Is The Furlough Scheme Taxable Income, Blog Kings Accountancy

Is the furlough scheme taxable income Indeed recently is being hunted by users around us, perhaps one of you. People are now accustomed to using the net in gadgets to view video and image data for inspiration, and according to the title of the post I will discuss about Is The Furlough Scheme Taxable Income.

- Cjrs Flexible Furlough Scheme Timetable Of Changes Brightpay Documentation

- General Election 2019 How Much Tax Do British People Pay Bbc News

- Lewis Silkin International Approaches To Covid 19 Job Retention And Wage Subsidy Schemes

- Coronavirus Job Retention Scheme Get The Details Right Accountingweb

- Flexible Furloughing What Is It And Why Is 10 June Important Low Incomes Tax Reform Group

- T Ukbhcji1dy8m

Find, Read, And Discover Is The Furlough Scheme Taxable Income, Such Us:

- Coronavirus Job Support Scheme The Details And What It Might Mean For Employers

- Income Tax Wikipedia

- Coronavirus Job Retention Scheme How To Furlough Workers The Legal Partners

- Coronavirus Job Retention Scheme Get The Details Right Accountingweb

- Government Announces Furlough Scheme Changes What You Need To Know

If you are looking for Government Gazette 2020 September Job Vacancies you've reached the ideal location. We have 104 images about government gazette 2020 september job vacancies adding pictures, photos, pictures, backgrounds, and much more. In such webpage, we additionally have variety of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Steps To Take Before Calculating Your Claim Using The Coronavirus Job Retention Scheme Gov Uk Government Gazette 2020 September Job Vacancies

Covid 19 Updates Summary Of The Uk Government S Policy On Furlough Government Gazette 2020 September Job Vacancies

This is in addition to billions of pounds in tax deferrals and grants for businesses.

Government gazette 2020 september job vacancies. Chancellor rishi sunak has extended the furlough scheme until the end of march. The furlough scheme protected over nine million jobs across the uk and self employed people have received over 13 billion in support. If you need assistance in these changing times tax innovations can help with furlough scheme and self employed income support scheme claims as well as payroll administration.

Is the government taxing furlough income. If e pays that amount it would also have the extra employers nic cost of 138 which e must fund. Whether e pays w an extra 1000 is a matter for e and w subject to contractual obligations.

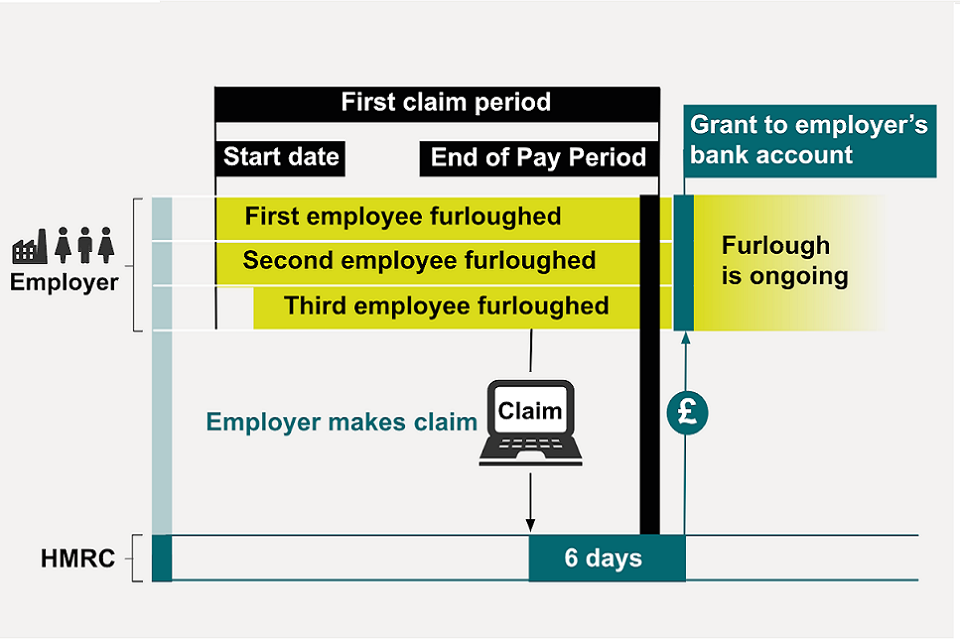

The job support scheme that was intended to replace the furlough scheme has now been postponed until the furlough scheme ends. The scheme will initially run for at least three months from 1 march 2020 with all uk businesses eligible and will be extended if necessary. However hm treasury will now extend the furlough scheme until december when it will be replaced by the job support scheme.

A furlough scheme is offering financial support to millions around the uk. You must include them as income when you calculate your taxable profits for income tax and corporation tax purposes. But if youve been furloughed and only earning 80 per cent of your salary your monthly pay drops to 1000 none of which is.

While on furlough the employees wage will be subject to usual income tax and other deductions. Out of that 20833 is taxable and so you pay 4167 in income tax. But will furlough income be subject to taxation.

Under the terms of the extension the government will pay 80 of a workers salary while the employer will have to meet the cost of national insurance payments and pension contributions. Businesses can deduct employment costs as normal when calculating taxable profits for income tax and corporation tax purposes my question here and forgive me if it sounds a stupid question i presume you would not be able to use the payroll costs for example of furlough employees as a taxable expense but the money paid to furlough will be. The job retention bonus is a 1000 one off taxable payment to the employer for each eligible employee that.

How Long Does Furlough Scheme Last And Will I Be Taxed Your Rights Over Uk Coronavirus Scheme Birmingham Live Government Gazette 2020 September Job Vacancies

More From Government Gazette 2020 September Job Vacancies

- Self Employed Vs Employed Test

- New Furlough Scheme Rules Hmrc

- Lenovo E4325 Government Laptop Battery

- Government Island Stafford Virginia

- Government To Citizen E Commerce

Incoming Search Terms:

- Coronavirus Job Retention Scheme Update Employee Furlough Kirk Rice Government To Citizen E Commerce,

- Changes To The Coronavirus Job Retention Scheme From 1 July 2020 Charity Tax Group Government To Citizen E Commerce,

- Coronavirus Job Retention Scheme Processing Furlough Pay In Brightpay Brightpay Documentation Government To Citizen E Commerce,

- Martin Lewis Warns Furloughed Workers To Check Payslips Now In Case You Ve Been Underpaid Government To Citizen E Commerce,

- Job Retention Scheme Phase 1 What Is It Faq S Government To Citizen E Commerce,

- T Ukbhcji1dy8m Government To Citizen E Commerce,