Government Employee Gift Limit, 4 2 17 Today Was Our Volunteer Banquet At Mountain Jack S Wonderful Foo Volunteer Appreciation Gifts Volunteer Appreciation Quotes Volunteer Appreciation Week

Government employee gift limit Indeed recently is being hunted by users around us, maybe one of you personally. People now are accustomed to using the net in gadgets to view video and image information for inspiration, and according to the name of the article I will discuss about Government Employee Gift Limit.

- Central Govt Relaxes Monetary Limits On Gifts Employees Can Accept

- Central Government Employees Can Accept Gifts Worth Up To Rs 5000

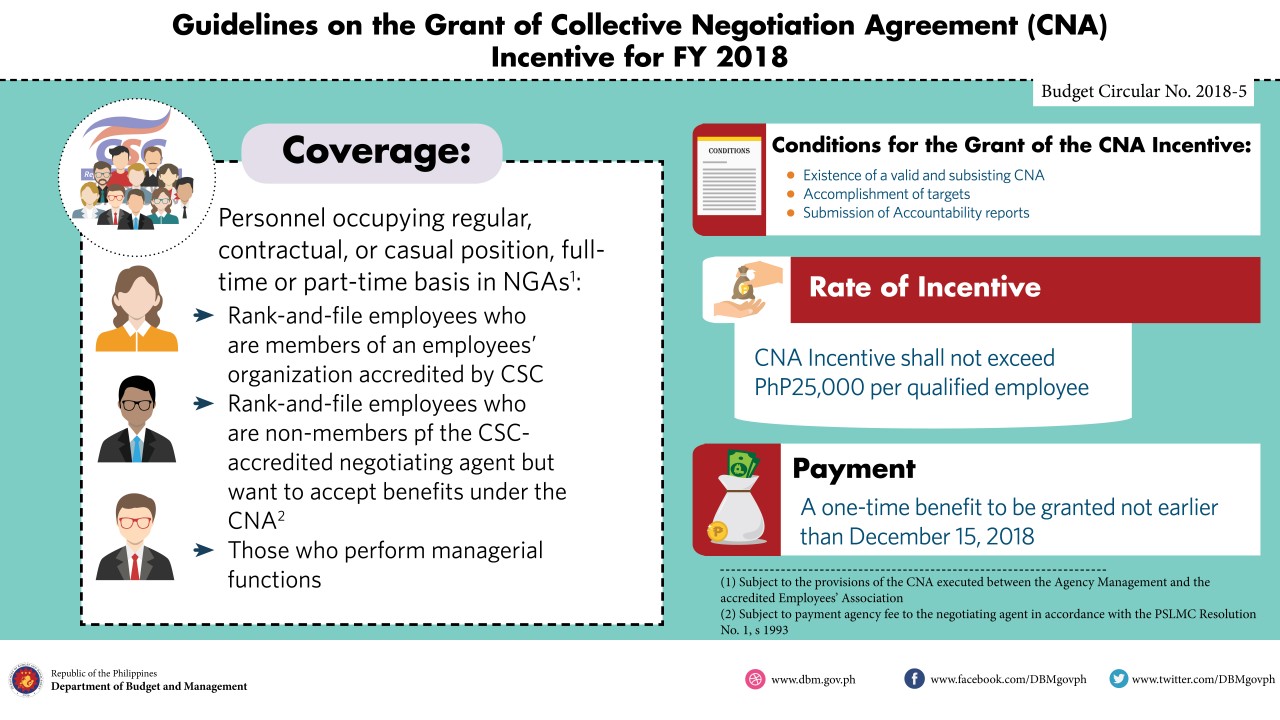

- 2 Fam 960 Solicitation And Or Acceptance Of Gifts By The Department Of State

- Gst Gifts Above Rs 50 000 Per Year By An Employer Subject To Gst Government The Economic Times

- Income Tax Efiling Received Gifts During The Year Here Is What That Means For Your Itr The Financial Express

- Ppt Dhra Ethics Officials Powerpoint Presentation Free Download Id 4833757

Find, Read, And Discover Government Employee Gift Limit, Such Us:

- 5 Rules About Income Tax On Gifts Received In India Exemptions

- Establishing Company Gift Giving Guidelines Risk Management Monitor

- 22 Gift Ideas For Government Coworkers That Don T Break Ethics Rules Community Govloop

- How My Dad Got Scammed For 3 000 Worth Of Gift Cards

- Government Discounts For Federal State Employees Samsung Us

If you re searching for Self Employed Business Grants Covid you've reached the ideal place. We ve got 101 graphics about self employed business grants covid including images, photos, photographs, backgrounds, and much more. In such web page, we additionally have variety of graphics available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Federal Register Standards Of Ethical Conduct For Employees Of The Executive Branch Amendment To The Standards Governing Solicitation And Acceptance Of Gifts From Outside Sources Self Employed Business Grants Covid

4 nothing in this section precludes an employee of a private sector organization while assigned to an agency under chapter 37 from continuing to.

/gift-policy-c5acfd2650674d929945807ba8f53c6f.jpg)

Self employed business grants covid. If you determine that a gift you wish to give is not based upon improper motives you should next consider whether the federal employee is permitted to accept the gift. Government employees under group b could either be gazetted or non gazetted. City employees cannot accept a gift worth 50 or more also called a valuable gift from a city vendor meaning any person or firm who the city employee knows is or intends to become engaged in business dealings with the city.

