Self Employed Business Loans Covid, Incentives

Self employed business loans covid Indeed recently has been hunted by users around us, perhaps one of you. Individuals now are accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the name of this article I will talk about about Self Employed Business Loans Covid.

- Govt Stepping In To Help Small Businesses 100k Interest Free Loans

- Coronavirus Ppp Loans Give Pa Small Businesses Almost 10 Billion

- Covid 19 Small Business Relief La Marque Tx Official Website

- Self Employed And Need A Ppp Loan You Should Wrap Up Your 2019 Taxes

- Delays In Sba Loans For Independent Contractors Self Employed Workers

- Coronavirus Self Employed Grant Scheme Sees Big Rush Bbc News

Find, Read, And Discover Self Employed Business Loans Covid, Such Us:

- Coronavirus Advice Company Financial

- Here S How To Apply For Financial Aid During The Coronavirus Pandemic If You Re Self Employed Or A Small Business In The Arts The Art Newspaper

- Coronavirus Self Employed Grant Scheme Sees Big Rush Bbc News

- Self Employed And Need A Ppp Loan You Should Wrap Up Your 2019 Taxes

- Self Employment 1099s And The Paycheck Protection Program Bench Accounting

If you re looking for Government Regulation Of Business Meaning you've reached the perfect location. We have 100 images about government regulation of business meaning including images, photos, photographs, wallpapers, and more. In these page, we also provide variety of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

City Of Pittsburgh Office Of The Mayor As Part Of The Federal Cares Act Businesses Nonprofits Can Apply Now For The Paycheck Protection Program Self Employed And Independent Contractors Can Apply Government Regulation Of Business Meaning

Claim a grant if youve lost income.

