Local Government Taxes In Nigeria, National Open University Of Nigeria Pdf Free Download

Local government taxes in nigeria Indeed recently has been sought by consumers around us, perhaps one of you personally. Individuals are now accustomed to using the net in gadgets to view image and video data for inspiration, and according to the name of this article I will talk about about Local Government Taxes In Nigeria.

- Transporters Fight The Nigerian Government Fare Prices May Increase By 500

- Taxes You Should Beware Of Before Starting A Business In Nigeria

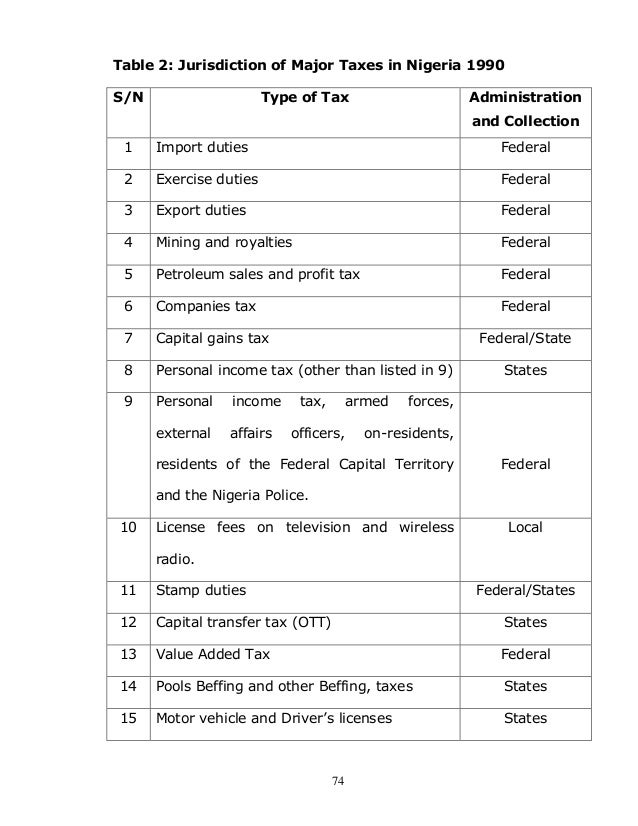

- Nigeria S Federal State And Local Tax Jurisdiction And Assignment Download Table

- An Assessment Of Revenue Generation Drive Of Lagos State Government T

- Federal Inland Revenue Service And Taxation Reforms In Democratic Nigeria Okauru Ifueko Omoigui 9789784877657 Amazon Com Books

- Acc 004 Complete Module 1 Progressive Tax Taxpayer

Find, Read, And Discover Local Government Taxes In Nigeria, Such Us:

- 16 The Impact Of Multipletaxation On Competitiveness In Nigeria Tariff Nigeria

- Taxes Different Taxes In Nigeria And How To Pay Your Tax

- Mobilizing Local Government Tax Revenue For Adequate Service Delivery

- Daily Trust Union Moves Against Multiple Taxes In Council Roads

- Tax Administration In Nigeria Is Vested Nakudu Law Partners Facebook

If you re looking for Government Vouchers Malta Application you've reached the perfect location. We have 104 graphics about government vouchers malta application including pictures, photos, photographs, backgrounds, and more. In these web page, we additionally have variety of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

If youve gone through our detailed article where we discussed the relationship between the three levels of government in nigeria youll have a clue on how things work.

Government vouchers malta application. Local government areas of nigeria nigeria has 774 local government areas lgas. I personal income tax. Vi naming of street registration in state capitals vii right of occupancy on land.

Iv business premises registration v development levy. Tax rates in nigeria. Ii road taxes iii pools betting and lotteries.

Thus nigeria has 3 tiers of government. They are responsible for the assessment and collection of all taxes fines and rates under its jurisdiction and account for all revenue collected to the chairman of the local government. Taxation and local government development in nigeria.

Major sources of government revenue in nigeria. There are 36 states in nigeria the taxes they collect are. The law is to be cited as local government levies approved collection list law 2010 the law.

Each local government area is administered by a local government council consisting of a chairman who is the chief executive of the lga and other elected members who are referred to as councillors. According to william robson 2006 defined local government as involving. Most local government in nigeria are very large both in terms of territorial and population sizes in such a circumstance a greater need for revenue arises to enable such a local government cope with the developmental problems of such a large area and at the same time be able to meet satisfactorily the diverse needs of the large population.

According to lawal 2000 local government as a political sub division of a nation in federal system which is constituted by law and has substantial control of local affairs which includes the power to impose taxes or exact labor for prescribed purpose. National state and local. There are 3 levels of government in nigeria.

Organisationslevies or taxes aside from those listed in the schedule to the stipulated for breach of its bye government. The government sought to collect the taxes by introducing tax clearance certificates. The local government collects taxes through the local government revenue committee.

Each of the states is divided into local governments. The state government is the second tier of government in nigeria. See below a schedule of taxes and rates due to local government authority.

The law is enacted to regulate the administration of and unify the levies and taxes collected by lgcs and lcdas within lagos state the state.

More From Government Vouchers Malta Application

- Answer Key Types Of Government Worksheet Answers

- Government Island Stafford Va

- Hp 246 Government Laptop Drivers Download

- Government School Vacancy 2020

- Government Issues Drawing

Incoming Search Terms:

- Transporters Fight The Nigerian Government Fare Prices May Increase By 500 Government Issues Drawing,

- Top 5 Richest Local Governments In Nigeria Check Out If Your L G An Is Among On Of Them Opera News Government Issues Drawing,

- Taxation In Nigeria A Beginner S Guide To Nigeria S Tax System Government Issues Drawing,

- Local Government Tax Mobilization And Utilization In Nigeria Government Issues Drawing,

- Http Citeseerx Ist Psu Edu Viewdoc Download Doi 10 1 1 473 8148 Rep Rep1 Type Pdf Government Issues Drawing,

- Local Government Authority Rates And Taxes In Nigeria Tegsol Consulting Government Issues Drawing,