Block Government Monopoly,