Self Employed Covid Loan, The Cares Act Paycheck Protection Program What You Need To Know Wordstream

Self employed covid loan Indeed lately has been sought by users around us, maybe one of you. Individuals now are accustomed to using the net in gadgets to view video and image information for inspiration, and according to the title of this post I will discuss about Self Employed Covid Loan.

- Millions Of Self Employed To Benefit From Second Stage Of Support Scheme Gov Uk

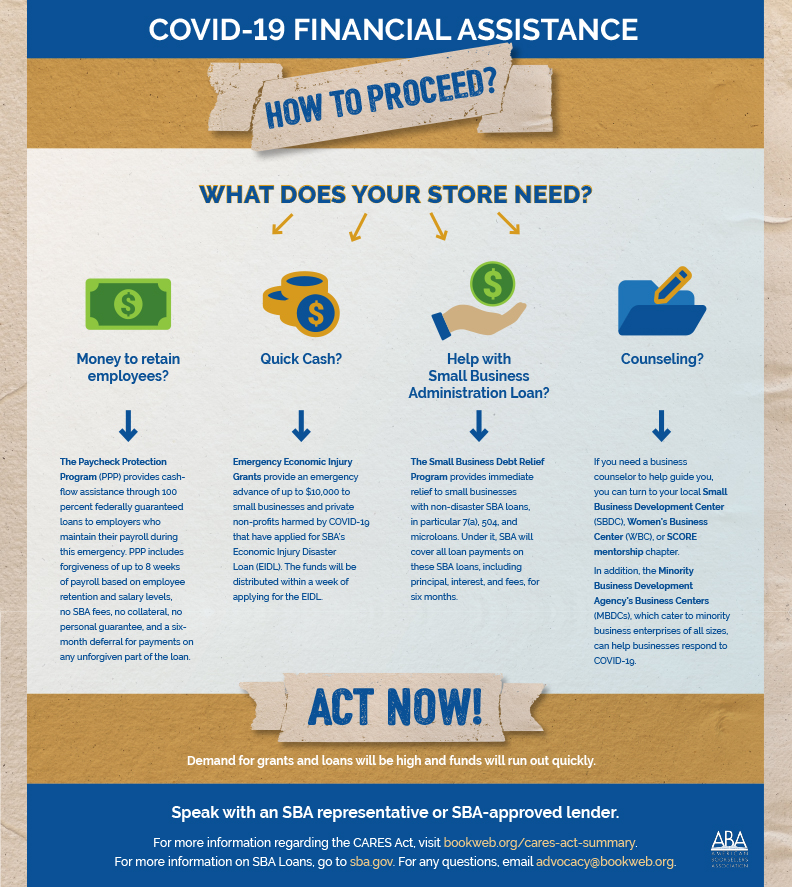

- Important Covid 19 Information For Small Business Owners Congressman Sean Maloney

- Covid 19 Financial Assistance For Businesses American Trucking Associations

- Covid 19 Updates Hampshire Butler Co

- Covid 19 Resources For Gig Creative Entrepreneurs Contract Employees Artsnow

- Financial Assistance For Businesses Affected By Covid 19 North Devon

Find, Read, And Discover Self Employed Covid Loan, Such Us:

- Quick Guide Self Employment Income Support Scheme Y Ny Growth Hub

- Financial Assistance For Businesses Affected By Covid 19 North Devon

- Coronavirus Covid 19 Sme Policy Responses

- Third Self Employed Grant To Rise To 7 500 Which News

- Self Employment 1099s And The Paycheck Protection Program Bench Accounting

If you are searching for My Government Quiz you've come to the perfect place. We have 100 graphics about my government quiz including images, photos, pictures, backgrounds, and more. In such web page, we also have variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

If youre self employed or a member of a partnership and have been adversely affected by coronavirus covid 19 find out if you can use this scheme to claim a grant.

My government quiz. You should wrap up your 2019 taxes right now published tue apr 14 2020 1204 pm edt updated tue apr 14 2020 253 pm edt. The coronavirus business interruption loan scheme cbils provides financial support to smaller businesses affected by coronavirus covid 19. The maximum loan available is 50000.

The scheme helps small and medium sized businesses to borrow between 2000 and up to 25 of their turnover. The self employment income support scheme seiss is made up of a series of grants designed to support self employed people whose business has been adversely affected by coronavirus. Plus how ppp and unemployment benefits are handled by lenders.

Health and government officials are working together to maintain the safety security and health of the american people. Here is the list of documents that can assist you to speed up your loan process. If youre getting less work or no work because of coronavirus covid 19 you might be able to claim a grant through the coronavirus self employment income.

Claim a grant if youve lost income. Self employed and need a covid 19 relief loan. Published 23 march 2020 last updated 2 november 2020.

The requested documents may differ from lender to lender. The rules havent changed drastically for self employed borrowers however lenders are requesting additional income documentation to ensure your business hasnt been impacted by covid 19. What documents do i need to provide.

The government guarantees 100 of the loan and. Small businesses are encouraged to do their part to keep their employees customers and themselves healthy. Lenders set new requirements for self employed mortgage borrowers during covid 19.

The first grant paid 80 per cent of three months average monthly trading profits over the last three years capped at 7500.

More From My Government Quiz

- Furlough Training Rules Uk

- Furlough Scheme Extended September

- November Furlough Scheme Hmrc

- Government Bond Yield Curve Uk

- Self Employed Grants Due To Covid

Incoming Search Terms:

- Coronavirus Self Employed Grant Claims Top One Million Bbc News Self Employed Grants Due To Covid,

- If You Did Not Receive A Ppp Loan Be Ready To File Again Self Employed Grants Due To Covid,

- Coronavirus Covid 19 Sme Policy Responses Self Employed Grants Due To Covid,

- Small Business Administration Sba Loans Immediately Available To Child Care Providers First Five Years Fund Self Employed Grants Due To Covid,

- Coronavirus Covid 19 Sme Policy Responses Self Employed Grants Due To Covid,

- Switzerland Measures In Response To Covid 19 Kpmg Global Self Employed Grants Due To Covid,