Self Employed National Insurance Pension, National Insurance Contributions Complete Guide And Faq

Self employed national insurance pension Indeed lately is being hunted by consumers around us, perhaps one of you. People are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the title of this article I will talk about about Self Employed National Insurance Pension.

- Online Company Registrations By Evan Kenty At Zdk Formations Ltd Issuu

- Diverging Productivist Pension Regimes In Japan Korea And Taiwan How Productive Are They Young Jun Choi Ppt Download

- How To Check Your National Insurance Contributions Saga

- Use This Form To Register For Self Employment And Or Advise Of Low

- The Stings In The Tail Of Chancellor Sunak S Announcement

- What Pension Can I Get If I M Self Employed Pensionbee

Find, Read, And Discover Self Employed National Insurance Pension, Such Us:

- The Class2less Society Warr Co Chartered Accountants

- Not Fit For Purpose Tax Glitch Putting Pensions Of Self Employed At Risk Money The Guardian

- Self Employed National Insurance Most Important Facts Billomat

- Budget National Insurance Rise For Self Employed Breaks Manifesto Pledge Politics News Sky News

- Pdf Pathways To A Universal Basic Pension In Greece

If you re looking for Government Departments Ireland 2020 you've arrived at the ideal place. We have 104 images about government departments ireland 2020 adding pictures, pictures, photos, wallpapers, and much more. In these web page, we additionally provide number of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

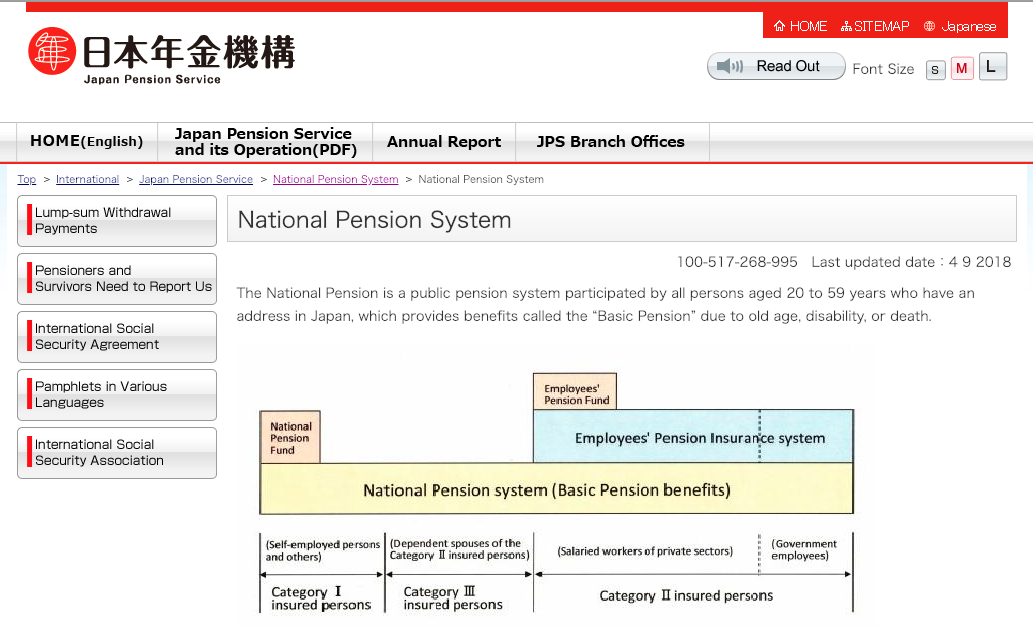

How Social Insurance System Works For Full Time Employee In Japan Career Village Government Departments Ireland 2020

Your state pension is based on your own national insurance record which you build up by paying national insurance contributions external website class 2 when you are self employed.

Government departments ireland 2020. As a self employed person you were paying two types of national insurance. If youre self employed youre entitled to the state pension in the same way as anyone else. Class 2 contributions were a relatively modest flat rate weekly amount for those with profits above a.

Youre employed and earning over 183 a week from one employer youre self employed and paying national insurance. For the current tax year 2019 20 the maximum value of the new state pension is 17520 per week. If your profits are more than 8632 in the tax year 20192020 you will need to pay class 4 nics.

If they then fail to make the nic payments they lose their full entitlement to a state pension. Certain benefits are also based on the contributions you have made. The class 2 national insurance contribution is a fixed amount of 305 a week and its only charged if your annual profits are 6475 or more.

Class 4 national insurance contributions are only charged if your profits are above 9500 a year. If you are self employed and you have made at least 6363 in the tax year 20192020 or 6 205 in the tax year 20192020 you will need to pay class 2 nics national insurance contributions. In order to receive a state pension employment and maternity allowances the self employed must pay.

When youre working you pay national insurance and get a qualifying year if. The rate is nine per cent of profits between 9501 and 50000 and two per cent on profits over 50000. You usually pay 2 types of national insurance if youre self employed.

So unless people expect to work until they. National insurance contributions nics are contributions which pay for certain benefits including the state pension and universal credit. From april 2016 there is a new flat rate state pension which is based entirely on your national insurance ni record.

Self employed national insurance rates. National insurance contributions if youre self employed. Class 4 if your profits are 9501 or more a year.

More From Government Departments Ireland 2020

- Furlough Scheme Extension November

- Anti Government Covid Meme

- New Government Job Vacancy 2020 Rajasthan

- Government Budget Deficit Equation

- Extended Furlough Meaning

Incoming Search Terms:

- National Insurance Number Change Address How To Update Your Details Extended Furlough Meaning,

- The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk Extended Furlough Meaning,

- How To Get Social Security And Be Self Employed In Spain Closing The Gap Extended Furlough Meaning,

- Should You Pay Voluntary Nics Statepension Selfemployed Extended Furlough Meaning,

- Nic Category Letters Brightpay Documentation Extended Furlough Meaning,

- Diverging Productivist Pension Regimes In Japan Korea And Taiwan How Productive Are They Young Jun Choi Ppt Download Extended Furlough Meaning,