Certain types and values of gifts are permitted between employees. Regardless of the number of dod employees contributing to a gift on a special infrequent occasion as permitted by 5 cfr 2635304c1 a dod. Gifts having a value.

The following documents provide the details regarding gift limitations and exceptions. The cumulative value of gifts that may be accepted from any one source in a calendar year must be less than 100. Nothing in this section precludes a member officer or employee from accepting gifts on behalf of the united states government or any of its agencies in accordance with statutory authority.

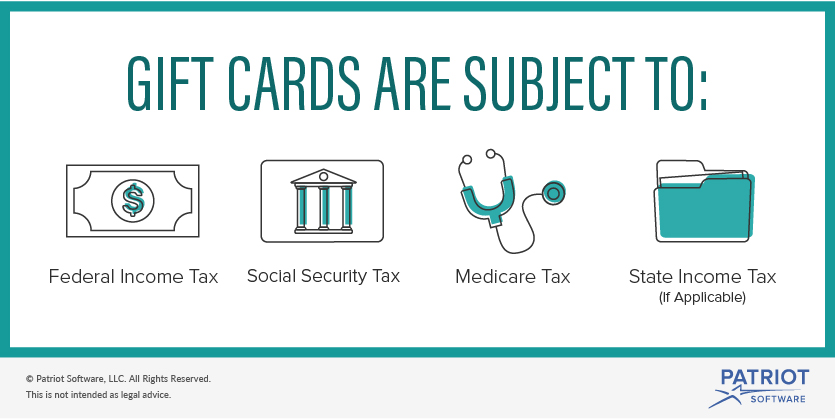

Government employees under group a are senior officials. Generally you may not give a gift to your supervisor or others in your management chain and employees may not accept a gift from another employee receiving less pay unless the gift is given under one of the following situations. A gift is anything of value including a meal a ticket to an event a gift card a loan a swag bag or a holiday fruit basket.

The government strictly limits the ability of its employees to accept gifts from so called outside sources such as you and your company. A member officer or employee may accept a gift other than cash or cash equivalent having a value of less than 50 provided that the source of the gift is not a registered lobbyist foreign agent or private entity that retains or employs such individuals. A gifts from a group that includes a subordinate.

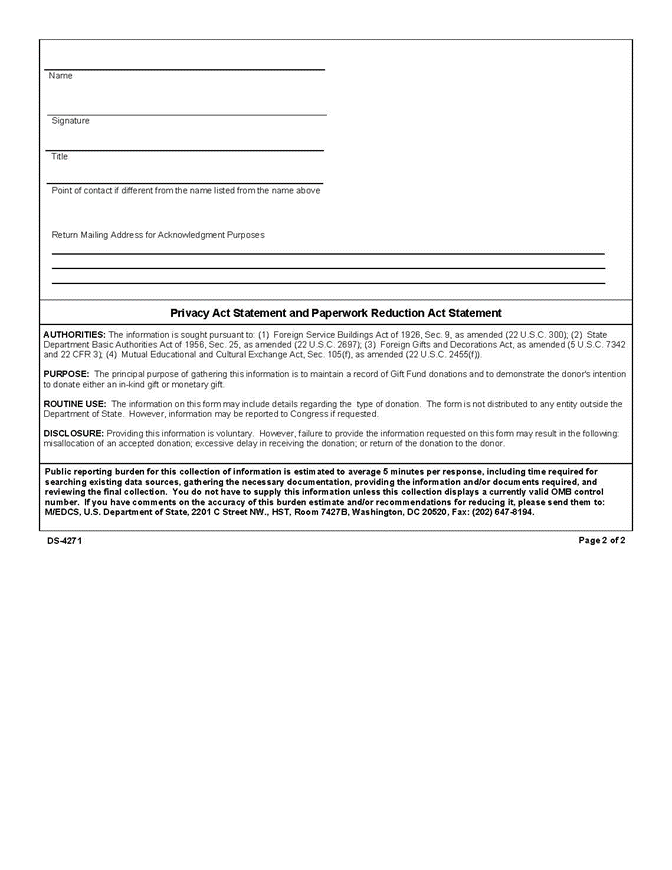

Policies on exchanges of gifts among employeesas well as on acceptance of gifts or hospitality from other sourcesare set by government wide rules found in the code of federal regulations at 5 cfr 2635 201205 and 301304. Similarly group c employees will be able to accept gifts up to rs 2000 instead of rs 500 without taking government approval. The limit to accept gifts for these groups of employees was rs 1500 earlier.

Different rules apply depending on who is giving you the gift. Gifts of 10 or less on certain occasions when gifts are traditionally given or. In addition exceptions to the prohibitions permit certain gifts from outside sources such as awards free attendance and honorary degrees.

More From Self Employed Business Grants Covid

- Furlough For Self Employed After June

- Government Office

- Government Building Cartoon Png

- Self Employed Person Income Relief Scheme

- Government Yoga Institute In Delhi

Incoming Search Terms:

- Guidance On The Gift Rule Government Yoga Institute In Delhi,

- Giving And Receiving Gifts Coates Canons Coates Canons Government Yoga Institute In Delhi,

- Year End Bonus And Cash Gift Of Government Employees Government Yoga Institute In Delhi,

- Http Tdept Cgaux Org Mt Pdf Ethics Pg Ind Learn Pdf Government Yoga Institute In Delhi,

- Nps Income Tax Benefits Latest Rules For Private Govt Employees Explained Government Yoga Institute In Delhi,

- Gift Taxation Itr Gifts Have To Be Declared In Itr Here S How They Are Taxed Government Yoga Institute In Delhi,