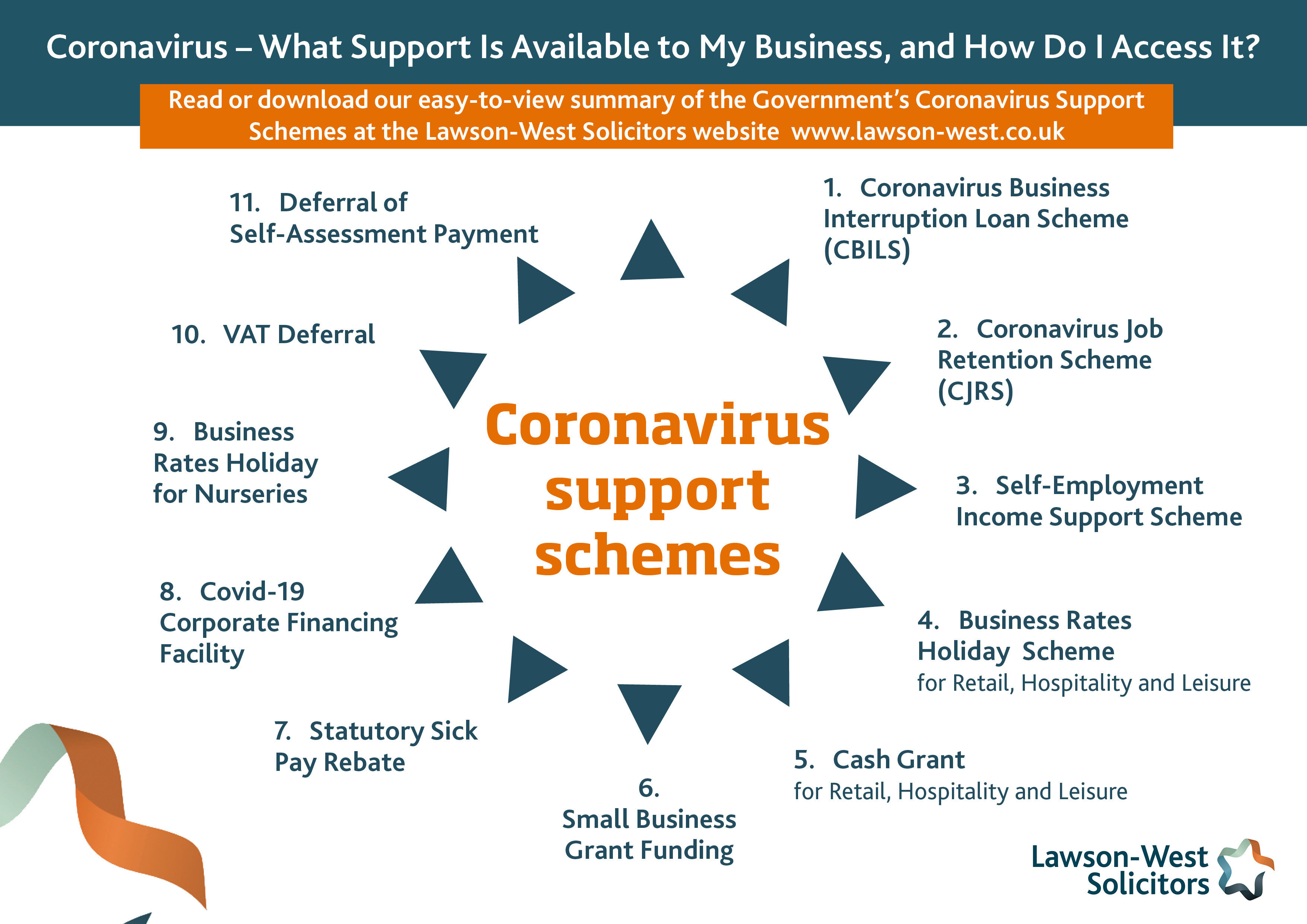

Government regulation of business meaning. The temporary coronavirus business interruption loan scheme is open to self employed people and offers access to loans overdrafts invoice finance and asset finance of up to 5 million for up to six years. Two laws provide covid 19 relief for small businesses and the self employed including access to forgivable loans. Alternatively you can apply for a business interruption loan.

Economic injury disaster loan eidl and paycheck protection program ppp. The government guarantees 80 of the finance to the lender and pays interest and. The first grant paid 80 per cent of three months average monthly trading profits over the last three years capped at 7500.

Cares act created two loan programs for small businesses and the self employed. Chamber of commerce has issued this guide and cheat sheet to help small businesses and self employed individuals prepare to file for a loan from the cares acts paycheck protection program. If youre getting less work or no work because of coronavirus covid 19 you might be able to claim a grant through the self employment income support scheme.

Guide to small business covid 19 emergency loans us. Elizabeth renter may 21 2020 on a similar note. Small business guidance loan resources.

The self employment income support scheme seiss is made up of a series of grants designed to support self employed people whose business has been adversely affected by coronavirus. Small businesses are encouraged to do their part to keep their employees customers and themselves healthy. Self employed people or independent contractors arent typically eligible for unemployment but thats all changed with the passage of the 2 trillion coronavirus relief package or cares act.

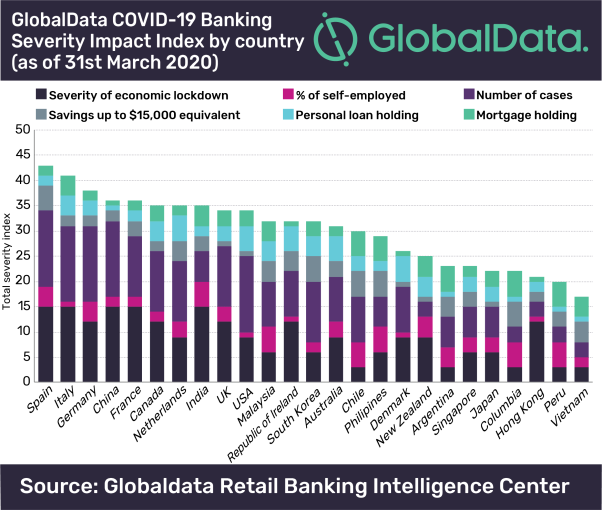

Spain Likely To Be Hit Hardest By Pandemic According To Globaldata S Covid 19 Banking Severity Impact Index Globaldata Government Regulation Of Business Meaning

More From Government Regulation Of Business Meaning

- Government Majority Party

- Government Public Hospitals In India

- Upcoming Government Exams 2020 21

- Government Gazette Rakiya Abarthu Sinhala 2020

- Furlough Retention Scheme Calculator

Incoming Search Terms:

- Coronavirus Relief For Small Businesses And The Self Employed Considerable Furlough Retention Scheme Calculator,

- Spain Likely To Be Hit Hardest By Pandemic According To Globaldata S Covid 19 Banking Severity Impact Index Globaldata Furlough Retention Scheme Calculator,

- Covid 19 Business Resources Orono Me Furlough Retention Scheme Calculator,

- Paycheck Protection Program Relief For Small Businesses Within The Cares Act Alloy Silverstein Furlough Retention Scheme Calculator,

- Delays In Sba Loans For Independent Contractors Self Employed Workers Furlough Retention Scheme Calculator,

- Https Home Treasury Gov System Files 136 How To Calculate Loan Amounts Pdf Furlough Retention Scheme Calculator,