Furlough Scheme Rules Holiday Pay, Coronavirus Crisis Your Financial Rights Financial Times

Furlough scheme rules holiday pay Indeed recently has been hunted by users around us, perhaps one of you. People now are accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the name of the article I will discuss about Furlough Scheme Rules Holiday Pay.

- Uk Covid 19 Update On Employee Holiday Issues Coronavirus In A Flash

- Furloughing And Fundamental Rights The Case Of Paid Annual Leave Ier

- Latest Furlough And Holiday Pay Guidance What Has It Cleared Up

- Holiday And Furloughed Agency Workers New Guidance Onrec

- Coronavirus Job Retention Scheme Furlough Rules Need Clarification

- Https Www Eca Co Uk Cmspages Getfile Aspx Guid 820bb725 5e5b 4703 88d6 Fc26c4d707cf

Find, Read, And Discover Furlough Scheme Rules Holiday Pay, Such Us:

- Furlough Hmrc Clarifies Tupe Rules And Warns Against Fraud Personnel Today

- Are Your Managers Also Great Leaders

- Coronavirus Job Retention Scheme How To Furlough Workers The Legal Partners

- Cjrs Further Updates To Government Guidance Fcsa

- Flexi Furlough Changes To Jrs Employment Lawyers

If you are searching for New Furlough Scheme From October you've come to the right place. We ve got 100 images about new furlough scheme from october adding images, photos, pictures, backgrounds, and much more. In these page, we additionally provide number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

If the employer and the worker agree that the bank holiday can be taken as annual leave while on furlough the employer must pay the correct holiday pay for the worker.

