Self Employed Mortgage Loan Covid, How The Coronavirus Pandemic Is Reshaping The Economics Of Home Buying The Seattle Times

Self employed mortgage loan covid Indeed recently is being sought by consumers around us, perhaps one of you. People now are accustomed to using the net in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about Self Employed Mortgage Loan Covid.

- Self Employed Mortgage Options Get Your Loan Approved

- Covid 19 Relief For Small Businesses And The Self Employed Nerdwallet

- How To Get A Mortgage When You Re Self Employed Rocket Mortgage

- Emergency Loans For Small Businesses Are Coming Here S What To Know Bostonomix

- Mortgage Repayment Pauses During Covid 19 Canstar

- Bank Statement Mortgage Loan Loan For Self Employed Borrowers Nasb Home Loans

Find, Read, And Discover Self Employed Mortgage Loan Covid, Such Us:

- Covid 19 Small Business Relief La Marque Tx Official Website

- Fha Mortgage Qualifying Gets Tougher For The Self Employed Mortgage Rates Mortgage News And Strategy The Mortgage Reports

- Self Employed Here S How To Get A Mortgage Better Mortgage

- Keep Your Business Going During The Covid 19 Pandemic Small Business

- Mortgage Repayment Pauses During Covid 19 Canstar

If you are looking for Government Furlough Scheme Tax you've arrived at the ideal place. We ve got 100 images about government furlough scheme tax adding pictures, photos, photographs, wallpapers, and much more. In such page, we additionally provide number of graphics available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Obtaining A Mortgage When You Re Self Employed In The Age Of Covid 19 Government Furlough Scheme Tax

Call us on 1300 889 743 or fill in our online assessment form to speak with one of our specialist mortgage brokers who specialise in self employed home loans.

Government furlough scheme tax. About 100 million of that support is designed for self employed people and viable micro and sme businesses in distress due to coronavirus. A new mortgage deal aims to help self employed people bounce back and progress up the property ladder even if theyve faced financial difficulties during the covid 19 outbreak. Posted on april 5 2020 67 comments.

Our mortgage brokers can help you prepare a covid 19 impact statement which is the key to getting approved as a self employed borrower. Now we need a year to date profit and loss statement as well as business bank statements to support the profit. Its been a tough few months for mortgage lenders and borrowers with banks cutting many of their deals and home movers and remortgagers facing uncertainty.

Get your loan applications in. Self employed homebuyers and remortgagers might be concerned about their options in the wake of covid 19 but there are signs that lenders are looking to help. Covid 19 loans for self employed.

Proof of income for self employed borrowers could be more burdensome due to the coronavirus pandemic. The scheme helps small and medium sized businesses to borrow between 2000 and up to 25 of their turnover. Cares act created loan programs for the self employed.

Theres more documentation required post covid for self employed borrowers. Lenders set new requirements for self employed mortgage borrowers during covid 19. Congress passed the cares act to mitigate the negative economic impact brought by the coronavirus pandemic.

The big change reflecting the covid 19 pandemics impact on the home loan industry will require self employed workers to provide more recent documents to prove their income. Getting a mortgage for self employed borrowers could be more challenging during the covid 19 downturn as lenders take extra steps to verify income. This week beverley building society announced its bounce back initiative allowing self employed borrowers to be considered for a 75 mortgage with just one year of accounts.

The scottish government announced on wednesday 15 april a further 220 million in grants to help businesses including the recently self employed.

More From Government Furlough Scheme Tax

- Government Covid Relief For Businesses

- Government To Government Consultation

- Government Building Drawing Easy

- Self Employed Invoice Template South Africa

- Korean Government Scholarship Program Philippines

Incoming Search Terms:

- Covid 19 Coperative Banks Actions Eacb News Korean Government Scholarship Program Philippines,

- How To Pause Your Home Loan Repayments During Covid 19 Home Loans Realestate Com Au Korean Government Scholarship Program Philippines,

- Want To Buy A Home It S Harder To Get Loans Or Tap Equity Los Angeles Times Korean Government Scholarship Program Philippines,

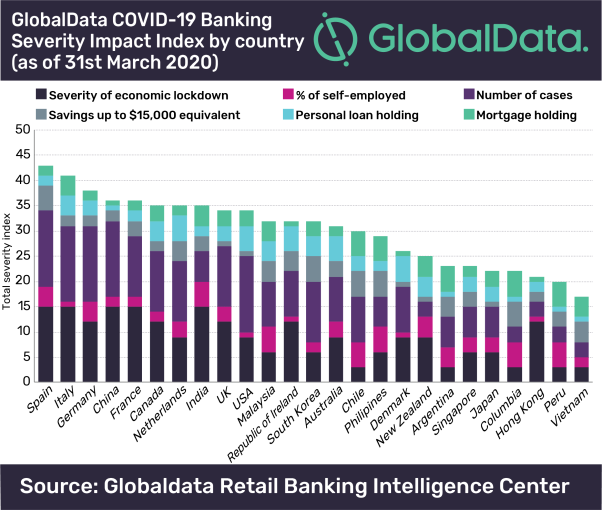

- Banking Markets With Higher Self Employment Hit Hardest By Covid 19 Korean Government Scholarship Program Philippines,

- 750 000 Self Employed Miss Out On Uk Coronavirus Support Study Enterprise Research Centre Korean Government Scholarship Program Philippines,

- Obtaining A Mortgage When You Re Self Employed In The Age Of Covid 19 Korean Government Scholarship Program Philippines,