Self Employed Utr Number How To Get One, What Is A Company S Unique Taxpayer Reference Utr

Self employed utr number how to get one Indeed lately is being sought by consumers around us, maybe one of you. Individuals are now accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the name of this post I will discuss about Self Employed Utr Number How To Get One.

- Sansdrama

- Cat Fletcher On Twitter Why Does Everyone Say There S No Way Of Knowing Who S Selfemployed And That There S No Mechanism For Govt To Pay Us Solo Traders Have A Utr Unique Tax

- Government Support For The Self Employed The Tax Blog

- Who Needs A Utr Number Anyway News

- Self Employed People In The Uk Usually Rebecca Mason Art Facebook

- A Guide To Unique Tax Reference Numbers What Is A Utr

Find, Read, And Discover Self Employed Utr Number How To Get One, Such Us:

- Self Employed Hmrc Insure Number Utr E Tax Return Entenda O Processo Acompanhe Youtube

- Self Employed Tax Codes What You Need To Know

- How To Get A Utr Number From Hmrc Goselfemployed Co

- Information Guide For Unique Tax Reference Numbers

- Construct Recruitment Blog How To Get Your Utr Number

If you re searching for Government Grants For Individuals In Nigeria you've arrived at the right place. We ve got 104 images about government grants for individuals in nigeria adding images, photos, photographs, backgrounds, and much more. In these web page, we also have number of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

How To Get A Utr Number From Hmrc Go Self Employed In 2020 Business Checklist Financial Stress Budgeting Worksheets Government Grants For Individuals In Nigeria

Coronavirus Self Employed Scheme Get The Details Right Accountingweb Government Grants For Individuals In Nigeria

How to get a utr number.

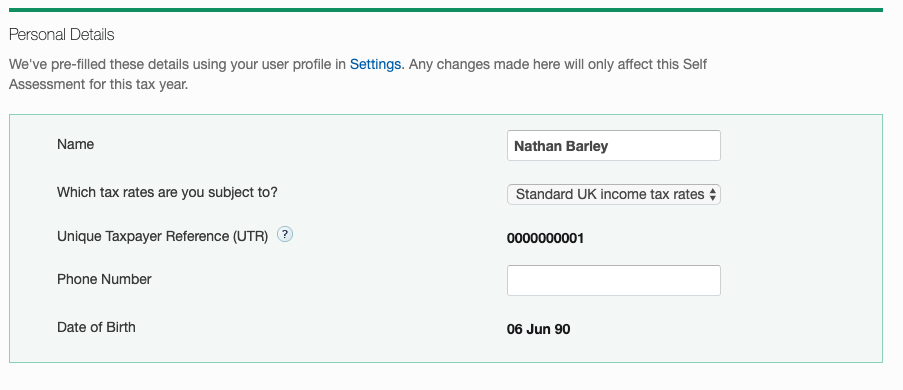

Government grants for individuals in nigeria. Review and click submit. Enter the date you started your self employment. Self assessment unique taxpayer reference utr number if you do not have this find out how to get your lost utr how to tell hmrc use the government gateway user id and password that you used.

If you think it sounds complex youre not alone. Security guard uber driver freelance designer etc. Visit the hmrc website and choose the option to register online.

Youll get a letter containing your unique taxpayer reference utr within 10 working days 21 if youre abroad. A utr number is unique to you and highly confidential just like your national insurance number. Your utr number is a unique taxpayer reference that you get when you register for self assessment.

Self employed workers will need the following info to claim. The quickest way to get a utr number is to go online but you can also apply by phone. Self assessment unique taxpayer reference utr if you do not have this find out how to get your lost utr.

First time filers need a unique taxpayer reference or utr number in order to submit a self assessment tax return but it can take time to get one. Before you submit a tax return for the first time say after youve started a new business you need to register for self assessment which you can do on the hmrc website. If youve sent a self assessment tax.

Submit more details including your national insurance number heres how to get one. You need to register for self assessment to be issued with one. Heres how to do it.

Workers that register as self employed automatically get assigned a unique string of 10 digits but its not just reserved for individuals. Ive never had a utr how to get it. Youll get a letter with your unique taxpayer reference utr number by post.

Hmrc says it can take up to 10 working days to receive your utr number and a further seven working days to receive an activation code. It consists of ten digits sometimes with a letter k at its end and is issued to you by hmrc. By registering for self assessment at hmrc.

However utr numbers are pretty straightforward when you know what they do and how you can get one. Register for self assessment online. You need your utr to send a return.

Describe the work you do. Before you start the registering as self employed online make sure you have your national insurance number handy. For that reason retrieving it may be a bit more tricky than you anticipate.

Or we can do it for you for a flat 25. Companies are also given a utr number at registration. How to get a utr number.

You can get it in two ways.

Self Employed Hmrc Insure Number Utr E Tax Return Entenda O Processo Acompanhe Youtube Government Grants For Individuals In Nigeria

More From Government Grants For Individuals In Nigeria

- Furlough Extension November

- Local Government Bodies In Tamil Nadu

- Furlough Scheme End Date Scotland

- Government Policy Making Process

- Indian Government Budget 2020

Incoming Search Terms:

- Self Employed People In The Uk Usually Rebecca Mason Art Facebook Indian Government Budget 2020,

- 5 Ways To Streamline Your Self Assessment Tax Return Alexander Co Indian Government Budget 2020,

- Who Needs A Utr Number Anyway Indian Government Budget 2020,

- Self Employed Tax Return Self Employed Tax Return In 2020 Indian Government Budget 2020,

- Everything You Need To Know About The New Government Grant For The Self Employed Inews Online News Europe Indian Government Budget 2020,

- A Guide To Unique Tax Reference Numbers What Is A Utr Indian Government Budget 2020,