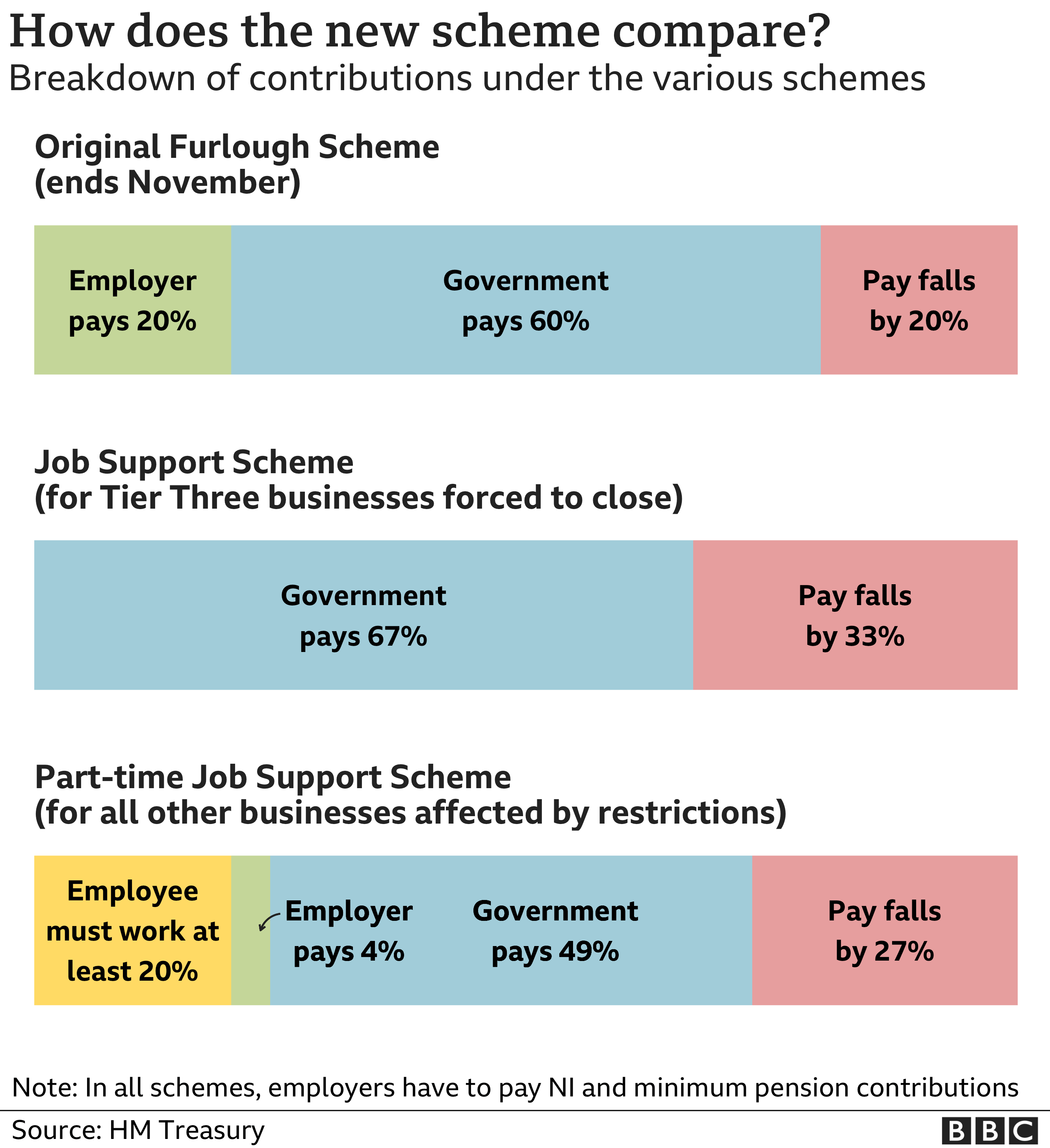

New furlough scheme from october. However the guidance states that employers should not place employees on furlough simply because they are on holiday at that time. In october the final month of the scheme the government will pay 60 with a cap up to 1875 for the hours the employee is on furlough. For all employers trying to understand how the governments furlough rules apply to your workforce including their annual leave and holiday pay then read our latest article below.

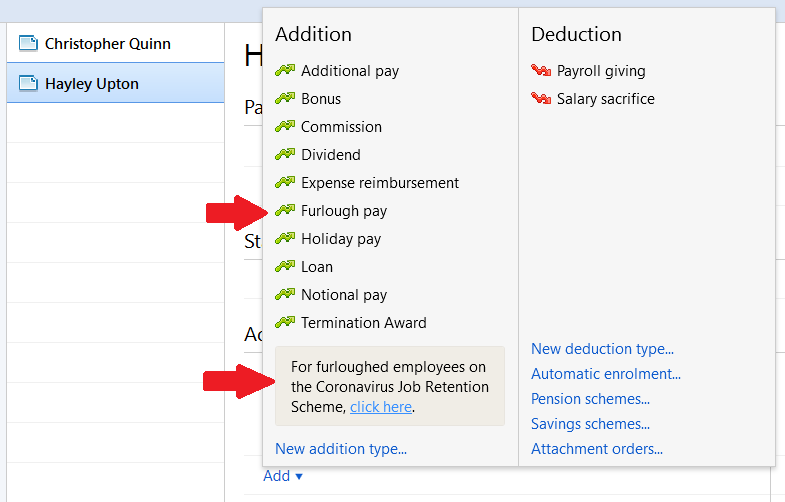

The coronavirus job retention scheme cjrs better known as the furlough scheme will be extended for another month following the announcement of a new national lockdown. The guidance clarified that employers can claim through the job retention scheme for furloughed workers even while they were taking holiday. Any holiday entitlement that is taken for bank holidays or any other days must be paid based on the holiday pay regulations which changed on 6 april 2020 si 20181378.

However as taking holiday does not break the furlough period your employer can continue to claim the 80 per cent grant from the government to cover most of the cost of holiday pay. Furlough rules during the ongoing coronavirus pandemic changed on july 1 heres what it all means including part time furlough calculations of pay and holiday entitlement birminghammail share. In view of the two extensions to the furlough scheme the issue of what happens to holidays is important.

Employers must pay er nic and pension contributions as well as topping up the employees wages so that they reach 80 for the time that theyre furloughed. It is therefore important to distinguish between periods of leave taken up to 5 april 2020 and subsequently. The employer will be able to claim 80 of the employees pay for the whole of the holiday period through the scheme although they will still have to top up the employees wage to their full rate pay.

But they are required to make the difference up if the employee is entitled to higher holiday pay than their furlough pay it said. Between march and july the government paid for 80 of furloughed workers wages up to 2500 a month and it also.

More From New Furlough Scheme From October

- Will The Uk Extended Furlough

- New Furlough Scheme From November 2020

- Government Guidelines Covid 19 Ireland

- Sindh Government Services Hospital Logo

- Hp 241 G1 Government Laptop Price

Incoming Search Terms:

- Covid 19 Employment Update On Employee Holiday Issues Clyde Co Hp 241 G1 Government Laptop Price,

- Key Questions About The Furlough Extension Hp 241 G1 Government Laptop Price,

- Last Week S Poll Has Your Employer Furloughed Any Workers The Engineer The Engineer Hp 241 G1 Government Laptop Price,

- Covid 19 Job Retention Scheme Faqs Hp 241 G1 Government Laptop Price,

- Paid Sick Leave To Protect Income Health And Jobs Through The Covid 19 Crisis Hp 241 G1 Government Laptop Price,

- Coronavirus Job Retention Scheme What Employers Should Do Hp 241 G1 Government Laptop Price,